Publications /

Policy Brief

This policy brief explores the transformative role of BRICS as a platform for Global South cooperation and an emerging alternative to Western-dominated governance frameworks. Established with a shared goal of reforming international institutions and addressing global decision-making imbalances, BRICS has evolved from an economic concept into a multifaceted alliance that spans finance, diplomacy, development, and security. As the global order shifts towards multipolarity, BRICS has positioned itself as a key counterbalance to the G7 and G20, advocating for financial sovereignty, inclusive growth, and a more equitable international architecture.

Despite internal asymmetries and geopolitical tensions, BRICS has introduced institutional innovations—such as the New Development Bank—and proposed initiatives like a digital currency, demonstrating its commitment to reshaping the rules of global engagement. This brief examines BRICS’s comparative advantages, critiques its cohesion and capacity, and explores the potential impact of its expansion into BRICS+. Moreover, it argues that BRICS’ pragmatic focus on development, sovereignty, and South-South cooperation offers a credible framework for a new global paradigm.

As the global economy evolves, BRICS stands not only as a challenger to the existing order but also as a potential source of significant benefits for the developing world. Its future relevance will depend on strengthening institutional frameworks, enhancing strategic coordination, and demonstrating its capacity to deliver tangible outcomes for the Global South.

Introduction

The BRICS grouping—Brazil, Russia, India, China, and South Africa—has emerged as a significant force in global governance, challenging the traditional dominance of Western powers. Since its inception, BRICS has advocated for a more inclusive and multipolar world, providing a platform for emerging economies to voice their concerns and contribute to global decision-making. This mission distinguishes it from the G7, which primarily represents the interests of advanced industrialized economies. However, BRICS has faced criticism for internal disparities, a lack of cohesion, and limited impact on global governance.

This Policy Brief explores BRICS' history, role in global governance, prospects as a global player, recent expansion, and how it complements the G7 and G20 by fostering a more inclusive framework for global cooperation and development. It also examines critiques, counterarguments, vulnerabilities, and weaknesses, proposing ways to address these challenges. One such proposal is the potential for a digital BRICS currency, a forward-thinking initiative that could reshape the global financial landscape.

The Genesis and Evolution of BRICS

BRICS was initially conceptualized as “BRIC” by economist Jim O’Neill in 2001,[1] describing the economic potential of Brazil, Russia, India, and China. With their large populations, rapid economic growth, and increasing geopolitical influence, these countries were identified as key players in reshaping the global economy. The first formal BRIC summit, held in 2009 in Yekaterinburg, Russia,[2] marked the institutionalization of the group. South Africa's inclusion in 2010 transformed BRIC into BRICS, adding a voice from the African continent and solidifying its global significance.[3]

The formation of BRICS was driven by a shared ambition to reform global governance structures, long perceived as being dominated by Western powers. The group sought to address issues such as the underrepresentation of emerging economies in institutions like the International Monetary Fund (IMF) and the World Bank. Over the years, BRICS has evolved from an economic concept into a robust political and strategic alliance. Member states now collaborate on various issues, including trade, climate change, and security, demonstrating its growth and increasing influence. By creating alternative institutions, such as the New Development Bank (NDB) in 2014, BRICS has actively challenged the dominance of Western-led financial mechanisms, promoting a model of economic cooperation that emphasizes national sovereignty and mutual benefit.[4]

The emergence of BRICS represents a significant shift in global governance, actively challenging the entrenched dominance of Western-led institutions. Since its inception, BRICS has been a proactive force, seeking to create a more inclusive and multipolar world where the voices of emerging economies shape global decision-making. This proactive stance challenges the status quo and invites broader engagement in the evolving process of global governance. While the G7 represents the interests of advanced industrialized economies, BRICS has positioned itself as an alternative platform for the Global South, advocating for economic fairness, political sovereignty, and a more balanced international order.

Despite its aspirations, BRICS has faced persistent scrutiny. Critics argue that disparities among its members, both in economic strength and political stability, hinder its ability to act as a cohesive force. These disparities range from the financial gap between the rapidly growing economies of China and India and the more stagnant economies of Brazil, Russia, and South Africa to political differences stemming from varying governance systems and foreign policy priorities. Additionally, limited institutional capacity and geopolitical tensions pose further challenges to the bloc’s effectiveness. Nevertheless, BRICS continues to evolve, expanding its membership and adapting its structures to strengthen its influence.

