Publications /

Opinion

Unless trade wars end around the globe, the world is headed for the biggest recession in living memory. The crisis arising from the coronavirus will hit fragile economies in Africa, the Pacific, and the Caribbean the hardest. At such a time, the world should be dropping barriers but, instead, new barriers are being built.

In the past month, U.S. President Donald Trump threatened retaliation against India unless it released supplies of hydroxychloroquine. Worse still, he got his way when Modi's government caved in to his demand. The United States has been accused of ‘piracy’ in acquiring medical supplies originally meant for France and Germany during the crisis. Elsewhere Russia and Saudi Arabia are at loggerheads over the price of a barrel of oil, the European Union and the Association of Southeast Asian Nations are in a dispute that is preventing smoother trade ties, and small Caribbean countries are locked out of important markets around the globe. None of this bodes well for the post-COVID-19 economy.

In the Caribbean, one easy economic fix would be to allow small islands states including Saint Lucia and Saint Vincent & the Grenadines access to the United Kingdom and EU markets under the terms of the 2001 Lomé Convention, and other agreements that were slowly phased out before 2009 because those economies were deemed to have sufficiently developed. Given the crisis, it might be worth returning to such agreements. Caribbean countries are net importers of food, and their fragile economies will be coronavirus victims twice over—from reduced tourist inflows and from food hoarders around the world who will increase the prices of commodities for islanders.

Yet, so far, the global consensus has been to lean into this protectionism or to propose stimulus packages. Stimulus packages act as mere economic Band-Aids. They do not contribute to building long-term growth around the globe. The U.S. has spent $2 trillion so far to prop-up its economy. Meanwhile, Japan has committed nearly $1 trillion, and even emerging economies have tried to keep up with large aid packages. Another example is Malaysia which has pushed forward with a $57 billion stimulus package. Yet, the underlying problem in the economy is trade barriers. Malaysia, an oil producer, has also been hard hit by the low oil price brought about by Russia-Saudi rivalry.

Perhaps most alarming for Malaysia has been the EU ban on one of its most important crops—palm oil. Despite spending years developing the world's first sustainable palm oil production regulations, the EU has inexplicably declared palm oil verboten. A ban is set to go into effect this year, blocking all EU importation of the critical commodity.

On top of this, the EU has launched another set of thinly-veiled protectionist measures with the recent announcement of its Farm to Fork (F2F) strategy and biodiversity strategy. The former claims to set "the global standard for sustainability", while the latter aims to "put Europe's biodiversity on the path to recovery by 2030".

Yet the EU’s F2F strategy will lead to the opposite of what Brussels claims it wants to achieve. Countries in the global south will be adversely affected and will have to diversify exports to countries with lower economic and environmental standards. By doing that, the EU loses its trade leverage. More importantly, this will be bad for the environment, bad for EU consumers, and bad for the global south, but good for protectionism.

At the same time, we should remember the lessons of Harvard University economist Dani Rodrik who in 2018 argued in the Journal of Economic Perspectives that while free trade agreements increase the volume of trade, the distribution of those gains is another matter: “A trade agreement captured by an alternative set of special interests may make things worse just as easily as it makes them better”. He also wrote that “such an agreement can move us away from the efficient outcome, even if it takes the guise of a free trade agreement and expands the volume of trade and investment”. Rodrik noted that the impact of FTAs is fundamentally uncertain and protectionism is on the rise.

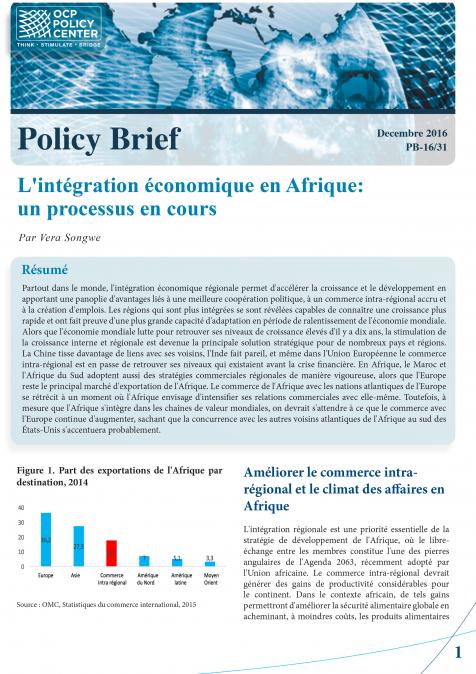

Between 2009 and 2014, total EU trade with ASEAN countries exhibited a similar pattern with a low point in 2009 (https://ec.europa.eu/eurostat/statistics-explained/index.php?title=ASEAN-EU_-_international_trade_in_goods_statistics), followed by a strong recovery (see below) which flattened between 2012 and 2014. Throughout this period, the trade deficit fluctuated between €12 billion and €20 billion. After 2014, imports from ASEAN countries grew more strongly than exports and consequently the trade deficit grew to €40 billion in 2019.

Graph from Eurostat

Stimulus packages and barriers will not solve any of these problems either. They will only make matters worse as governments drive more countries into debt with the bill eventually being passed onto hard-working citizens or other nations in the form of harmful tariffs.

What are needed are new forms of EU-ASEAN cooperation and partnerships. This can enable all sides to come out stronger and better-equipped to tackle future environmental, health and economic crises.

Thus, the choices finance ministers and heads of state make will make or break the global economy for decades to come. Liberalizing trade is more important than ever.

About the author

Datu Sadja Matthew Pajares Yngson is the Representative Councillor of the Caribbean ASEAN Council, and Executive Director and Envoy for Diplomatic Affairs of the Eastern Caribbean-Southeast Asia Chamber. He is the Secretary General of the 35th Sultan of Sulu and North Borneo and an alumnus of H.R.H. The Duke of Edinburgh’s Commonwealth Study Conferences. Datu Yngson is a Fellow of the Royal Society for the Encouragement of Arts, Manufactures and Commerce.