Publications /

Policy Brief

Low-carbon hydrogen is a potential contributor to the goals defined in the Paris Agreement, i.e. limiting the increase in the global average temperature to 1.5°C above pre-industrial levels. The transformation of hydrogen production is a part of this effort, as current production methods in the hydrogen industry are carbon-intensive. To achieve net-zero scenarios, hydrogen production and consumption will need to change.

Creating a pipeline of projects plays a central role in driving overall costs down. However, notwithstanding the impressive targets and project announcements that have been made, few low-carbon hydrogen projects have reached the final investment decision stage.

It is necessary to design a set of policy tools to promote low-carbon hydrogen investment. To that end, we assess the matching process between the potential supply of capital and the demand for capital associated with projects. This paper looks at the problem from the point of view of financial closure of those projects.

INTRODUCTION

Low-carbon hydrogen, according to IEA (2023a), refers to hydrogen produced through a low-emissions process. It does not define any kind of technology but excludes traditional hydrogen production from unabated fossil fuels. Although this interpretation is broad, the definition proposed can be applied to any subset within the low-carbon hydrogen spectrum (such as renewable hydrogen), on the condition that it is clearly defined and certified (Vazquez and Hallack, 2022).

Low-carbon hydrogen is a potential contributor to the goals defined in the Paris Agreement, i.e. limiting the increase in the global average temperature to 1.5°C above pre-industrial levels. The transformation of hydrogen production is part of this effort, as current production methods in the hydrogen industry are carbon-intensive. To achieve net-zero scenarios, hydrogen production and consumption will need to change.

The IEA found that the world was set to invest a massive $1.8 trillion in clean energy in 2023. But much more work remains to be done. Investments in clean energy need to climb to $4.5 trillion a year by the early 2030s, while global renewable capacity needs to triple by 2030 (Carbon Brief, 2023).

However, there is a gap between the cost of producing low-carbon hydrogen and the willingness of its potential users (potential hydrogen users) to pay. Nowadays, the cost gap with traditionally-produced hydrogen is estimated to be $4/kilogram1.

Creating a pipeline of projects can play a central role in driving overall costs down. In that context, international initiatives are already in place, such as H2Global, with a considerable focus on Brazilian projects, or the NEOM project in Saudi Arabia. Moreover, the European Union has launched the European Hydrogen Bank. However, notwithstanding the impressive targets and project announcements that have been made, few low-carbon projects have reached the final investment decision stage (Hydrogen Council, 2023).

In that context, it is necessary to design a set of policy tools to promote low-carbon hydrogen investment. To that end, we may consider the matching process between the potential supply of capital and the demand for capital associated with the projects, (Canuto and Liaplina, 2017; Arbouch et al, 2020; El Aynaoui and Canuto, 202). This paper approaches the problem from the point of view of financial closure of those projects2.

I. BUSINESS MODELS AND THE NEED FOR NEW INFRASTRUCTURE

The strategy pursued in this paper to describe the potential sources of capital for low-carbon hydrogen projects is to analyze the characteristics of the risks involved in the potential hydrogen projects. Thus, we consider a generic transaction associated with hydrogen projects, which is made up of the intake and the offtake. The analysis will be then related to the matchmaking between transactions associated with the intake and those associated with the offtake.

Let us put forward a simple example. Consider that a certain industrial end user needs to purchase hydrogen to produce steel. This end-user would be the off-taker of the hydrogen transaction. The set of arrangements involved in delivering hydrogen to the end user would represent the ‘in-taker’ of the hydrogen transaction. In this context, by analyzing the risks associated with those transactions, we can characterize the potential availability of required finance.

1.1 Off-take Transactions

We may classify potential users of low-carbon hydrogen under two broad headings. On the one hand, it is possible to identify those already consuming hydrogen produced by Steam Methane Reforming (SMR). This kind of demand is largely associated with industrial applications, especially related to chemicals and refining (IEA, 2022). The current production of hydrogen to satisfy this demand uses natural gas as an input. According to IRENA (2022), 47% of global hydrogen production was from natural gas at the end of 2021. In the United States, it was estimated at 95% (EERE, 2023).