Over the years, BRICS's scope has expanded significantly. No longer confined to economic discussions, it has developed into a strategic alliance engaging with trade, security, climate change, and sustainable development. Through annual summits and sectoral cooperation, BRICS has positioned itself as an emerging force capable of shaping the contours of the 21st-century global order.

BRICS, G7 and G20

While the G7 and G20 have traditionally been considered dominant forums for global governance, their effectiveness has increasingly been questioned. The G7 remains an exclusive club of industrialized Western economies, no longer representative of the world's economic realities. The G20, though more inclusive, has often struggled to implement meaningful reforms due to the entrenched interests of Western-led financial institutions. In contrast, BRICS presents a more dynamic and adaptable alternative, offering a vision of global governance that better reflects the multipolar world of the 21st century.

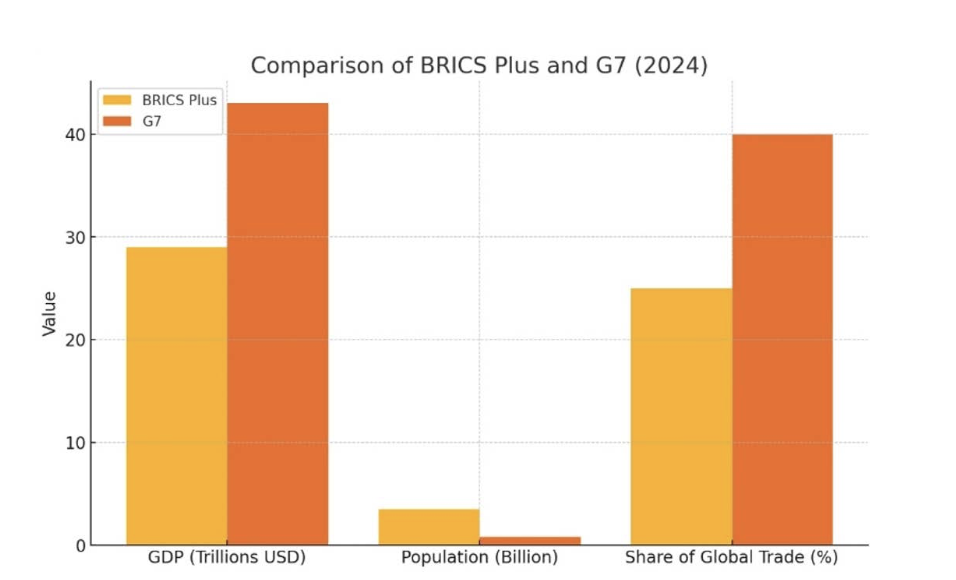

The chart below shows the BRICS+ and G7 groups across key metrics such as GDP, population, and share of global trade, highlighting the growing importance of BRICS+ in the global economy. BRICS+, which includes Brazil, Russia, India, China, South Africa, and potentially other emerging economies, represents a significant shift in economic power. With a larger population and a substantial share of global trade, BRICS+ is increasingly seen as a counterbalance to the traditional dominance of the G7 nations. This shift reflects the ongoing multipolarization of the global economy, where emerging markets play an increasingly prominent role.[5] With a larger population and a substantial share of global trade, BRICS+ is increasingly seen as a counterbalance to the traditional dominance of the G7 nations, reinforcing the growing influence of emerging markets on the global stage.

One of BRICS' fundamental advantages over the G7 is its demographic and economic weight. While the G7 nations represent about 10% of the world's population, BRICS accounts for over 40%, making it a far more representative body of global interests. Economic growth projections also favor BRICS members, particularly China and India, which are expected to continue driving global economic expansion in the coming decades. The economic stagnation facing several G7 nations contrasts sharply with the rapid industrialization and technological advancements across BRICS economies.

BRICS also surpasses the G20 in its ability to focus on the concerns of emerging economies. While the G20 includes advanced and developing nations, its agenda is often dominated by the policy priorities of the United States, the European Union, and their allies. The needs of developing countries are frequently sidelined in favor of maintaining the existing financial order, which remains structured around Western dominance. In contrast, BRICS has prioritized issues such as infrastructure development, sustainable growth, and economic sovereignty, ensuring that emerging economies have a platform to advocate for their interests.

