Publications /

Policy Brief

The second Trump administration’s reversal of federal climate policy is reshaping the U.S. energy and industrial landscape, with significant implications for macroeconomic performance, clean technology competitiveness, and global climate cooperation. While the deregulatory shift and emphasis on fossil-fuel production may generate short-term output gains in selected sectors, the long-term structural transformation necessary for sustained growth in an increasingly low-carbon global economy is likely to be undermined. President Donald Trump’s efforts to dismantle the Inflation Reduction Act (IRA) and related climate policies has disrupted private investment flows, stalled infrastructure deployment, and raised uncertainty for firms in clean-energy supply chains. Simultaneously, regulatory weakening—particularly of emissions standards—has heightened fiscal and systemic risks, while eroding the credibility of U.S. financial markets in pricing climate exposure.

Internationally, the U.S. retrenchment has altered the global balance of climate leadership. The European Union and China are moving rapidly to consolidate their dominance in strategic sectors such as batteries, hydrogen, and renewable-energy manufacturing. The U.S. risks ceding ground in future export markets, as well as facing new trade frictions from carbon border measures. Developing countries, meanwhile, face a shortfall in climate finance, with implications for just-transition partnerships and adaptation investment. This Policy Brief assesses the macroeconomic, industrial, and geopolitical consequences of the U.S. climate policy reversal, and outlines a framework for mitigation anchored in subnational action, market forces, and international cooperation. While the reversal carries lasting consequences, targeted efforts can preserve elements of resilience and prepare the ground for future U.S. federal re-engagement.

Introduction: From Leadership to Retrenchment

The United States entered the Biden administration era with renewed momentum in clean-energy deployment, manufacturing, and climate innovation. The Inflation Reduction Act (IRA), signed into law in 2022, marked a turning point in federal climate and industrial policy, mobilizing over $300 billion in clean-energy investments and anchoring the U.S. trajectory toward net-zero emissions. By 2024, clean technology had emerged as a major source of capital formation and employment growth, with policy certainty driving a rebound in domestic battery, electric vehicle (EV), and renewable energy manufacturing.

This momentum, however, has been interrupted abruptly. The inauguration in January 2025 of President Trump for the second time has led to a sweeping reversal of climate-related initiatives. IRA tax credits and grants have been curtailed or repealed. Regulatory standards—on emissions, vehicle fuel economy, and methane leakage—have been rolled back. Funding for federal clean-energy R&D programs, including the Advanced Research Projects Agency–Energy (ARPA-E) and Department of Energy innovation offices, has been cut significantly. These policy shifts have already altered investor expectations, delayed infrastructure deployment, and introduced volatility into long-horizon project planning.

The rationale advanced by the administration emphasizes energy affordability, industrial deregulation, and fossil-fuel expansion as pillars of energy security and competitiveness. Yet this approach diverges from the direction of global industrial policy and the economics of technological change. Most major economies are pursuing climate-aligned growth strategies centered on low-carbon innovation and infrastructure investment. As a result, the U.S. risks isolation in a rapidly evolving international energy landscape.

This policy brief analyzes the consequences of the second Trump administration’s climate reversal in six areas: (i) macroeconomic trade-offs and sectoral realignment; (ii) employment and growth in clean and fossil sectors; (iii) the hidden costs of deregulation; (iv) industrial competitiveness in clean technology; (v) global trade and climate diplomacy; and (vi) the role of domestic and international counterweights. While the policy environment has shifted decisively, the structural foundations of a clean-energy transition—technological progress, cost competitiveness, and subnational leadership—remain intact. Preserving and leveraging these assets will be critical to mitigating long-term economic and geopolitical risks.

1- The Structural Economic Impacts of Climate-Policy Rollback

1.1 Macroeconomic Trade-Offs and Sectoral Realignments

The second Trump administration’s reorientation of energy policy marks a distinct break from the market signals and industrial reallocation patterns set in motion under the Inflation Reduction Act (IRA). At the center of this reversal lies an explicit effort to reassert fossil-fuel production—particularly oil and gas—as engines of growth and geopolitical leverage. In doing so, the administration has deprioritized investment incentives for clean-energy infrastructure, and has withdrawn key federal supports for low-carbon innovation.

