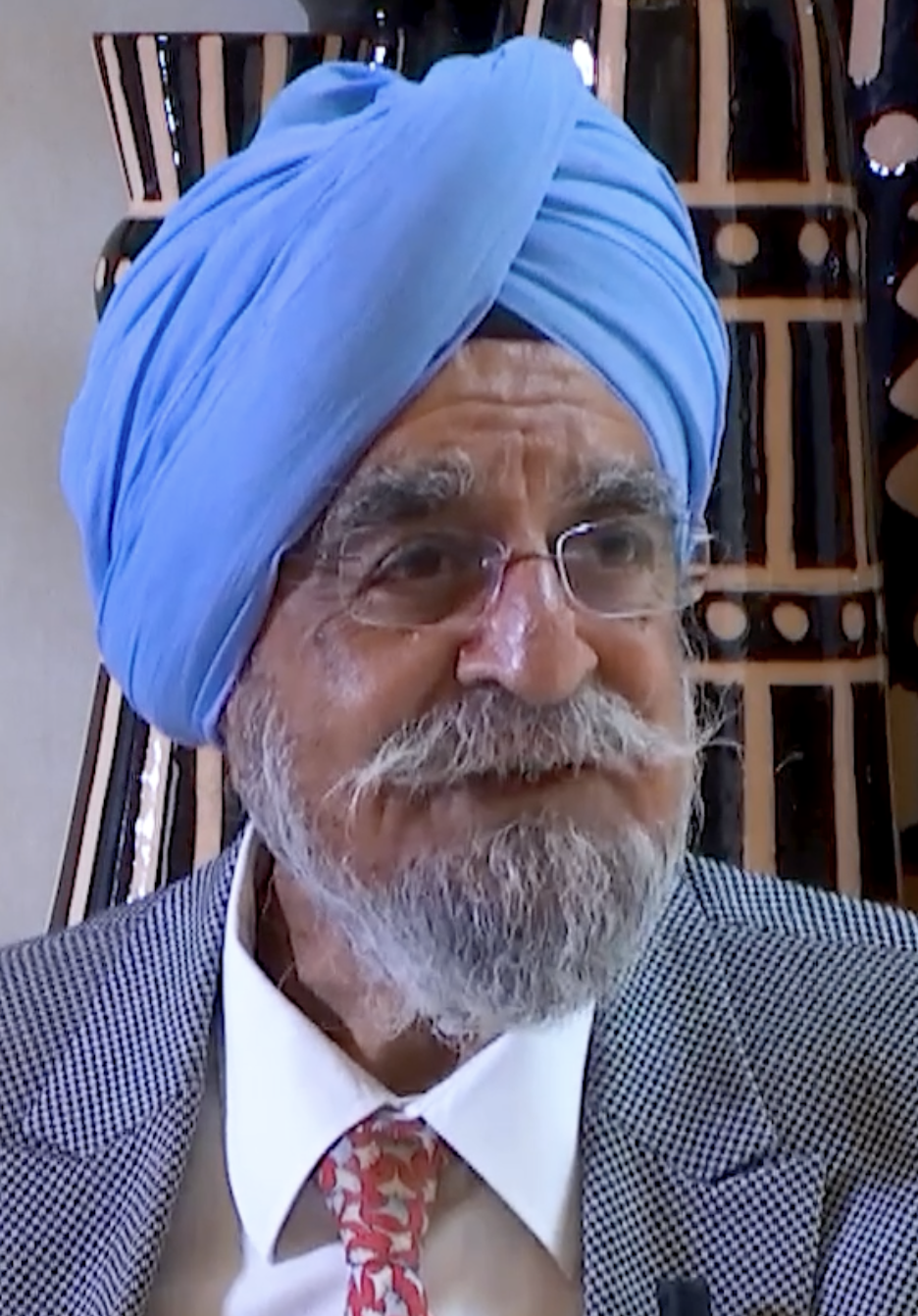

In this interview, Dr. Harinder Kohli, Founding Director and Chief Executive of the Emerging Markets Forum discusses the escalation of interest rates in the U.S. has consistently instilled a sense of apprehension in emerging markets, given the conventional outcome of capital outflows redirecting towards advanced economies. With the Federal Reserve embarking on rate hikes to counter an uncommon surge in inflation exceeding its target, an immediate inquiry arises: how have emerging economies navigated these circumstances, and to what extent have they demonstrated resilience in recent months? The question of resilience assumes heightened significance, particularly in light of the fact that emerging economies have grappled with an unprecedented pandemic, compelling them to provide protection to millions of citizens.