Another key strength of BRICS is its emphasis on financial independence and institutional innovation. The G7 and G20 continue to rely heavily on Western-dominated institutions like the IMF and World Bank, which have long faced criticism for imposing economic conditionalities that often serve the strategic interests of developed nations rather than fostering sustainable growth in recipient countries. Through the NDB, BRICS has pioneered an alternative financial model that prioritizes development without the political constraints typically associated with Western loans. By offering financing with fewer conditions and greater respect for national sovereignty, BRICS presents a viable alternative to the longstanding dominance of Western financial institutions. This potential to reshape the global economic landscape fosters a sense of optimism and anticipation for a more balanced financial order.

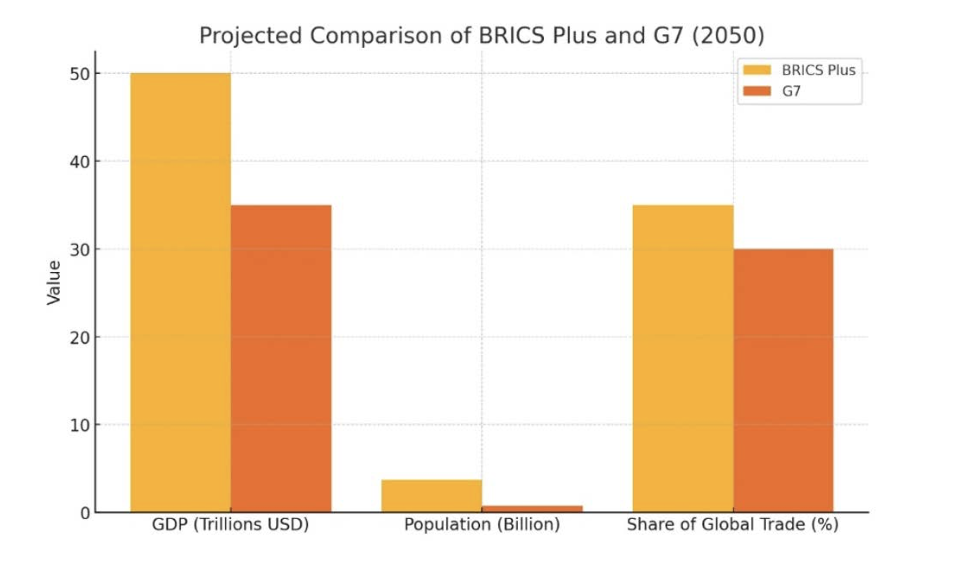

Additionally, as the chart projects, we observe a significant shift in global economic dynamics by 2050, with BRICS+ expected to surpass the G7 in key areas such as GDP, population, and share of international trade. This projection underscores the growing influence of emerging economies within the BRICS+ group, which includes Brazil, Russia, India, China, South Africa, and potentially other nations. The anticipated economic growth of these countries highlights the ongoing transition towards a more multipolar world, where traditional economic powerhouses in the G7 may see their relative influence diminish. The data suggests that by mid-century, BRICS+ could play a central role in shaping global trade and economic policies, reflecting the increasing importance of these nations in the global economy.

Diplomatically, BRICS has proven to be a more effective forum for fostering South-South cooperation. The G7 remains a platform primarily shaped by the strategic interests of the United States and its allies, often prioritizing geopolitical containment over genuine international collaboration. In contrast, BRICS provides a space where emerging economies can engage in dialogue on equal footing, free from the ideological constraints that often define Western-led organizations. Its approach to diplomacy, rooted in non-interference and mutual benefit, has made it an attractive model for nations seeking to navigate the complexities of a multipolar world.

In essence, BRICS offers a more inclusive, representative, and forward-thinking framework for global governance compared to the G7 or the G20. Its emphasis on development, financial sovereignty, and multipolar cooperation reflects the realities of a world where emerging economies are no longer peripheral players but central actors in shaping international relations. While the G7 and G20 struggle to adapt to this shifting landscape, BRICS continues to expand its influence, demonstrating that the future of global governance belongs not to the few but to the many.

The G20, which includes both advanced and emerging economies, serves as a broader platform for global economic cooperation. Unlike the G7, which is limited to advanced economies, the G20 includes countries like China, India, Brazil, and South Africa, making it a more representative forum for global governance.