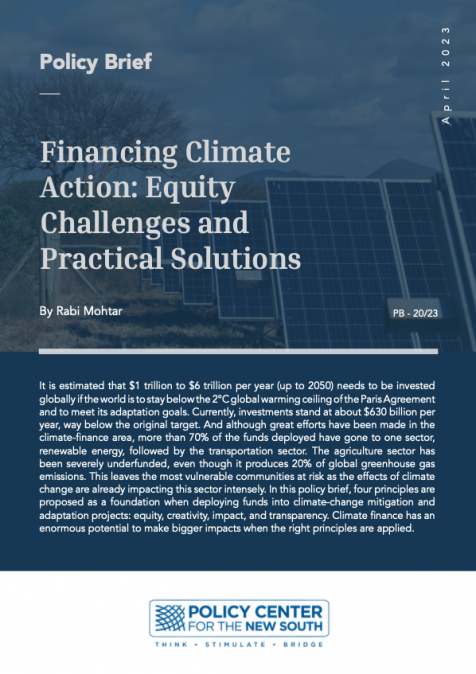

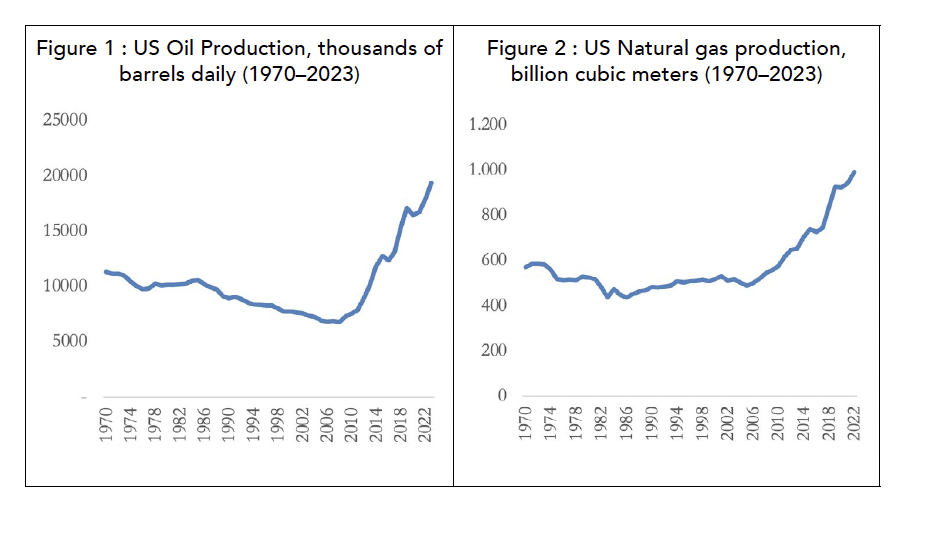

U.S. crude oil production, which had already reached a historical high of 17.1 million barrels per day in 2019, rose further to 19.3 million barrels per day by 2023 (Figure 1), aided by regulatory easing, accelerated permitting, and favorable commodity prices (EIA, 2024a; Energy Institute, 2024). The second Trump administration’s commitment to fossil-fuel extraction, as demonstrated by its ‘drill, baby, drill’ doctrine, aims to further continue this upward trend in oil production. Natural gas production and liquefied natural gas (LNG) exports have also continued to rise, reinforcing the U.S.’s position as a net energy exporter since 2018 (Figure 2). However, these gains are predominantly capital-intensive and regionally concentrated, with limited multiplier effects compared to emerging clean-technology industries.

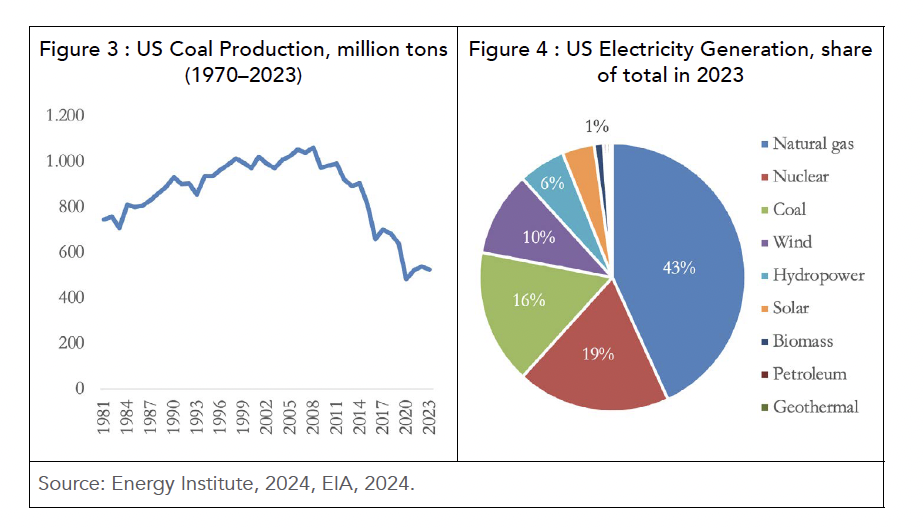

Coal presents a counterexample. Despite political rhetoric promising revival, market forces have continued to drive contraction. Production fell to 486 million short tons in 2020 (Figure 3), the lowest level since 1965, and has remained on a downward trajectory, declining by 5% annually between 2013 and 2023 (Energy Institute, 2024). Coal’s share in U.S. electricity generation dropped from 23% in 2019 to just 16% in 2023, while renewables rose to 21% (Figure 4) (EIA, 2024b; IEA, 2025a). This structural shift reflects underlying cost dynamics and the increasing competitiveness of solar and wind, rather than regulatory constraints alone.

The policy reversal under Trump has introduced significant uncertainty for the clean-energy sector. The IRA catalyzed more than $300 billion in clean-energy investment (UNCTAD, 2022), but much of this momentum is now at risk. The repeal or weakening of tax credits for renewable electricity, energy storage, electric vehicles (EVs), and manufacturing has led to project deferrals and investor hesitation. Unlike fossil-fuel expansion, which is less dependent on public incentives, capital formation in clean-technology sectors remains tightly linked to policy stability and regulatory visibility.

The macroeconomic trade-offs, therefore, are asymmetrical. While fossil-fuel expansion may contribute modestly to GDP growth in resource-rich states, and improve short-run trade balances through increased energy exports, these gains are unlikely to offset the opportunity cost of foregone clean-energy investment and industrial diversification. Moreover, the volatility of global energy prices—and the associated fiscal and inflationary risks—limits the reliability of fossil-fuel expansion as a foundation for sustainable growth

1.2 Labor-Market Dynamics: Short-Term Fossil Gains Vs. Clean Energy Growth Potential

The rollback of federal climate initiatives risks reshaping U.S. labor-market dynamics in the energy sector, with significant distributional and macroeconomic implications. While the administration’s focus on fossil-fuel production may offer modest employment gains in selected regions, the broader picture reveals a missed opportunity to sustain momentum in clean-energy job creation, one of the fastest-growing segments of the U.S. labor force in the early 2020s.

Employment in fossil-fuel industries is increasingly capital-intensive and geographically concentrated. In 2023, oil and gas extraction benefitted from an uptick in upstream investments, supported by new leasing of federal lands and fast-tracked infrastructure approvals, leading to localized employment gains in pipeline construction and servicing (Rapier, 2024). However, the total employment base remains small relative to clean-energy sectors. For instance, the entire U.S. coal mining industry employs between 50,000 and 60,000 workers, while the solar energy industry alone supported over 230,000 jobs as of 2020 (SEIA, 2021; EIA, 2024c).

Under the influence of IRA-linked incentives, clean-energy employment had been outpacing national labor market growth. In 2023, clean-energy jobs expanded by 149,000, more than twice the rate of overall employment gains, driven by growth in solar and wind installation, battery, and EV manufacturing, and building energy efficiency (U.S. Department of Energy, 2024). These sectors offer broader geographic dispersion, and also provide significant multiplier effects through construction, advanced manufacturing, and engineering services.

