Publications /

Policy Brief

Multiple shocks faced by the global economy over the past three years have apparently shaken the conventional wisdom on gains from economic integration, and have sparked widespread calls for protectionist and nationalist policies. Is there already evidence of some ‘deglobalization’, or do the factors that underlie globalization remain strong enough despite the shocks?

So far, there are no signs of an overall reversal in the long-term trend of greater global trade integration. However, a partial realignment seems to be underway, reflecting the more durable side of those recent shocks. This is probably leading to higher costs and prices on the margin, in the case of realignments done to overcome shocks of a geopolitical nature. The answer seems to be that global trade has been resilient, although it is undergoing some realignment.

The global economy has been through multiple shocks recently: the perfect-storm combination of a pandemic, war in Ukraine, higher frequency of adverse weather events reflecting climate change, and the emergence of a so-called ‘New Washington Consensus,’ accompanying the ongoing U.S.-China technological rivalry. Such shocks over the past three years have shaken the conventional wisdom on gains from economic integration and have sparked widespread calls for protectionist and nationalist policies.

In advanced economies, the appetite for trade measures and industrial policies discriminating against external agents has therefore increased in recent history. One example of this, among several, is the more frequent adoption of punitive tariffs, export restrictions, and local purchase mandates by the United States.

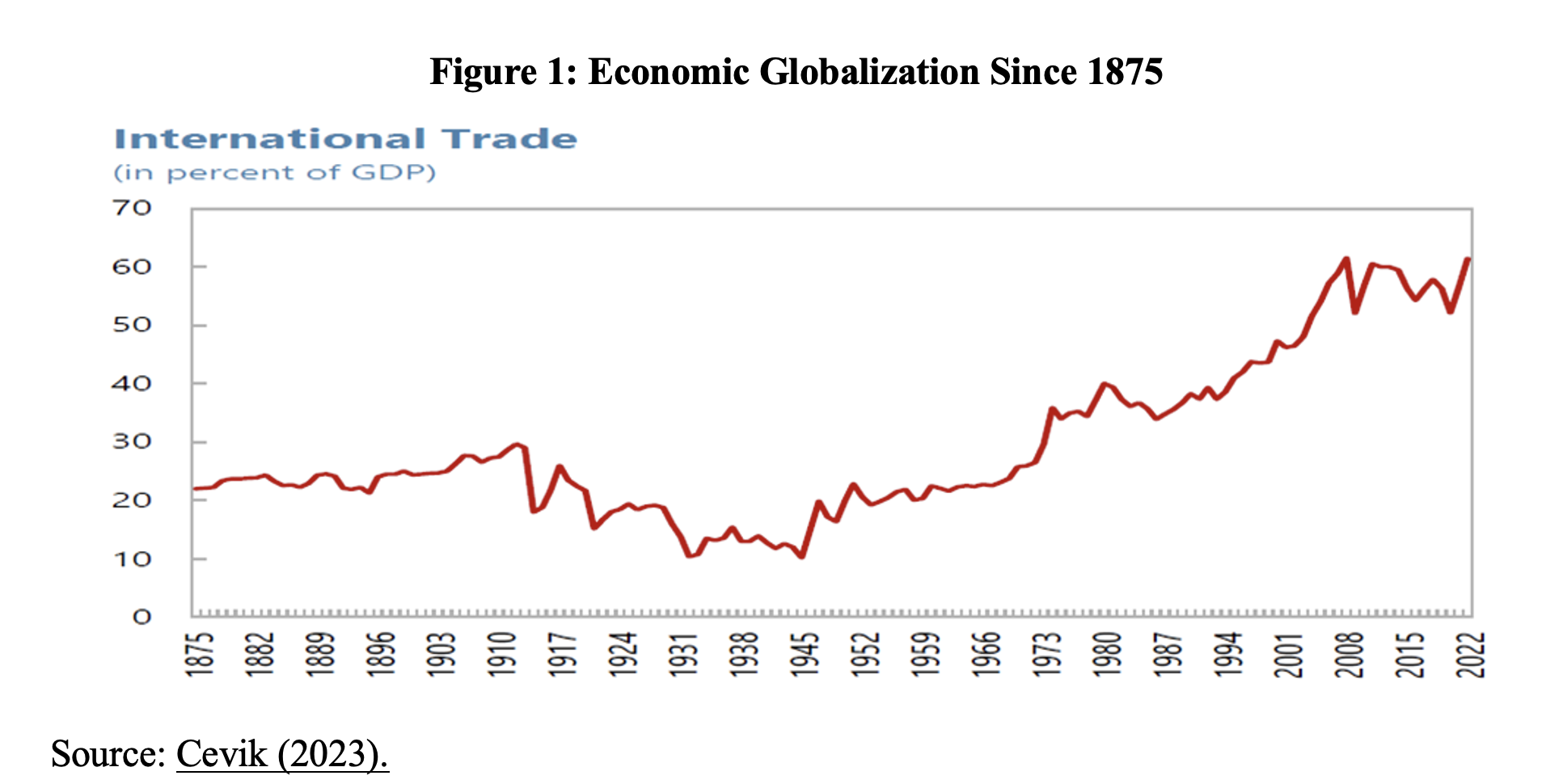

Several analysts now speak of an ongoing trend towards ‘deglobalization’, understanding this as a commercial fragmentation of the world, reversing or reconfiguring the integration that has taken place via global or regional chains, and which underpinned the extraordinary increase in foreign trade in relation to GDP from the 1990s onwards (Canuto, 2023a). This was a process that even allowed almost 1 billion people worldwide to be lifted out of poverty (Canuto, 2021, Ch. 9).

Deglobalization Factors

There has been a recent wave of protectionist trade measures, restrictions on foreign direct investment, and industrial policies discriminating against external agents (Canuto et al, 2023). Four classes of justification can be found for such a wave.