However, the G20 has faced criticism for its limited effectiveness in addressing global governance challenges. One major issue is its lack of enforcement mechanisms—while it can issue declarations and recommendations, it lacks the authority to implement policies, reducing its impact (Stephen, 2014). Additionally, the G20 has been criticized for prioritizing short-term economic issues over long-term challenges such as climate change and inequality, undermining its credibility.

In contrast, BRICS has taken a more proactive approach, focusing on long-term structural issues and establishing alternative institutions like the NDB. While the G20 remains an important forum for global economic cooperation, BRICS offers a more focused platform for emerging economies to collaborate on shared priorities.

The G7 and G20 have also faced criticism for their inability to effectively meet global governance demands. A major critique is their lack of inclusivity. The G7 is often seen as an exclusive club of advanced economies that does not adequately represent the interests of developing countries, which undermines its legitimacy as a global governance forum.

Both the G7 and G20 have been criticized for focusing on maintaining the status quo. These groups have shown reluctance to challenge the dominance of Western financial institutions like the IMF and World Bank, limiting their ability to address the needs of developing countries.

Additionally, both groups have been criticized for their failure to tackle pressing global challenges such as climate change, inequality, and public health. Critics argue that the G7 and G20 have not provided meaningful solutions to these issues, further undermining their credibility as forums for global governance.

BRICS in Global Governance

While BRICS does not seek to replace the G7 or G20, it serves as a complementary platform that amplifies the voice of emerging economies in global governance. The G7 remains a vital forum for advanced economies, and the G20 serves as a broader platform for both advanced and emerging nations. However, BRICS ensures that the voices of developing countries are heard, promoting a more balanced and equitable international order.

BRICS has been instrumental in advocating for reforms in global governance to reflect the realities of a multipolar world. The NDB serves as an alternative to traditional Western-dominated financial institutions, offering loans with fewer conditionalities and greater respect for national sovereignty.

Additionally, BRICS has played a key role in promoting the use of local currencies in trade and financial transactions, reducing reliance on the US dollar and challenging the dominance of Western financial systems. The group has also advocated for a more democratic and inclusive United Nations, particularly calling for reforms to the Security Council to better represent the interests of developing countries.

Challenges Ahead for BRICS

Despite its achievements, BRICS has faced significant criticism. One major critique is its lack of cohesion and internal disparities. While China and India have experienced rapid economic growth, Brazil, Russia, and South Africa have faced economic stagnation and political instability. These disparities hinder the group's ability to present a unified front on global issues. However, proponents argue that BRICS' diversity is one of its strengths, enabling it to address a broad range of issues from multiple perspectives. The group has shown resilience in navigating these internal disparities, as seen in its ability to establish institutions like the NDB despite differing economic conditions among members.

Another critique is BRICS' limited impact on global governance. While it has established institutions like the NDB, its influence on global financial systems remains marginal compared to traditional institutions like the IMF and World Bank. Critics argue that BRICS has struggled to translate its economic weight into meaningful political influence. Supporters, however, contend that BRICS' value lies in providing an alternative platform for dialogue and cooperation among emerging economies. Over time, as the group expands its membership and institutional capacity, its influence is expected to grow.

BRICS has also been criticized for lacking a clear agenda and strategic vision. The group's broad and often ambiguous declarations have raised questions to effectively address complex global challenges. However, advocates argue that BRICS' flexibility and informality are strengths rather than weaknesses. By avoiding rigid structures and fixed agendas, the group can adapt to changing global dynamics and respond to emerging challenges more effectively, underscoring its relevance in an evolving international landscape (Cooper & Farooq, 2015).

One of BRICS’ major vulnerabilities is its dependence on China, which accounts for a significant share of the group's economic output. This imbalance of power often results in smaller members deferring to China's interests (Hurrell, 2018).

Another weakness is BRICS’ limited institutional capacity. Unlike the G7, which has a well-established secretariat and formal decision-making processes, BRICS lacks a permanent administrative structure. This limits its ability to coordinate policies and implement initiatives effectively (Cooper & Farooq, 2015).

Additionally, geopolitical tensions among BRICS members present a significant challenge. Longstanding border disputes between India and China, as well as Russia's aggressive foreign policy stance, have at times strained relations within the group. These tensions threaten to undermine BRICS’ cohesion and effectiveness (Pant, 2013).