Model-based projections had estimated that the IRA could generate up to 1 million jobs and contribute $1.7 trillion to U.S. GDP by 2032, largely via private-sector reinvestment in domestic supply chains (Maye and Mazewski, 2023). This reindustrialization process, already underway, was central to regaining domestic competitiveness in critical technologies. However, the partial rollback of the IRA and broader policy uncertainty have jeopardized these employment gains. Project developers and manufacturers have announced hiring freezes, and several large-scale industrial investments have been delayed or canceled. For instance, at least two billion-dollar U.S. battery plant projects have been canceled since the inauguration, with Kore Power abandoning a plan to build a $1.2 billion facility in Arizona and Freyr Battery dropping a plan to build a $2.6 billion factory in Georgia in the past month (Johnson, 2025). Furthermore, automakers such as Ford and General Motors have cited uncertainty around federal incentives and the reimposition of tariffs as major constraints on expanding EV production capacity (Isidore and Yurkevich, 2025). These trends suggest not only a drag on employment but the potential erosion of skill formation and workforce planning in clean-energy sectors.

From a labor-market efficiency perspective, the shift back toward fossil-fuel-centric policy appears misaligned with the direction of structural employment growth. Clean-energy jobs have demonstrated higher growth rates in the U.S., longer-term demand resilience, and better alignment with decarbonization imperatives and global technological trends. Reallocating labor and capital away from this trajectory introduces opportunity costs that will grow over time, particularly as international markets continue their transition toward net-zero industries.

1.3 The Cost of Deregulation: Environmental Externalities and Systemic Risk

The deregulatory agenda pursued by the second Trump administration has centered on reducing compliance burdens for fossil-fuel producers and energy-intensive sectors. Major regulatory rollbacks have included the suspension of methane emissions standards for oil and gas operations, the weakening of Corporate Average Fuel Economy (CAFE) standards, and the relaxation of clean air and water rules affecting energy infrastructure (U.S. EPA, 2024). While these actions have reduced direct costs for U.S. targeted energy companies, estimated at approximately $6 billion annually (API, 2024), the broader economic and social implications suggest rising long-term liabilities.

First, the environmental cost of reversing methane regulations is substantial. Methane is a highly potent greenhouse gas, with a global warming potential over 80 times that of CO₂ over a 20-year period (European Commission, 2025). Attempts to weaken methane regulations started with the first Trump administration. At that time, the Environmental Defense Fund estimated that the relaxation of federal methane rules could result in an estimated additional 4.5 million metric tons of methane pollution into the atmosphere each year (EDF, 2020). These emissions not only accelerate climate change but also worsen local air quality, increasing the incidence of respiratory and cardiovascular illnesses.

Second, the rollback of fuel-economy standards is reversing a policy trajectory that historically delivered significant consumer and macroeconomic benefits. Prior to the reversal, CAFE standards were projected to save U.S. consumers nearly $23 billion in fuel costs and avoid the consumption of about 70 billion gallons (265 million liters) of gasoline (equivalent) through 2050 (NHTSA, 2024). The weakening of these standards, by contrast, is expected to increase cumulative gasoline consumption. This not only raises consumer costs but increases vulnerability to oil-price volatility, a factor that has historically contributed to U.S. macroeconomic instability.

Third, the suspension of climate-related financial oversight measures undermines the resilience of the broader financial system. Under the previous administration, efforts had been made to incorporate climate risk into financial supervision, including through the Financial Stability Oversight Council and the Securities and Exchange Commission (SEC). These initiatives have now been deprioritized, with the SEC suspending implementation of its 2023 climate disclosure rule (Costa, 2025). As a result, investors face greater difficulty in assessing transition risks, stranded asset exposure, and liabilities linked to extreme-weather events. The risk of mispricing in capital markets is growing, increasing the probability of disorderly corrections, and undermining the financial system’s ability to internalize long-term climate risk.

Finally, the fiscal consequences of these regulatory decisions are non-trivial. The U.S. Government Accountability Office (GAO) has repeatedly flagged the federal government’s rising exposure to climate-related liabilities, including disaster response, infrastructure damage, and flood insurance obligations (US GAO, 2019). The decision to scale back resilience funding and halt progress on adaptation programming increases this exposure. In 2023, the United States experienced 28 separate weather or climate disasters, each resulting in at least $1 billion in damages, totaling approximately $92.9 billion (Smith, 2024). The decision to deprioritize climate-resilience investments and adaptation programs exacerbates these fiscal vulnerabilities. According to the Congressional Budget Office (CBO), without effective mitigation, the frequency and severity of climate-related disasters are expected to rise, potentially leading to increased federal spending on disaster relief (CBO, 2023).

Overall, the deregulatory framework generates short-term cost savings for targeted firms but imposes mounting long-term liabilities, economic, fiscal, and health-related, on the broader economy. From a macroprudential and efficiency standpoint, these policies exacerbate climate-related market failures and increase systemic vulnerability.

2- U.S. Industrial Competitiveness in Global Clean-Tech Markets

The shift in U.S. federal climate policy comes at a time when clean-energy technologies have moved to the core of global industrial policy and export competitiveness. The number of countries that have pledged to achieve net-zero emissions has grown rapidly and now covers around 70% of global CO2 emissions (IEA, 2021). Leading economies have positioned decarbonization as a strategic vector for reindustrialization. This trend is not limited to environmental concerns; it reflects a recognition that future economic advantage will hinge on technological leadership in low-carbon sectors.

The European Union has anchored its Green Deal Industrial Plan around subsidies for renewables, hydrogen, electric vehicles, and battery manufacturing, reinforced by regulatory tools such as the carbon border adjustment mechanism (CBAM) (European Commission, 2023). China’s ‘Made in China 2025’ strategy and Five-Year Plans have long prioritized clean-technology leadership (Kennedy, 2015). In 2024, China’s total installed capacity increased by 14.6% in 2024, surpassing 3,348 gigawatts. Solar capacity surged by 45.2% (+277 GW) to reach 887 GW, while wind power capacity increased by 18% (+80 GW) to reach nearly 521 GW (Enerdata, 2025). Furthermore, China now controls more than 70% of global lithium-ion battery-production capacity (IEA, 2025). Japan and South Korea, meanwhile, are accelerating domestic green-industry growth under strategic innovation programs. Together, these countries are setting the pace in capturing high-value segments of the global green economy.