First are reasons of a ‘social’ nature. After the global financial crisis of 2008, the belief grew among inhabitants of several advanced countries that globalization and the transfer of industrial jobs to Asia—or immigration, in some cases—was responsible for the difficulties in progress faced by their middle- and low-income classes. This culminated in electoral victories, or at least increases in the shares of votes, of populist leaders, who took advantage of this feeling, promising a reversal of what had occurred in previous decades.

A second source of justification has been a supposed search for resilience in the face of shocks, something exacerbated by the vulnerability to shocks attributed to globalization during the pandemic, when severe disruptions occurred in global production chains. The severe strains during the pandemic, with supply-chain bottlenecks and disruptions to key supplier relationships, followed by the Russian invasion of Ukraine, led to discussions about reshoring, near-shoring and friend-shoring. Discussions have centered on the possible merits of building shorter, more resilient supplier relationships, especially for critical inputs to key industries.

National security has also been a frequently used justification, given the potential dual civil and military uses of some technologies (Canuto, 2023b). Russia's invasion of Ukraine highlighted geopolitical risks, but in fact the rivalry between the United States and China had already generated narratives about the reversal of globalization.

Finally, the decarbonization agenda has also generated arguments for the adoption of discretionary measures over external agents. The struggle for decarbonization will be costly, and compensatory or defensive measures for locals would be justifiable or necessary.

This includes, for example, the European Union law on compensatory commercial tariffs for local producers, who are obliged to pay a price for the carbon they emit—the Carbon Border Adjustment Mechanism (CBAM; Berahab, 2023). The objective of the measure is to prevent the risk of carbon leakage by equalizing the price of carbon between domestic products and imports in selected sectors, in order to avoid the mere replacement of local production by imports from areas free from carbon prices. In its turn, the Inflation Reduction Act and the CHIPS and Science Act, approved by the U.S. Congress in the last two years, provide subsidies favoring domestic production of semiconductors and clean energy (Canuto, 2023b).