The second group of users is made up of those that currently use other forms of fuels that could be substituted by hydrogen as an energy carrier. These include the energy providers to hard-to-abate sectors, e.g. industry, transport, buildings, and the electricity sector (IEA, 2022). While the role of hydrogen in meeting each potential demand is still uncertain, energy uses for steel, shipping, and jet aviation are considered promising areas (Liebreich, 2023). Overall, even if traditional uses of hydrogen drove the demand increase in recent years (IEA, 2022), it is the new demand that is expected to increase in the following decades, especially in transport, industry, and power generation (IEA, 2023b). Up to 2030 and 2035, industry has the greatest potential to decarbonize hydrogen, considering both traditional and new uses as energy vectors.

In any case, regardless of the announced low-carbon hydrogen projects, and the major expected role of low-carbon hydrogen in decarbonization, few projects are getting to final investment decisions (Hydrogen Council, 2023). Besides the extra cost associated with low-carbon hydrogen technologies with respect to traditional ones, high transaction costs (including those associated with the lack of contract standardization that comes with an organized market) may be slowing the industry’s development. In this context, the absence of an offtake agreement hampers the financial structuring of the project, which delays achievement of the final decision phase. This means less investment, lower scale, and thus further delays in industry development.

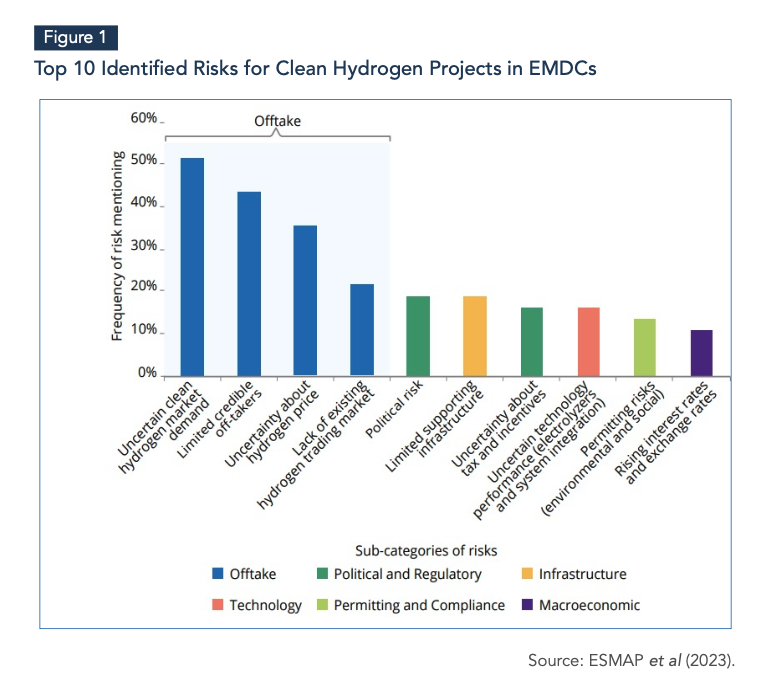

One of the main risks faced by low-carbon hydrogen projects is the offtake risk. Figure 1 shows that those risks represent about 50% of the total risk faced by the undertaking.

Despite highlighting risks with greater impact in emerging and developing countries, it provides an overview on the relative importance of the various agreements involved in low- carbon hydrogen projects.

1.2 In-take Transactions

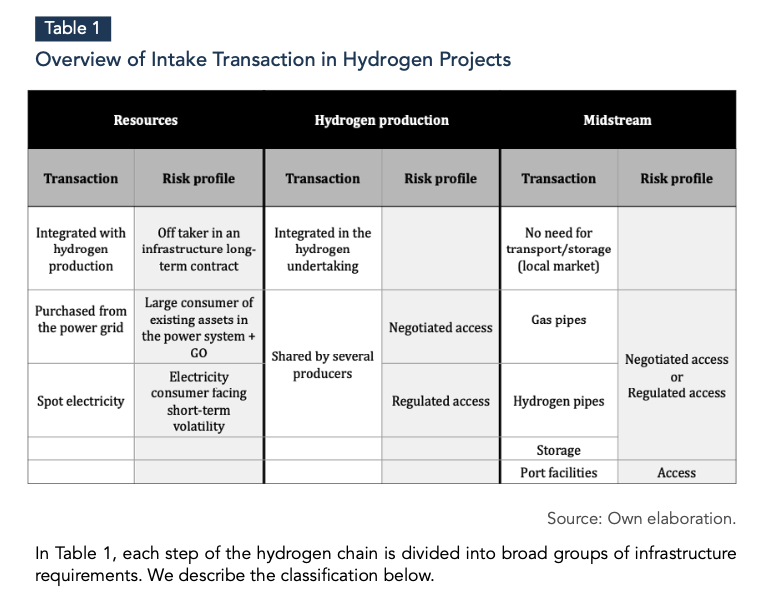

Table 1 shows an overview of the potential transactions involved in low-carbon hydrogen production and transport. We split those transactions into three broad categories: i) resources, including potential ways of obtaining the required renewable electricity; ii) hydrogen production, which refers to the facilities associated with the transformation of electricity into hydrogen (mainly electrolyzers); and iii) midstream, which involves the infrastructure required to deliver hydrogen from the producer to the off-taker.