Until early 2024, the United States was closing the gap. The IRA and Bipartisan Infrastructure Law catalyzed over $300 billion in investment announcements across batteries, electric vehicles, clean hydrogen, and grid modernization (UNCTAD, 2022). The IRA’s production-linked incentives attracted both domestic and foreign capital, supporting the reshoring of advanced manufacturing. Supply-chain plans for battery gigafactories, EV assembly plants, and electrolyzer-production facilities proliferated, with over 800 projects announced by late 2024 (U.S. Department of Energy, 2024).

However, since the attempts to reverse key IRA provisions, investor sentiment risks deteriorating in response. In the final quarter of 2024, clean energy and transportation investment in the United States totaled $70 billion, reflecting a slight 1% decline from the previous quarter but a 6% increase from the same period in 2023 (Rhodium Group, 2025). While this broadly signaled continued growth, it also reflected a deceleration from the previous streak of quarter-on-quarter increases. These investments occurred before any policy changes in 2025. Firms have postponed plant openings, revised production targets, or shifted projects abroad. Ford, General Motors, and Hyundai have publicly cited uncertainty around federal policy as a key factor in delaying investments (Isidore and Yurkevich, 2025). This instability is especially damaging for capital-intensive sectors with long planning horizons.

The effects of the policy shift go well beyond electric vehicles. Federal support for emerging technologies—such as green hydrogen, carbon capture and storage (CCS), and advanced nuclear—has been scaled back significantly. Under President Trump, the Department of Energy’s ARPA-E program, which funds early-stage clean energy innovation, has faced repeated defunding attempts. His administration proposed eliminating ARPA-E in the 2018, 2019, and 2020 budgets, arguing that the private sector should lead this type of research (Worland, 2017; Dzikiy, 2019; Lavelle, 2019). For instance, the 2018 budget sought to slash ARPA-E’s funding from $290 million to just $20 million (Maloney, 2017), and the 2020 proposal called for its complete elimination, along with several other clean-energy programs. Despite these efforts, Congress—recognizing the strategic importance of energy innovation—maintained ARPA-E funding with bipartisan support (Worland, 2017). Still, the persistent push to dismantle the program has introduced uncertainty and weakened U.S. leadership in next-generation technologies. In fast-moving sectors such as electrolyzers and green ammonia, where global demand is rising and technological dominance is still up for grabs, such delays carry a high opportunity cost.

Moreover, the fragmented regulatory framework now emerging—marked by weakened coordination, uncertain incentives, and shifting standards—deters private investment. In contrast, the EU and China are tightening alignment between industrial policy, infrastructure deployment, and climate goals. The EU’s Net-Zero Industry Act, for example, seeks to capture 40% of domestic demand for clean technologies by 2030. China’s industrial banks and local governments continue to finance clean-tech scale-up on favorable terms.

From a competitiveness standpoint, the divergence is stark. Clean technology is no longer a fringe sector; it is central to global value chains, capital allocation, and labor demand. The U.S. risks forfeiting leadership in strategic sectors that will define global trade and growth patterns over the coming decades. While certain states may sustain investment momentum through local incentives and procurement mandates, the absence of consistent federal policy undermines the scale and coherence needed for national competitiveness.

3- Global Consequences: Trade, Diplomacy, and Climate Governance

The U.S. withdrawal from climate leadership under the second Trump administration has triggered a cascade of global responses. Allies and competitors alike are recalibrating their industrial policies, trade strategies, and diplomatic postures in response to a diminished American role in the global energy transition. While the domestic effects of policy reversal are significant, the geopolitical and systemic consequences may prove even more enduring.

3.1 Trade Frictions and Carbon Border Measures

Nowhere is the divergence more pronounced than in transatlantic climate and trade relations. The EU has responded to the U.S. backtracking, since the first Trump Administration, by reinforcing its own decarbonization agenda, most notably through the carbon border adjustment mechanism (CBAM). Scheduled to take full effect in 2027, CBAM will impose carbon tariffs on imports of high-emission goods including steel, cement, and aluminum. Initially modest in scope—only 1.1% ($4 billion) of U.S exports fell within the categories covered by the CBAM in 2022 (Hoening, 2023)—the policy sends a clear signal: European firms will not be disadvantaged by importing from countries with weaker environmental standards.

As U.S. regulatory standards diverge further from EU benchmarks, a growing share of American industrial exports could become subject to these levies, eroding price competitiveness. Moreover, Brussels has expressed interest in forming ‘climate clubs’ with other decarbonizing economies, such as Canada, Japan, and the United Kingdom. These alliances may involve harmonized standards, preferential trade terms, and coordinated border adjustments, potentially isolating the U.S. from emerging green trade blocs (Adams et al, 2022).

3.2 China’s Strategic Positioning

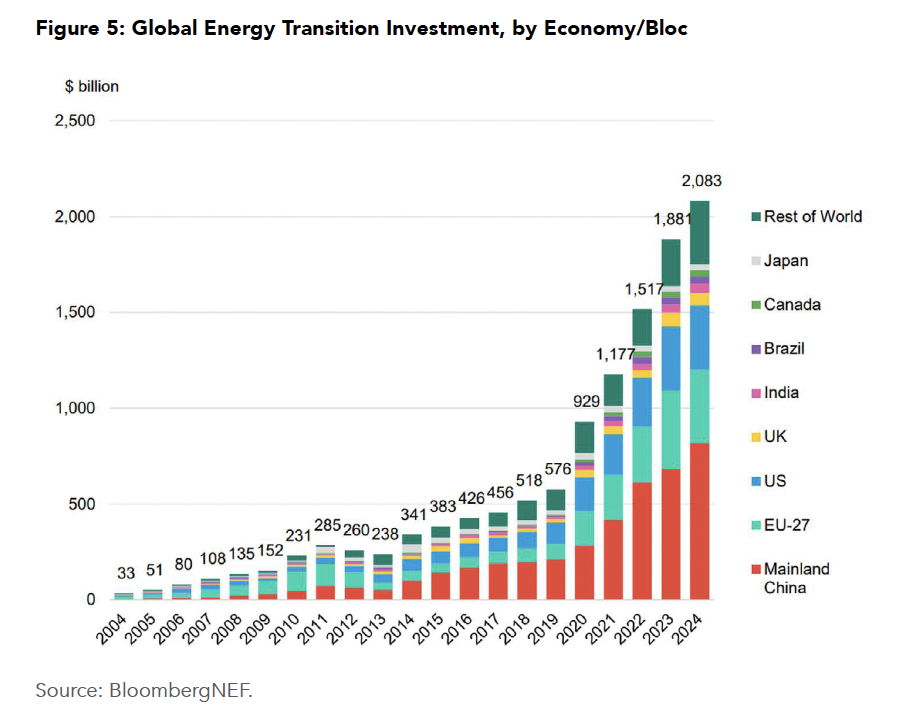

China, the world’s largest emitter and a dominant player in clean-energy manufacturing, is both a competitor of the U.S. and potential beneficiary of its retreat. Beijing has continued to position itself as a global leader in renewable-energy deployment and supply chains, despite a mixed record on emissions reductions. In 2024, China’s growth in energy-transition investment accounted for two-thirds of the global uptick, as China invested $818 billion in 2024, more than double any other economy (Figure 5). In comparison, U.S. investment was stable at $338 billion, while EU and UK investment fell (BloombergNEF, 2025).