Factors of Resilience of Globalization

There are, however, some reasons to believe that this deglobalization will be limited (Canuto, 2022). First, it is worth remembering that the configuration of global and regional supply chains is not accidental, having arisen for reasons of cost efficiency. Abandoning such a configuration implies costs for value chains and their users.

Take the case of resilience to shocks. The pandemic brought to the fore the idea of a trade-off between resilience and efficiency. But this does not necessarily lead to reshoring. If everything is brought back home, given the possibility of domestic shocks, the exposure to potential risks remains as high as if there were full dependence on global supply chains. Without the existence of chains abroad, the effects of local shocks would also be maximized.

In many sectors, companies can choose to bear some costs by accumulating stocks at points in the value chains and/or duplicating sections of these chains in different geographic locations. But the microeconomic incentives faced by companies establish cost-benefit limits to such calculations of renouncing efficiency to increase resilience to shocks. This logic will lead maybe to some costly diversification or duplication of links depending on the sectors, but not a full reversal of globalization.

As Canuto et al (2023) showed in a policy brief for the T20, the recovery of manufacturing output, particularly in technology sectors, was really nothing commensurate with the retrenchment fears established during the pandemic. Data already shows a reversal of the shocks of the pandemic and the cooling of fears about resilience in the face of shocks.

What about public policies designed to affect those private calculations in favor of what the formulators of so-called ‘industrial policies’ want, including promotion of ‘reindustrialization’ and manufacturing employment, promised as ‘social’ justifications? It is worth noting in this case how the trade tariff policies adopted by President Trump against China proved to be a drag on employment in the United States’s own manufacturing industry, according to studies by economists at the U.S. Federal Reserve. In addition, the U.S. agriculture sector was also affected directly by the trade war with China (Canuto, 2021, p.135-8).

National security reasons are perhaps those with the greatest reach and influence. Geopolitical risks and geoeconomic rivalry are already present in the implementation of industrial policies in segments including advanced semiconductor and computing technologies, medical and military equipment, biotechnology, and clean-energy technology. In a September 2022 speech, U.S. White House national security adviser Jake Sullivan (2022) mentioned those as areas in which the U.S. should maintain global leadership, as “a national security imperative”.

Access to critical minerals for the use of these technologies and for the energy transition will also grow as an object of geopolitics (Canuto, 2023b).

The reversal of globalization will not tend to be sought, however, in the case of foreign trade in other items. There will be a cost for those who opt for an exaggerated demarcation of what should be considered ‘strategic’.

It is worth noting that an accelerated digital transformation has been expanding the scope for a possible globalization of services. The scope of services as a driver of development has an open path ahead. The rise in digital cross-border activity suggests that the nature and scope of globalization is likely to evolve in the coming years, as flows may continue to decline in tangible areas, such as trade in goods, while accelerating in intangible areas, including trade in services and flows of cross-border data.

On the Chinese side, one can assume a preference for preserving the globalization that facilitated China’s success in growth-with-structural-transformation, even though China is also affected by the new directions in the geopolitical area and shows signs of seeking less dependence on the outside.

One can certainly expect slower globalization and some regionalization, or a slowdown in the growth of cross-border flows of goods, capital, and people, something already present since the global financial crisis, rather than ‘deglobalization’, understood as absolute decline and/or fragmentation.

Industrial policies imply economic costs (fiscal, inefficiency), which are compensatable from the perspective of a country only to the extent that, within a certain time horizon, the effects are such that they not only make such costs redundant, but also offset them. The reasons for relative disenchantment with globalization do not appear to be sufficient for its widespread reversal.

The Resilience of Globalization

At the end of October 2023, the International Monetary Fund issued a research paper showing the high resilience of trade and economic interconnection between countries, despite shocks, when viewed in aggregate (Cevik, 2023). The findings were consistent with Canuto et al (2023).