Prospects of BRICS as a Global Player

The future of BRICS as a global player is promising but not without challenges. Economically, the group represents over 40% of the world's population and accounts for a substantial share of global GDP. With China and India expected to drive global economic growth in the coming decades, BRICS' influence is set to expand further. The bloc has also demonstrated resilience and adaptability, broadening its agenda to include digital governance, climate change, and public health — highlighting its commitment to addressing contemporary global challenges.

In recent years, BRICS has actively pursued expansion to include other emerging economies. In 2023, the group announced the inclusion of new members such as Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates. This expansion—often referred to as "BRICS+"—reflects the bloc’s ambition to extend its influence and represent a more diverse range of voices in global governance.

For several reasons, developing countries are likely to gain more from BRICS+ than from the G7 or G20. First, BRICS+ provides a dedicated platform for emerging economies to collaborate on shared priorities, such as infrastructure development, poverty reduction, and climate resilience. Unlike the G7, which is dominated by advanced economies, BRICS+ ensures that the perspectives and interests of developing nations take center stage in shaping the global agenda (Hurrell, 2018).

Second, BRICS+ offers an alternative to the conditionalities often imposed by Western-dominated institutions like the IMF and World Bank. Through the NDB and other BRICS-led initiatives, member nations can access financing with fewer restrictions, allowing them to pursue their development goals without compromising their sovereignty.

Finally, BRICS+ represents a broader shift toward a more inclusive and multipolar world order. By expanding its membership, BRICS is actively challenging the dominance of traditional Western powers and fostering a more balanced global governance framework. This transformation is particularly significant for developing countries, which have historically been marginalized in global decision-making processes.

Addressing Vulnerabilities and Weaknesses

To enhance its long-term prospects, BRICS must address several key vulnerabilities. One crucial step is to strengthen its institutional capacity by establishing a permanent secretariat and formal decision-making processes. This structural improvement would enhance the group's ability to coordinate policies effectively and implement initiatives with greater efficiency (Cooper & Farooq, 2015).

Another crucial step for BRICS is to reduce its dependence on China by fostering greater economic integration among member states. This could be achieved through initiatives such as a BRICS free trade agreement or a common currency for trade and financial transactions (Griffith-Jones, 2014). Additionally, BRICS must address geopolitical tensions among its members by fostering greater trust and cooperation. Regular dialogue, confidence-building measures, and a focus on shared priorities—such as climate change and public health—can strengthen internal cohesion (Pant, 2013).

China’s Role in BRICS

China plays a pivotal role within BRICS, both economically and geopolitically. As the world's second-largest economy and the most significant contributor to BRICS' collective GDP, China provides substantial financial and institutional support to the group's initiatives. The Chinese Renminbi (RMB) has increasingly become a regional currency, particularly in Asia and Africa, and is gaining prominence in international trade and finance. This positions China as a key driver in discussions surrounding a potential digital BRICS currency.

China's leadership within BRICS is further demonstrated by its substantial contributions to the NDB and its advocacy for reforms in global financial institutions. By leveraging its economic strength and diplomatic influence, China has played a key role in positioning BRICS as a counterweight to Western-led institutions such as the IMF and the World Bank. However, this dominance has also raised concerns about an imbalance of power within the group, with smaller members occasionally aligning with Chinese interests rather than asserting their own (Hurrell, 2018).

The Potential for a Digital BRICS Currency

One of the most ambitious proposals to strengthen BRICS' global relevance is the creation of a digital BRICS currency.[6] Such an initiative would reduce the group's reliance on the US dollar for trade and financial transactions, challenging the dollar's dominance in the global financial system. While the Chinese RMB already plays a significant role in regional trade and finance, a digital BRICS currency would represent a collective effort to advance a multipolar monetary system. However, this initiative faces significant challenges, including economic disparities among member states and ongoing geopolitical tensions. Despite these obstacles, the proposal signals a bold step toward reshaping global financial governance. To implement the adoption of a digital BRICS currency, the group could establish a BRICS Monetary Council to oversee its development and management. By leveraging blockchain technology, the currency could ensure transparency, security, and efficiency in transactions. Initially, it could be introduced for intra-group trade, with a gradual expansion to other developing countries. Close coordination with the NDB would be essential to provide liquidity and stabilize the currency during its rollout, ensuring a smooth transition and building confidence in the new monetary system. This approach would not only reduce reliance on the US dollar but also strengthen financial cooperation among BRICS members and their partners.