In Table 1, each step of the hydrogen chain is divided into broad groups of infrastructure requirements. We describe the classification below.

1.2.1 Renewable Energy Resources

The transactions involved in obtaining renewable electricity may vary depending on the infrastructure involved. We may separate the possibilities as in Table 1:

-

Using dedicated renewable energy infrastructure to produce hydrogen. In this case, the arrangements involved will be similar to those associated with renewable energy investment. Hence, the risks involved will also be similar.

-

Purchasing electricity from the system. In this solution, it is important to have an adequate certification system to ensure that the electricity purchased is produced via low-carbon processes. This may become a hard task, as this kind of certification tends to be local or regional, making it difficult to harmonize schemes to allow for international hydrogen trade.

-

Although spot electricity purchase is an option, it is unlikely as the hydrogen producer would be open to electricity-price volatility. This option might be available in the future, with more developed hydrogen industries, but it does not seem feasible currently.

2.2.2 Hydrogen Production

One of the main questions associated with low-carbon hydrogen production is related to the property of the electrolyzer. That is, whether the electrolyzer is shared by several hydrogen producers or not. In the case of a shared facility, the development of third-party access rules, in line with the ‘essential facility doctrine’, is necessary to avoid conflict and facilitate investment. Depending on the access regime chosen (regulated or negotiated), the risk profile of the undertaking varies. From a structuring point of view, negotiated access is simpler, as it tends to result in use contracts that match the production contract.

1.2.3 Midstream

When infrastructure is needed to transport hydrogen from production to consumption points (as opposed to local production/consumption), the challenges are similar to the case of shared electrolyzers. Typically, transport infrastructure will be significant, so shared facilities will be the rule. Different access rules to those facilities will result in different risk profiles. Long-term contracting tends to be simpler from the structuring point of view.

II. SOURCES OF GREEN PUBLIC FINANCE

The other aspect that requires understanding to optimize the use of public financial instruments is the potential sources of capital that might be accessed by low-carbon hydrogen undertakings.

On the one hand, term structures are important to understand how long the hedge market is where participants can buy. When long-term vehicles are not liquid, it is difficult to hedge the capital required for the project. There may even be ‘missing markets’. Consequently, investors cannot price the risk according to market prices. On the other hand, high short- term rates may be an effective barrier to infrastructure investment.

From this point of view, the relevant characteristic is the investment opportunity associated with the different assets in the hydrogen chain. Therefore, considering the heterogeneity of sources of capital in terms of their risk profiles is central. With this, it is possible to identify potential investment opportunities with different characteristics, also depending on the assets involved. The financial structure might then be designed to maximize access to different sources of capital—a general point made by El Aynaoui and Canuto (2002) with respect to bridging finance and green-infrastructure investment.

2.1 De-risking Instruments

From the standpoint of making investment opportunities more attractive, one way to mitigate the financial risks stemming from large projects is to implement credit enhancement measures. In that context, as some low-carbon hydrogen projects require large physical assets, investors will benefit from all possible sources of capital. Green finance is a significant part of those sources.