The most common indicator used for globalization is trade openness, measured by the sum of exports and imports divided by GDP. Cevik (2023) showed that there are no signs of structural decline in this indicator, but only occasional fluctuations caused by cyclical factors and disruptions to the global supply chain, such as those experienced during the pandemic. Since then, however, international trade as a percentage of GDP has recovered strongly, despite fears of discriminatory geoeconomic fragmentation and ongoing protectionism (Figure 1).

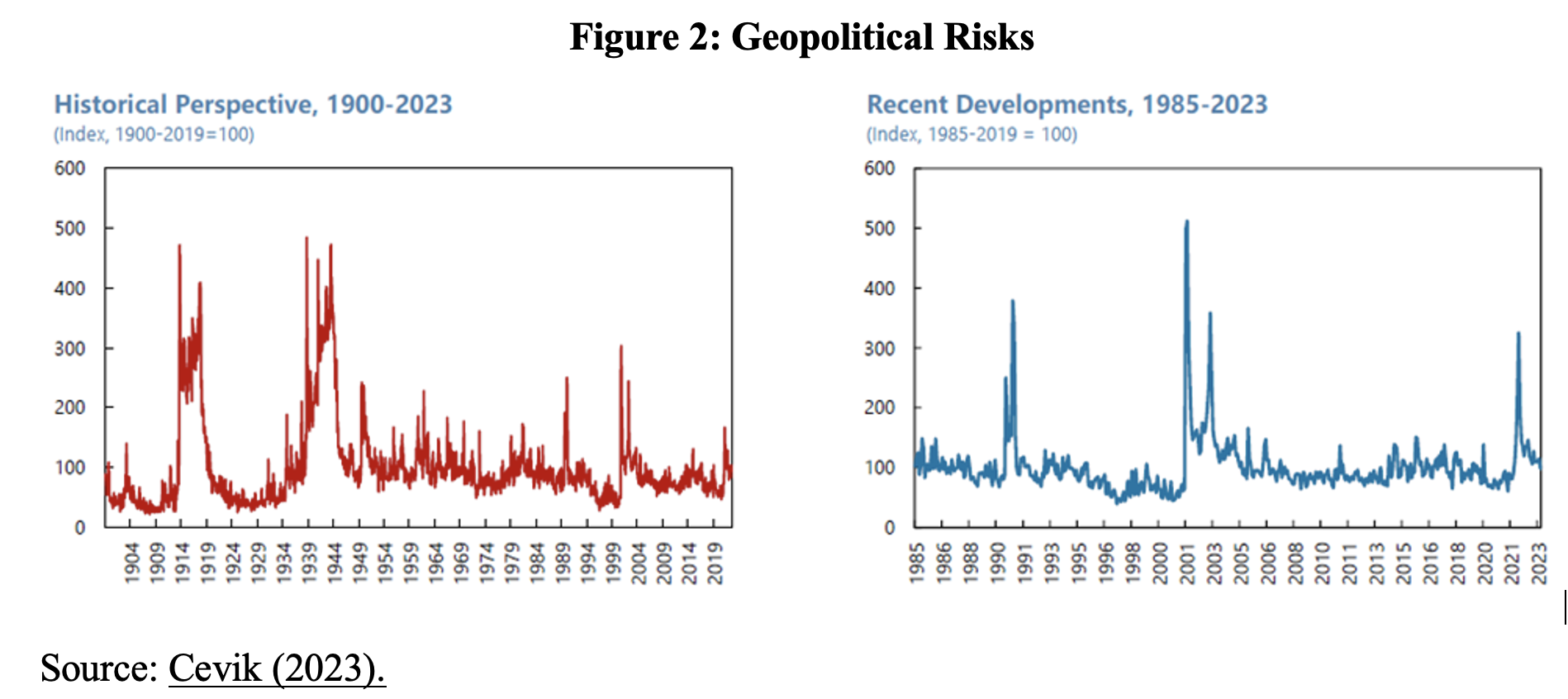

Cevik (2023) found no traces of a systemic retreat in trade globalization arising from geopolitical developments. Trade linkages and supply chains keep evolving over time, reflecting economic and technological evolution, including the adaptation to geopolitical factors. However, apart from specific non-frequent moments of radical ruptures in the geopolitical landscape (Figure 2), global trade integration has continued to move forward, with occasional setbacks.