Furthermore, China plays a dominant role in global mineral supply chains, particularly in refining and processing. It handles 68% of the world’s nickel refining, 40% of copper, 59% of lithium, and a striking 73% of cobalt (Castillo and Purdy, 2022). China is also the leading producer of 20 key minerals and is responsible for processing 85% of rare earth elements, contributing to 60% of total global critical mineral output (Energy World, 2024). Although China is not among the top mining nations by raw extraction, it has become a global investor in the sector. In 2023 alone, Chinese mining investments abroad totaled approximately $19.4 billion (Nedopil, 2023). This trend has accelerated, particularly in China’s overseas mining investments, especially in lithium, cobalt, and nickel, with over $10 billion committed during the first half of 2023.

With the U.S. retreating from coordinated climate diplomacy and public financing of clean energy abroad, China has an opportunity to expand its Belt and Road Initiative (BRI) energy partnerships, offering renewable infrastructure and financing to developing countries. At the same time, the absence of pressure from Washington may reduce incentives for Beijing to strengthen its domestic climate targets. Hardliners in China may view U.S. disengagement as justification for delaying costly structural reforms, particularly in carbon-intensive sectors such as steel, cement, and coal-fired power. There is also a risk of deepening fossil-fuel interdependence. During Trump’s first term, U.S.-China energy trade grew, with liquified natural gas (LNG) exports forming a new axis of bilateral engagement. A similar dynamic may re-emerge, with U.S. energy exporters viewing China as a strategic market. This could blunt competitive pressure in clean tech, even as both nations vie for leadership in key innovation domains.

3.3 Climate Finance and Global Coordination Gaps

The U.S. retreat from multilateral climate finance poses a major challenge for developing countries. Under the Biden administration, the U.S. pledged to scale up climate-related development assistance to $11 billion per year by 2024, including a six-fold scaling up of adaptation finance to over $3 billion per year (WRI, 2024), contributions to the Green Climate Fund, and bilateral support for clean-energy transitions. Those commitments have now been rescinded or suspended. The Trump administration rescinded $4 billion in U.S. pledges to the GCF, including Biden’s 2023 commitment, via an official note to the UN (Mathiesen, 2025). This directly revoked Biden-era contributions to multilateral climate funds. Furthermore, the United States has dropped out of Just Energy Transition Partnerships, a financing initiative that aims to help South Africa, Vietnam, and others transition from coal to clean-energy sources (Mirza, 2025).

The consequences are material. Without U.S. co-financing and concessional capital, many recipient countries may delay or abandon clean infrastructure projects, particularly where alternatives (e.g. coal or gas) remain cheaper. Europe and Japan may step in to fill part of the financing gap, but their fiscal capacity is limited. China’s policy banks may expand their roles, further aligning geopolitical influence with clean-energy investment flows.

The weakening of U.S. climate diplomacy also complicates coordination in international forums. During the Biden years, the U.S. was instrumental in shaping the Global Methane Pledge and pressing for stronger coal phase-down language at G7 and G20 summits. That leadership has vanished. Fractious negotiations have returned to forums like the United Nations Framework Convention on Climate Change, with the U.S. delegation now marginalized or absent. With the U.S. withdrawing again from the Paris Agreement, the multilateral architecture itself could fragment.

In sum, the global consequences of U.S. policy reversal extend well beyond lost credibility. They reshape trade rules, strategic competition, and the financing landscape for global decarbonization. In this vacuum, new alignments are forming—ones in which the U.S. plays a diminished role, and the rules of the emerging low-carbon order are increasingly shaped by others.

4- Domestic Resilience and Mitigation Pathways

Despite the federal government’s policy reversals, multiple institutional, market-based, and subnational mechanisms are helping sustain elements of the U.S. energy transition. These countervailing forces cannot fully replace coherent national leadership, but they have proven capable of preserving momentum, mitigating systemic risk, and maintaining a foundation for future federal re-engagement.

Measurable climate action in the U.S. persists through a network of subnational and private actors. As of 2025, 24 U.S. states, representing approximately 60% of the U.S. economy and over 55% of the population, remain committed to net-zero targets through the U.S. Climate Alliance (U.S. Climate Alliance, 2025). States including California, New York, and Washington continue to advance comprehensive decarbonization policies, including 100% clean electricity mandates, zero-emission vehicle (ZEV) standards, and building electrification codes. California’s Advanced Clean Cars II regulation alone will affect roughly 35% of U.S. auto sales because of its adoption by other states, creating a de-facto national market signal for electric vehicles (Goldstein et al, 2023; Shepardson, 2025).

Regional emissions trading schemes, such as the Regional Greenhouse Gas Initiative (RGGI), continue to cap power-sector emissions across the Northeast (ICAP, 2025). At the same time, state-level green banks, procurement mandates, and tax incentives are mobilizing clean-energy investment independently of federal policy. New York’s Climate Leadership and Community Protection Act and its associated $10 billion investment package serve as a template for such initiatives (CLCPA, 2025).

In the private sector, less than half (45%) of the leading listed companies in the U.S. have a net-zero target, hinting that, despite continued progress, net-zero commitments are the exception rather than the rule for the top U.S. companies (S&P Global, 2024). Corporate procurement of renewable-energy continues to grow, with more than 46 GW of corporate power purchase agreements (PPAs) signed in the U.S. in 2023 (BloombergNEF, 2024).