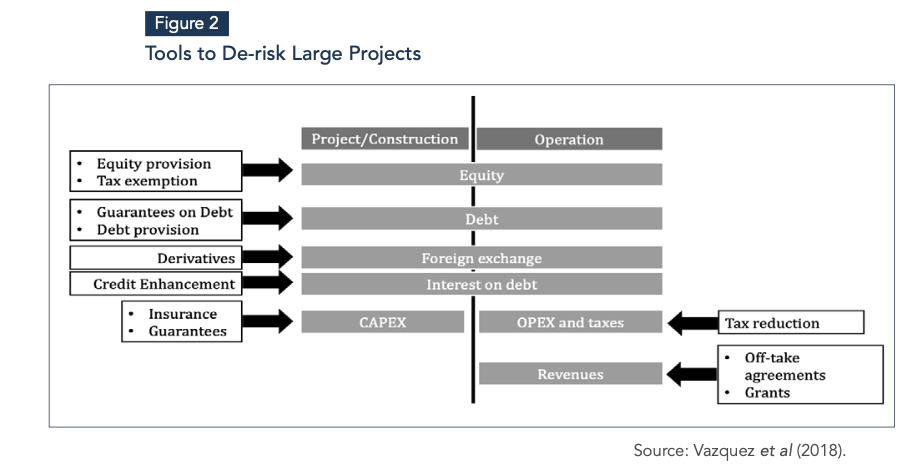

To map the tools that can be designed to improve investment conditions for large, risky projects, we may think of a typical project as involving two phases3:

-

The project/construction phase, during which most of the costs need to be absorbed and normally no cashflows are obtained, and

-

The operation phase, during which costs are lower and income streams begin to open, and cashflows become increasingly positive.

This classification identifying two phases with very different risk profiles to be identified. The construction phase normally carries all the risks, and the operation phase is normally exposed to less-risky cashflows. This is especially true in project-finance type of investments, where income streams are usually agreed for the entire lifecycle of the infrastructure before construction begins.

Thus, we may summarize the tools available to enhance investment conditions as in Figure 2.

The existence of these tools will be more relevant in the in-take transactions involving large infrastructure. For instance, if the hydrogen project is a local one (i.e. it does not require construction of large midstream infrastructures), and it purchases electricity from the grid (i.e. it does not require construction of large electricity-generation plants), investment conditions will be simpler than in the opposite case.

2.2 General Overview of Players

Table 2 describes stylized profiles that aim to serve as a guide to different investment objectives. State-owned companies are traditionally relevant for infrastructure investment, as they are relatively more willing to bear risk in the construction phase. In that context, their actions to implement public policies are often characterized by the development of infrastructure. They typically use equity and senior bonds.

Development banks and financial institutions (including multilateral development banks) make up another important set of players for infrastructure investment. As state- owned companies, they can invest in the construction phase and also provide de-risking instruments (guarantees, financial insurance...). In particular, they can assume subordination (e.g. mezzanine finance).

Another important source of finance for infrastructure is energy corporations. By having strong short-term positions in the energy market using the infrastructure, they add projects to their balance sheets. In recent years, oil and gas companies have increased their participation in this kind of investment.

Institutional investors (including sovereign funds, insurance, and pension funds) are not usually interested in high exposures (equity), but long-term (senior) debt tends to match adequately their risk profiles. Commercial banks are normally interested in short-term instruments, but they can play an important role in structuring debt.

The characteristics described above help to identify which players may find investing in hydrogen projects attractive, and which types of opportunity they are most likely to be interested in. That is, hydrogen projects involving the development of large assets might attract more capital from investors interested in infrastructure.

III. POLICIES TO FACILITATE HYDROGEN TRADE

Three issues need to be dealt with to facilitate the rise of a liquid international market for low-carbon hydrogen. We do not take into account potential industrial policies, such as local content requirements, or innovation policies.

3.1 International Standardization

The certifications associated with sustainability in energy are a broad issue. So far, most of these sustainability certifications are based on a country or a region; they are not harmonized internationally (although efforts are being made to do this). This contrasts with fossil fuels, which tend to have harmonized quality certification. To develop an international market for low-carbon fuels, sustainability certification will need to be harmonized, if not unified.

In this context, the certification of low-carbon hydrogen should consider three variables: (1) it can be produced from different sources, so any scheme needs to enable comparison of the different value chains and their certifications, such as electricity renewables and biofuels; (2) it can be internationally traded, so certification needs to permit the comparison of energy sources from different countries and their certification procedures; (3) it is a new evolving technology, so the certification procedure should avoid lock-in situations, and should also be harmonized as much as possible with green-finance requirements. For instance, the definition of low-carbon hydrogen should be compatible with that implied in green bonds.

3.2 Design of Procurement Mechanisms to Allocate Subsidies

We may compare low-carbon hydrogen development to renewable energy. Support mechanisms were deemed necessary to scale-up the technology, facilitating the drop in its cost. Currently, in many markets, renewables are competitive. Support mechanisms in practice involved either the use of some kind of subsidy to bridge the cost gap, or the obligation for regulated, captive electricity consumers to pay for this gap. The lessons learned from renewable electricity generation mechanisms can be valuable in designing the low-carbon hydrogen mechanism.