Realignment of Global Value Chains

Qiu et al (2023), from the Bank for International Settlements (BIS), also published relevant results in October, in relation to a realignment of global value chains (GVCs). GVCs exist as intricate networks of relationships between companies, both across countries and sectors. Using information about companies’ suppliers and customers to map the entire interconnection network, the work compared in detail two moments: December 2021 and September 2023.

The most recent data on company-level networks reveals that global value chains have lengthened—instead of shortening—although without a consequent network densification, which may indicate that relationships with suppliers are being diversified.

The lengthening of supply chains is especially significant for China’s supplier-customer linkages with the United States, where companies from other jurisdictions, particularly Asia, have inserted themselves into supply chains. This is an aspect to be highlighted: as a response to restrictions—including potential restrictions—on Chinese products in China, additional links are appearing between the two economies.

Direct connections between China and the U.S. have declined, giving way to links through other Asian economies. The percentage of Chinese companies that are direct suppliers to U.S. customers has declined. However, when indirect links are considered, the change appears more modest, suggesting the ‘interposition’ hypothesis. Asian firms from outside China have risen as a proportion of the value added in the supply chains catering to the United States.

The evidence that China-U.S. supply chains have been rerouted through other Asian Pacific economies is particularly striking in information technology segments, where the proportion of cross-country linkages is among the highest. We believe this is also one of the explanatory factors why, despite restrictions in the United States on solar energy from China, this continues to be the main source of North American imports of solar panels, via elongated value chains.

Concluding remarks

There are no signs of a reversal in the long-term trend of greater global trade integration in recent decades, especially in Asia. There has been, however, a partial realignment of global value chains, reflecting the more durable side of recent shocks. This is happening probably at some cost on the margin, in the case of realignment taking place to overcome shocks of a geopolitical nature.

References

Berahab, R. (2023). Navigating the CBAM Transitional Period: Understanding the Latest Developments, and Enhancing Preparedness, Policy Center for the New South, Policy Brief PB - 29/23, July.

Canuto, O. (2021). Climbing a High Ladder - Development in the Global Economy, Policy Center for the New South.

Canuto, O. (2022). Slowbalization, Newbalization, Not Deglobalization, Policy Center for the New South, June 1.

Canuto, O. (2023a). Growth Implications of a Fractured Trading System, Policy Center for the New South, September 21.

Canuto, O. (2023b). A Tale of Two Technology Wars: Semiconductors and Clean Energy, Policy Center for the New South, Policy Brief PB - 41/23, November.

Canuto, O.; Arbouch, M.; Zhang, P.; and Ali, A.A. (2023). GVCs, Resilience, and Efficiency Considerations: Improving Trade and Industrial Policy Design and Coordination, G20 India, T20 Policy Brief, June.

Cevik, S. (2023). Long Live Globalization: Geopolitical Shocks and International Trade, IMF Working Paper WP/23/225, October.

Qiu, H.; Shin; H.S.; and Zhang, L.S.Y. (2023). Mapping the realignment of global value chains, BIS Bulletin No. 78, October 3.

Sullivan, J. (2022). Remarks by National Security Advisor Jake Sullivan at the Special Competitive Studies Project Global Emerging Technologies Summit, Washington, D.C., September 16.

* This policy brief was prepared for a presentation at the 12th Aspen-GMF Bucharest Forum 2023, A Global Inflection Point – Where Are We Headed? 9-10 November, National Military Circle, Bucharest.