BRICS and Africa: A Strategic Partnership for Development

With its vast natural resources, growing population, and untapped economic potential, Africa is one of the most dynamic regions in the global economy. With the inclusion of three African members—South Africa, Egypt, and Ethiopia—BRICS is uniquely positioned to deepen its engagement with the continent. South Africa, as a founding BRICS member, has long served as a bridge between the group and Africa, advocating for the continent’s interests in global governance. The recent inclusion of Egypt and Ethiopia further strengthens this connection, demonstrating BRICS’ commitment to amplifying Africa’s voice on the global stage. By leveraging its collective economic and political influence, BRICS can play a transformative role in addressing Africa’s key development challenges, from infrastructure deficits to climate change and digital transformation.[7]

A critical area where BRICS can make a lasting impact is infrastructure development. Africa faces an estimated annual infrastructure gap of USD 130–170 billion to meet its development goals. The NDB, established by BRICS, has already begun financing key infrastructure projects in Africa, including renewable energy initiatives and transportation networks. Expanding these investments and aligning them with Africa’s Agenda 2063 can help lay the foundation for sustainable economic growth. Additionally, BRICS’ push for using local currencies in trade and investment can reduce Africa’s dependence on the US dollar, mitigating currency volatility and fostering greater financial stability.

Beyond infrastructure, BRICS can play a pivotal role in supporting Africa’s industrialization and technological advancement. With extensive experience in manufacturing and digital innovation, BRICS members—particularly China and India—can facilitate knowledge transfer and capacity-building programs tailored to Africa’s development needs. Initiatives such as the BRICS Digital Cooperation Initiative could help bridge Africa’s digital divide by expanding broadband access, promoting e-governance, and fostering innovation hubs.

Additionally, BRICS’ focus on climate resilience and renewable energy aligns closely with Africa’s priorities. As the continent seeks to transition to green economies while mitigating the disproportionate impacts of climate change, collaboration on clean energy projects and sustainable agriculture can serve as a model for inclusive, environmentally conscious development.

The inclusion of Egypt and Ethiopia in BRICS underscores the group’s recognition of Africa’s geopolitical significance. Egypt, with its strategic location and leadership in the Arab world, and Ethiopia, as a hub for African diplomacy and home to the African Union headquarters, bring unique perspectives to the BRICS framework. Their membership strengthens BRICS’ representation of the Global South and enhances its ability to advocate for global governance reforms that benefit developing nations.

As Africa continues to emerge as a key player in an increasingly multipolar world, BRICS can serve as a strategic partner, offering resources, expertise, and solidarity. Together, BRICS and Africa can build a more equitable and sustainable future, grounded in mutual respect and shared prosperity.

Policy Recommendations to Strengthen BRICS

For BRICS to consolidate its role as a leading force in global governance, it must implement structural and strategic reforms to enhance its institutional resilience and economic integration. A key step is to establish a permanent BRICS Secretariat. Currently, the bloc operates without a centralized administrative structure, leading to inefficiencies in coordination and policy continuity. A dedicated Secretariat, based in a neutral location such as South Africa, would provide a stable institutional framework, oversee the implementation of agreements, and ensure consistency in leadership transitions.

Economic integration must also be prioritized to enhance intra-BRICS trade and investment. Despite their collective economic potential, trade among BRICS members remains underdeveloped compared to their interactions with Western markets. A BRICS Free Trade Agreement would strengthen commercial linkages, reduce trade barriers, and encourage cross-border investments in infrastructure projects. Harmonizing regulatory frameworks and investment protections would further stimulate economic cooperation, reinforcing BRICS as a unified economic bloc.

A significant financial reform that could redefine BRICS’ global influence is the development of a digital BRICS currency.[8] By leveraging blockchain technology, such a currency could facilitate seamless transactions among member states, reduce dependency on Western financial systems, and shield BRICS economies from dollar-driven financial disruptions. The NDB could serve as the central institution for managing this currency, ensuring transparency and stability while gradually expanding its use beyond BRICS members.