While these actors cannot fully substitute for federal regulation—particularly in sectors such as interstate transport, industrial emissions, and national infrastructure—they play an increasingly material role in preserving elements of the U.S. energy transition. Their collective actions, grounded in market incentives and global regulatory convergence, slow the erosion of momentum and help maintain a foundation for eventual federal re-engagement.

The international community has not remained passive in the face of the U.S. federal climate-policy reversal. Instead, several institutions and partner countries have adapted their strategies to sustain momentum in global climate governance, bolster clean-tech markets, and preserve engagement with U.S. subnational and private sector actors.

The EU, Canada, and Japan have actively expanded diplomatic and technical cooperation with U.S. states and cities through subnational climate diplomacy. Building on precedents set during Trump’s first term, EU officials have continued outreach via transatlantic climate dialogues, direct state-level partnerships (e.g. with California and New York), and regulatory interoperability initiatives aimed at minimizing trade friction from diverging climate standards (EEAS, 2024).

At the multilateral level, institutions such as the International Monetary Fund (IMF) and World Bank Group have strengthened climate mainstreaming in their operations. The IMF, through its Climate Macroeconomic Assessment Program (CMAP) and Article IV consultations, has continued to emphasize that climate inaction poses fiscal and financial risks, including in the United States. These assessments now regularly highlight exposure to transition risks, climate-related public debt burdens, and the implications of delayed adaptation planning. While the Trump Treasury has distanced itself from these analyses, they remain influential among financial-market participants and international economic policymakers.

The World Bank, under pressure from both its developing and donor-country shareholders, has increased climate conditionality in project financing. Its revised 2023–2025 Climate Change Action Plan requires that at least 35% of all lending should have climate co-benefits, with a strong emphasis on adaptation and energy transition infrastructure (World Bank, 2021). In the U.S. context, this creates indirect pathways for funding state and municipal projects aligned with global climate priorities, especially in transit, resilience, and water infrastructure.

International coalitions are adapting to the evolving climate landscape. The High Ambition Coalition (HAC), a diverse group of nations including Antigua & Barbuda, Chile, and Germany, continues to champion ambitious global climate action (HAC, 2025). Meanwhile, the Climate Club, initially proposed by Germany and now supported by the EU, Japan, and Canada, is advancing frameworks for coordinating carbon pricing, trade rules, and industrial decarbonization standards. Although the U.S. federal government has not formally participated, these initiatives aim to establish de-facto global norms that companies must adhere to in order to access major markets.

5- Conclusion and Strategic Priorities

The reversal of U.S. federal climate policy under the second Trump administration represents a decisive shift in the trajectory of the American energy transition. By dismantling the policy frameworks that had begun to align industrial growth, investment flows, and environmental ambition, the administration has introduced substantial uncertainty into the domestic economy, weakened national competitiveness in clean-tech markets, and fractured global climate cooperation.

Short-term macroeconomic gains from fossil-fuel expansion and deregulation—such as increased energy exports and reduced compliance costs—are outweighed by longer-term structural costs. These include stranded investment in emerging clean industries, lost employment potential, rising public-health expenditures, and heightened fiscal exposure to climate-related disasters. Most significantly, the U.S. risks ceding technological leadership and export advantage to countries that continue to invest strategically in low-carbon industries.

The international consequences are no less severe. U.S. retrenchment has altered the alignment of global trade, finance, and diplomacy. Europe is moving to protect its industrial base through carbon border measures and domestic clean-manufacturing incentives. China is consolidating its dominance in crucial supply chains, and expanding its diplomatic influence through energy-infrastructure finance. Developing countries, meanwhile, face a growing gap in climate finance and project bankability.

Yet the policy shift is not irreversible. Market forces, subnational leadership, and institutional investors are preserving elements of momentum that can be scaled back up under future U.S. federal re-engagement. For these actors, the challenge is to stabilize expectations, avoid irreversible divestment from clean technologies, and maintain the technical, human, and institutional capital required to resume rapid decarbonization when the political context allows.

To that end, four strategic priorities emerge:

- Safeguard Clean Energy Infrastructure: State and local governments should work to preserve project pipelines and coordinate regulatory stability across jurisdictions. Targeted financial instruments—such as state-level tax credits, credit enhancements, and procurement mandates—can partly offset the effects of federal rollback.

- Protect Innovation Capacity: Philanthropic, academic, and private-sector actors should continue to support research, development, and demonstration in strategic technologies such as grid-scale storage, hydrogen, and advanced nuclear. The long-term competitiveness of U.S. industry will depend on sustaining innovation ecosystems, even during federal disengagement.

- Strengthen International Norms and Coalitions: International institutions and U.S. allies should maintain pressure through trade and finance mechanisms. Climate clubs, cross-border carbon adjustments, and aligned standards for disclosure and procurement can preserve multilateral ambition and incentivize re-entry by future U.S. administrations.

- Preserve Institutional Readiness for Re-engagement: Agencies, states, and non-governmental actors should document lessons learned and protect datasets, and maintain operational capacity for future federal reintegration into climate governance. When the political cycle permits, a coordinated and rapid scale-up will be essential to regain lost ground.

The long arc of the U.S. energy transition remains shaped by powerful economic and technological forces. While the current reversal has slowed progress, it has not extinguished it. With sustained engagement from subnational and international actors, the architecture of climate ambition can be preserved—ready to be rebuilt when U.S. national leadership returns.

References

Adams, B., K. Axelsson & A. Parr., 2022. The Carbon Club revisited: Harnessing enterprise and trade to decarbonise the global economy, University of Oxford, available at: https://netzeroclimate.org/the-carbon-club/

Bade, G., 2018, Omnibus spending bill rejects Trump EPA, DOE cuts, Utility Dive, available at: https://www.utilitydive.com/news/omnibus-spending-bill-rejects-trump-epa-doe-cuts/519737/

BloombergNEF., 2025. Energy Transition Investment Trends 2025: Tracking global investment in the low-carbon transition, Report, available at: https://about.bnef.com/blog/global-investment-in-the-energy-transition-exceeded-2-trillion-for-the-first-time-in-2024-according-to-bloombergnef-report/

_2024. Corporate Clean Power Buying Grew 12% to New Record in 2023, According to BloombergNEF, available at: https://about.bnef.com/blog/corporate-clean-power-buying-grew-12-to-new-record-in-2023-according-to-bloombergnef/

Castillo, R & C. Purdy, 2022. China’s Role in Supplying Critical Minerals for the Global Energy Transition, The Leveraging Transparency to Reduce Corruption project and the Brookings Institution, available at: https://www.brookings.edu/wp-content/uploads/2022/08/LTRC_ChinaSupplyChain.pdf

CBO (Congressional Budget Office)., 2024. Disaster Preparation and Relief, available at: https://www.cbo.gov/topics/disaster-preparation-and-relief?