From this point of view, long-term offtake contracts (like those found in the renewable energy industry) may be an interesting option. Moreover, if we assume that most of the demand for low-carbon hydrogen will be associated with relatively flat consumption profiles, the kind of off-take contract that we may propose is formally close to a take-or-pay contract traditionally applied in the natural gas industry.

Finally, it will be necessary to implement an efficient mechanism to allocate the subsidized contracts. As two kinds of asymmetric information need to be revealed (consumers’ willingness to pay and producers’ costs), auctions may be an interesting option (see Vazquez and Hallack, 2023).

3.3 Financial Instruments to Facilitate Low-carbon Hydrogen Trade

Adequate tools to maximize value for public subsidies depend on the investment requirements of each business model (matchmaking of supply and demand for finance). Currently, a risk common to all project configurations, and probably a high barrier to obtain financial closure, is the off-take risk. This means that, together with a mechanism to obtain a reasonable off-take commitment for the project, some support is required to bridge the difference between the low-carbon hydrogen cost and the expected willingness-to-pay of off-takers.

Besides support aimed at income streams, optimization of financial aid may be needed to facilitate access to sources of capital. The most efficient tools to do that depend on the kind of investment involved, and therefore, on the physical configuration of the hydrogen undertaking. The idea is to take to the market a menu of financial tools that help structure a project pipeline to the greatest extent possible.

As Table 1 shows, the investment characteristics vary significantly depending on the low- carbon hydrogen design. Consequently, the financial instruments aimed at facilitating development of those projects should adapt correspondingly. For instance, vertical integration of renewable energy and production implies investment in one large project (the renewable energy one). Facilitating instruments would be similar to those associated with PPAs, as seen in Figure 2.

If the electricity is purchased from the electricity grid, the generation investment may be disregarded, and the risk to be hedged wil be the wholesale electricity price risk. Correspondingly, producing hydrogen close to consumption points (as in hydrogen valleys) avoids concerns about transport infrastructure. Consequently, the available financial tools may impact the predominant business model, which might not be the most efficient technically but would be the cheapest financially. Therefore, the design of the financial instruments portfolio is crucial, not only for the industry to grow, but also to define the way in which the industry grows.

REFERENCES

Arbouch, M., Canuto, O., Vazquez, M., 2020. Africa’s infrastructure finance. Policy Brief for the T20’s TF3: Infrastructure Investment and Financing.

Canuto, O., Liaplina, A., 2017. Matchmaking Finance and Infrastructure. Ra- bat: Policy Center for the New South Policy Brief PB 17/23.

Carbon Brief (2023). DeBriefed 29 September 2023: Focus on carbon offsets; UK expands oil and gas; IEA’s path to 1.5C unpacked.

EERE, D., 2023. Hydrogen Production: Natural Gas Reforming.

El Aynaoui, K. and Canuto, O. (2022). Bridging green infrastructure and fi- nance, in Dirk Schoenmaker and Ulrich Volz (eds.), Scaling Up Sustainable Finance and Investment in the Global South, CEPR.

ESMAP, OECD, Hydrogen Council, 2023. Scaling hydrogen financing for development. ESMAP Paper.

Hydrogen Council, 2023. Hydrogen Insights.

IEA, I.E.A., 2023a. Towards hydrogen definitions based on their emissions intensity.

IEA, I.E.A., 2023b. Net Zero Roadmap: A Global Pathway to Keep the 1.5 °C Goal in Reach.

IEA, I.E.A., 2022. Global Hydrogen Review 2022. IRENA, 2022. Hydrogen.

Liebreich, M., 2023. Clean Hydrogen Ladder, Version 5.0,.

Vazquez, M., Hallack, M., 2023. Auctions to reveal consumers’ willingness- to- pay for low-carbon hydrogen projects: combining lessons from renewables and natural gas industries, in: Working Paper. Chaire Gouvernance et Régula- tion. Dauphine | PSL.

Vazquez, M., Hallack, M., 2022. The international implications of the Europe- an process for low-carbon hydrogen certification. European Energy & Climate Journal 11, 66–75.

Vazquez, M., Hallack, M.C.M., Andreão, G.O., Tomelin, A.C., Botelho, F., Perez, Y., Di Castelnuovo, M., 2018. Financing the Transition to Renewable Energy in the EU, Latin America and the Caribbean. EU-LAC reports.