Climate cooperation is another critical area where BRICS could assert leadership.[9] Given that BRICS countries are among the world’s largest carbon emitters, a collective commitment to sustainability is essential for enhancing the bloc’s credibility in global climate governance. Establishing a BRICS Green Fund to finance renewable energy projects and climate adaptation initiatives would demonstrate a strong commitment to sustainable development. Moreover, coordinated efforts in climate diplomacy could strengthen BRICS’ negotiating power in global forums, ensuring that climate policies reflect the needs of developing nations rather than being dictated solely by Western agendas.

Geopolitical cohesion remains a pressing challenge for BRICS. Tensions between China and India, in particular, have occasionally threatened to undermine the bloc’s unity. To mitigate these risks, BRICS must institutionalize regular diplomatic dialogues, implement confidence-building measures, and establish a structured conflict-resolution mechanism. Ensuring that internal disputes do not stall progress is essential for maintaining credibility and effectiveness on the global stage. Economic collaboration should be emphasized as a unifying force, ensuring that geopolitical differences do not overshadow shared economic and developmental goals.

Conclusion

BRICS stands at a pivotal moment in its evolution. While internal challenges persist, its potential to reshape global governance remains significant. By strengthening institutional frameworks, deepening economic integration, advancing financial autonomy through a digital currency, and asserting leadership in climate diplomacy, BRICS can transcend its role as a counterweight to the West and emerge as a transformative force in international politics. Its future will be defined by its ability to adapt, innovate, and lead in an increasingly complex global landscape.

Bibliography

Cooper, A. F. (2016). "The BRICS: A Very Short Introduction." Oxford University Press.

Eichengreen, B. (2019). Globalizing Capital: A History of the International Monetary System (3rd ed.). Princeton University Press.

Griffith-Jones, S. (2014). "A BRICS Development Bank: A Dream Coming True?" UNCTAD Discussion Paper No. 215.

Hurrell, A. (2007). On Global Order: Power, Values, and the Constitution of International Society. Oxford University Press.

Laidi, Z. (2012). "BRICS: Sovereignty, Power, and Weakness." International Politics, 2012, 49 (5), pp. 614-632

Pant, H. V. (2013). "The BRICS Fallacy." Washington Quarterly, 36(3), 91–105.

Roberts, C., Armijo, L. E., . and Katada, Saori N. (2017). "The BRICS and Collective Financial Statecraft." Oxford University Press.

Stephen, M. D. (2014). "Rising Powers, Global Capitalism, and Liberal Global Governance: A Historical Materialist Account of the BRICS Challenge." European Journal of International Relations, 20(4), 912–938.

[1] Jim O’Neill, then chief economist at Goldman Sachs, coined the term “BRIC” in 2001 to highlight the growing influence of Brazil, Russia, India, and China in the global economy. His prediction was based on macroeconomic projections suggesting these nations would become dominant suppliers of manufactured goods, services, and raw materials by 2050.

[2] BRIC was formalised during the 2009 summit in Yekaterinburg, Russia, marking the transition of the acronym from an economic forecast into a structured geopolitical grouping with ambitions to influence global governance.

[3] South Africa's inclusion in BRICS in 2010 was a strategic move to ensure African representation in the bloc, broadening its geographic legitimacy and enhancing its claim to represent the Global South.

[4]The New Development Bank (NDB), established by BRICS in 2014 and headquartered in Shanghai, is designed to finance infrastructure and sustainable development projects in emerging economies. It offers an alternative to the conditionality-based lending of the World Bank and IMF.

[5]BRICS+ represents a strategic expansion initiative that aims to include new members from Asia, Africa, and the Middle East, strengthening its legitimacy as a platform for Global South cooperation.

[6]The shift toward using local currencies in intra-BRICS trade is part of a broader de-dollarisation strategy intended to reduce vulnerabilities to US monetary policy and sanctions.

[7] BRICS' cooperation with Africa, mainly through its African members and NDB-funded projects, addresses infrastructure gaps and fosters industrialisation by leveraging South-South knowledge transfers and investment.

[8]The proposed BRICS digital currency, potentially using blockchain technology, aims to facilitate cross-border payments, reduce reliance on the US dollar, and provide an alternative model for financial globalisation.

[9] Environmental collaboration is becoming central to the BRICS' agenda, with discussions of a BRICS Green Fund indicating an effort to collectively support climate adaptation and sustainable energy transitions across member and partner states.