CLCPA (Climate Leadership and Community Protection Act)., 2025. New York’s Climate Leadership and Community Protection Act, file:///C:/Users/r.berahab/Downloads/CLCPA-Fact-Sheet.pdf

Climate Change News, 2025. What Trump’s second term means for climate action in the US and beyond, available at: https://www.climatechangenews.com/2025/01/15/what-trump-second-term-means-for-climate-action-in-the-us-and-beyond/#:~:text=Fossil%20fuels%20are%20also%20expected,administration%20aimed%20at%20slashing%20emissions

Costa, M., 2025. SEC moves to freeze its climate disclosure rule, Green Central Banking, available at: https://greencentralbanking.com/2025/02/17/sec-moves-to-freeze-its-climate-disclosure-rule/

Dzikiy, P., 2019. More Trump budget cuts: EPA and NOAA, elimination of ARPA-E advanced energy agency, available at: https://electrek.co/2019/03/11/trump-budget-epa-cuts/

EDF (Environmental Defense Fund)., 2020. EDF to Sue Trump Administration Over Rollback of Methane Standards for Oil and Gas Industry, Statement of EDF President Fred Krupp — August 13, 2020, available at: https://www.edf.org/media/edf-sue-trump-administration-over-rollback-methane-standards-oil-and-gas-industry?

EIA (US Energy Information Administration), 2024a. U.S. energy facts explained: Imports and Exports, available at: https://www.eia.gov/energyexplained/us-energy-facts/imports-and-exports.php#:~:text=The%20United%20States%20has%20been,total%20energy%20exporter%20since%202019

_2024b. Frequently Asked Questions (FAQs) -What is U.S. electricity generation by energy source? Available at: https://www.eia.gov/tools/faqs/faq.php?id=427&t=3#:~:text=In%202023%2C%20about%204%2C178%20billion,was%20from%20renewable%20energy%20sources

2024c. Annual Coal Report, available at: https://www.eia.gov/coal/annual/#:~:text=The%20average%20number%20of%20employees%20at%20U.S.%20coal,2022%20to%205.66%20short%20tons%20per%20employee%20hour.

_2021. In 2020, U.S. coal production fell to its lowest level since 1965, available at: https://www.eia.gov/todayinenergy/detail.php?id=48696#:~:text=In%202020%2C%20U,coal%20production%20in%20the

Enerdata, 2025. China installs record capacity for solar (+45%) and wind (+18%) in 2024, Daily Energy & Climate News, available at: https://www.enerdata.net/publications/daily-energy-news/china-installs-record-capacity-solar-45-and-wind-18-2024.html

Energy Institute, 2024. Statistical Review of World Energy, available at: https://www.energyinst.org/statistical-review/resources-and-data-downloads

Energy World, 2024. Will critical minerals be another poisoned chalice for Africa? Available at: https://energy.economictimes.indiatimes.com/news/coal/will-critical-minerals-be-another-poisoned-chalice-for-africa/112101557

EPA, 2025. U.S. Electricity Grid & Markets, available at: https://www.epa.gov/green-power-markets/us-electricity-grid-markets#:~:text=In%202019%2C%20natural%20gas%20had,geothermal%2C%20have%20a%20minor%20share

European External Action Service, 2024. United States: Informal EU-US dialogue on the climate and security nexus, available at: https://www.eeas.europa.eu/eeas/united-states-informal-eu-us-dialogue-climate-and-security-nexus_en?utm_source=chatgpt.com

European Commission, 2025. Carbon Management and Fossil Fuels- Methane Emissions, available at : https://energy.ec.europa.eu/topics/carbon-management-and-fossil-fuels/methane-emissions_en#:~:text=In%20fact%2C%20methane's%20ability%20to,on%20a%2020%2Dyear%20timescale.

_2023. Questions and Answers: Green Deal Industrial Plan for the Net-Zero Age, available at: https://ec.europa.eu/commission/presscorner/detail/pl/qanda_23_511

Goldstein, R., O’Brien, B & R. Orvis., 2023. Nationwide Impacts of California’s Advanced Clean Cars II Rule, Energy Innovation, available at: https://energyinnovation.org/wp-content/uploads/Nationwide-Impacts-Of-Californias-Advanced-Clean-Cars-II-Rule-1.pdf?

HAC (High Ambition Coalition)., 2025. What is the High Ambition Coalition? Available at: https://www.highambitioncoalition.org/

Hoening, D., 2023. Potential CBAM Impact on U.S. Industry, Climate Leadership Council, available at: https://clcouncil.org/blog/potential-cbam-impacts-on-u-s-industry/

ICAP (International Carbon Action Partnership)., 2025. USA - Regional Greenhouse Gas Initiative (RGGI), available at: https://icapcarbonaction.com/en/ets/usa-regional-greenhouse-gas-initiative-rggi

IEA, 2025a. Unites States – Electricity, available at : https://www.iea.org/countries/united-states/electricity

_2025b. The battery industry has entered a new phase, Commentary by Lombardo T, L., Paoli, A-F Pales & T. Gül, available at: https://www.iea.org/commentaries/the-battery-industry-has-entered-a-new-phase

_2021. Net Zero by 2050 A Roadmap for the Global Energy Sector, available at: https://iea.blob.core.windows.net/assets/7ebafc81-74ed-412b-9c60-5cc32c8396e4/NetZeroby2050-ARoadmapfortheGlobalEnergySector-SummaryforPolicyMakers_CORR.pdf

Isidore, C & V., Yurkevich, 2025. Automakers aren’t rushing to move production to US factories to avoid tariffs, CNN Business, available at: https://edition.cnn.com/2025/03/27/cars/us-automakers-production-tariffs-analysis-intl-hnk/index.html

Johnson, L., 2025. IRA funding freeze has put ‘many’ clean energy projects on pause, ESG Dive, available at: https://www.esgdive.com/news/ira-funding-freeze-caused-clean-energy-projects-to-pause/741940/

Kennedy, S., 2015. Made in China 2025, Center for Strategic & International Studies (CSIS), available at: https://www.csis.org/analysis/made-china-2025

Lavelle, M., 2019. Trump Budget Calls for Slashing Clean Energy Spending, Again, Inside Climate News, available at: https://insideclimatenews.org/news/12032019/trump-budget-cuts-renewable-energy-efficiency-electric-vehicle-tax-credit-deficit/

Maloney, P., 2017. A new study defends ARPA-E in wake of Trump’s proposed budget cuts, Utility Dive, available at: https://www.utilitydive.com/news/a-new-study-defends-arpa-e-in-wake-of-trumps-proposed-budget-cuts/445019/

Mathiesen, K., 2025. Trump rescinds $4B in US pledges for UN climate fund, Energy & Climate, Politico, available at: https://www.politico.eu/article/donald-trump-rescind-4-billion-us-pledge-un-climate-fund/

Maye, A., & Mazewski, M., 2023. Economic Impacts of the Inflation Reduction Act’s Climate and Energy Provisions, Data For Progress, available at: https://www.dataforprogress.org/memos/economic-impacts-of-the-inflation-reduction-acts-climate-and-energy-provisions#:~:text=efforts%20are%20successful%2C%20we%20estimate,overall%20employment%20impacts%20as%20well

Mirza, Z., 2025. US exits climate finance initiative aimed at helping developing nations quit coal, ESG Dive, available at: https://www.esgdive.com/news/us-exits-climate-finance-initiative-jetp/741942/

Nedopil, C., 2024. China Belt and Road Initiative (BRI) Investment Report 2023, available at: https://greenfdc.org/wp-content/uploads/2024/02/Nedopil-2024_China-BRI-Investment-Report-2023.pdf

NHTSA (National Highway Traffic Safety Administration)., 2024. NHTSA Announces Final Rule for CAFE and HDPUV Standards, available at: https://www.nhtsa.gov/laws-regulations/corporate-average-fuel-economy

Rapier, R., 2024. Biden vs. Trump: Comparing Energy Policies for 2024, Energy Network Media Group, available at: https://shalemag.com/biden-vs-trump-energy-policies/

Rhodium Group, 2024. Clean Investment Monitor: Q4 2024 Update, MIT CEEPR, available at: https://www.cleaninvestmentmonitor.org/reports/clean-investment-monitor-q4-2024-update

SEIA (Solar Energy Industries Association), 2021. National Solar Jobs Census 2020, available at: https://seia.org/research-resources/national-solar-jobs-census-2020/#:~:text=yet%20to%20fully%20recover%20from,time

Samantaroy, S., 2025. US EPA Rollback of Dozens of Air, Water and Chemical Pollution Regulations Threatens America’s Health, Experts Warn, available at: https://healthpolicy-watch.news/epa-plans-to-roll-back-dozens-of-regulations-threatening-americas-health-environmental-health-experts-warn/

Shepardson, D., 2025. US agency blocks vote to repeal California EV rules, Reuters, available at: https://www.reuters.com/business/autos-transportation/us-agency-blocks-vote-repeal-california-ev-rules-2025-03-06/

Smith L., 2022. The Energy Crisis is Real – Is the Inflation Reduction Act a Realistic Answer? American Petroleum Institute, available at: https://www.api.org/news-policy-and-issues/blog/2022/08/09/the-energy-crisis-is-real-is-the-inflation-reduction-act-a-realistic-answer?utm_source=chatgpt.com

Smith, A-B., 2024. 2023: A historic year of U.S. billion-dollar weather and climate disasters, Climate.gov, available at: https://www.climate.gov/news-features/blogs/beyond-data/2023-historic-year-us-billion-dollar-weather-and-climate-disasters?

S&P Global., 2024. Net-zero commitments are still the exception for top US companies, not the rule, available at: https://www.spglobal.com/esg/insights/featured/special-editorial/net-zero-commitments-are-still-the-exception-for-top-us-companies-not-the-rule

Worland, J., 2017. President Trump Wants to Kill This Clean Energy Program Even Though It Has Bipartisan Support, Times, available at: https://time.com/4703638/donald-trump-budget-energy-arpa-epa/

UNCTAD (UN Trade and Development), 2022. United States of America - $369 billion in investment incentives to address energy security and climate change, available at: https://investmentpolicy.unctad.org/investment-policy-monitor/measures/4004/-369-billion-in-investment-incentives-to-address-energy-security-and-climate-change-

U.S. Climate Alliance, 2025. U.S. Climate Alliance Marks Another Year of High-Impact, State-Led Climate Action, Press Release, available at: https://usclimatealliance.org/press-releases/year-in-review-dec-2024/?utm_source=chatgpt.com

US Department of Energy, 2024. 2024 U.S. Energy & Employment Jobs Report (USEER), available at: https://www.energy.gov/policy/us-energy-employment-jobs-report-useer#:~:text=In%202023%2C%20jobs%20in%20clean,adding%20149%2C000%20new%20jobs

US EPA (US Environmental Protection Agency), 2025. EPA Launches Biggest Deregulatory Action in U.S. History, Press release, available at: https://www.epa.gov/newsreleases/epa-launches-biggest-deregulatory-action-us-history

US GAO (US Government Accountability Office)., 2019. Climate Change: Opportunities to Reduce Federal Fiscal Exposure, available at: https://www.gao.gov/products/gao-19-625t?

Worland, J, 2018, This Clean Energy Research Has Been a Bipartisan Priority for Decades. Donald Trump Wants to Cut It by 72%, The Time, available at: https://time.com/5128572/donald-trump-clean-energy-research/

World Bank Group., 2021. Climate Change Action Plan 2021-2025: Supporting Green, Resilient, and Inclusive Development (Vol. 1 of 2) (English). Washington, D.C.: World Bank Group. http://documents.worldbank.org/curated/en/705731624380363785

WRI (World Resources Institute)., 2024. Statement: United States Achieves Biden’s Climate Finance Goal, available at: https://www.wri.org/news/statement-united-states-achieves-bidens-climate-finance-goal