Publications /

Opinion

This opinion blog provides an overview of the expected impacts on climate policy following President Trump’s election victory and the resulting new mandate. It examines how potential policy shifts could influence the U.S.’s decarbonization efforts and assesses the broader implications for the global energy sector, considering the interaction between geopolitics and climate.

How Did the Previous Trump Administration Address Climate Change?

A strong supporter of fossil fuels, President Donald Trump’s 2017-2021 tenure was marked by setbacks in climate change policies, paving the way for more emphasis on conventional energy sources. One of the most significant actions of his first term was the withdrawal of the U.S. from the Paris Agreement in 2017, which he justified by claiming it put the country at a competitive disadvantage to China.

With President Biden’s victory in the 2020 election, the U.S. rejoined the Paris Agreement in 2021. However, fears about the U.S. leaving the Paris Agreement again are revived under President Trump’s reelection. During his first term, President Trump also issued an executive order aimed at dismantling several federal actions addressing climate change, instead focusing on “promoting energy independence and economic growth.”

As a result, during President Trump’s previous mandate, the U.S. became the world’s leading producer of oil and natural gas, achieving “American energy independence and delivering historically low costs for oil, gas, diesel and electricity to consumers and businesses.” However, looking ahead, the outlook seems less promising in the face of climate change. A renewed Trump presidency is likely to signal a stall in national efforts to address the climate crisis and protect the environment. The second Trump administration could contribute to an increase in greenhouse gas (GHG) emissions by 4 billion tons through 2030 alone, exacerbating risks such as more frequent heatwaves, floods, wildfires, droughts and famine. Additionally, rising air pollution could lead to more deaths and diseases, potentially resulting in $900 million in climate-related damage on a global scale. Hope remains however, that most U.S. state, local and private sector leaders are showing strong commitment to supporting environmental goals and ensuring ongoing progress toward climate objectives.

The Inflation Reduction Act under a Renewed Trump Mandate

Since its signing into law in 2022, the Inflation Reduction Act (IRA) has directed federal spending to reduce carbon emissions, lower healthcare costs, fund the Internal Revenue Service, and improve taxpayer compliance. It represents the most significant action Congress has taken on clean energy and climate change in U.S. history. In terms of energy, the IRA allocates nearly $400 billion in federal funding to clean energy, aiming to lower U.S. carbon emissions by the end of the decade. The law includes billions in subsidies for electric vehicles (EVs), solar and wind energy, and other clean energy sources, driving substantial investment in domestic manufacturing.

However, since the IRA was introduced under President Biden’s mandate, the current U.S. President has signalled plans to “rescind all unspent funds under the IRA.” According to President Trump, the IRA is too costly for the country. However, repealing the IRA would require more than just a presidential decision—it would necessitate votes from lawmakers, including those in states that have benefited from IRA-driven investments in solar-panel factories and wind farms.

The world is About to Face a “Drill, Baby, Drill” Era

Under President Trump’s previous mandate, the U.S. became the world’s largest oil producer in 2018, surpassing all other nations in oil output. In 2024, President Trump claimed that the U.S. holds the largest oil reserves of any country, and that he intends to continue ramping up production, particularly through aggressive drilling policies. He argued that these measures could reduce energy costs by 50%.

Historically, President Trump’s policies have favored business and economic growth, with a strong emphasis on fueling demand for oil. Following his election, concerns about oil supply exceeding demand led to a drop in oil prices, as expectations of increased output, combined with a stronger dollar, put downward pressure on oil prices.

However, while it might initially appear that higher production under the renewed Trump mandate could outstrip oil demand, this assumption overlooks the ongoing supply disruptions from Venezuela and Iran, both of which have been significantly impacted by U.S. sanctions.

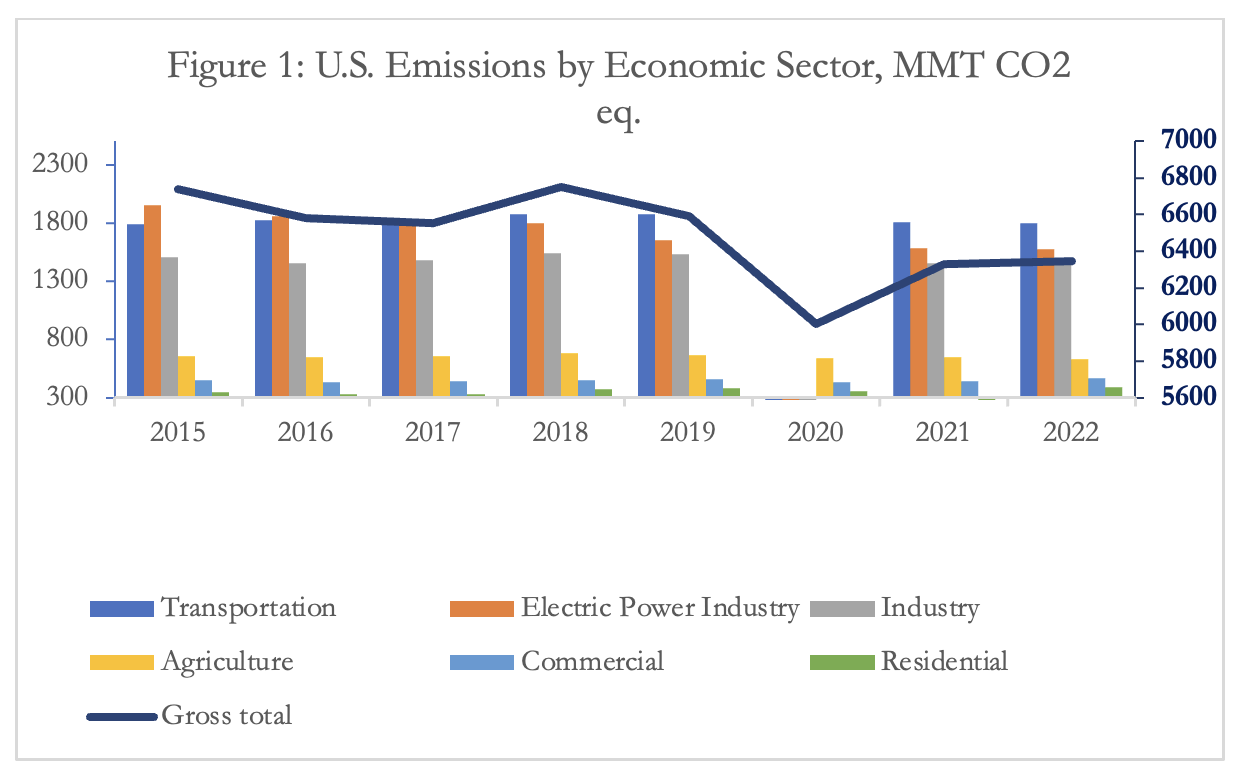

In terms of emissions, the future may not look promising in the years ahead. As shown in Figure 1 below, GHG emissions declined in 2020 compared to the 2015-2019 period during President Trump’s presidency. However, this decrease is not attributable to his climate actions.

The sharp decline in emissions in 2020 was likely due to the global COVID-19 pandemic, which reduced economic and transportation activities, rather than any specific policy changes. The policies promoting energy independence and deregulation allowed for strong economic output without causing significant increases in emissions prior to the pandemic.

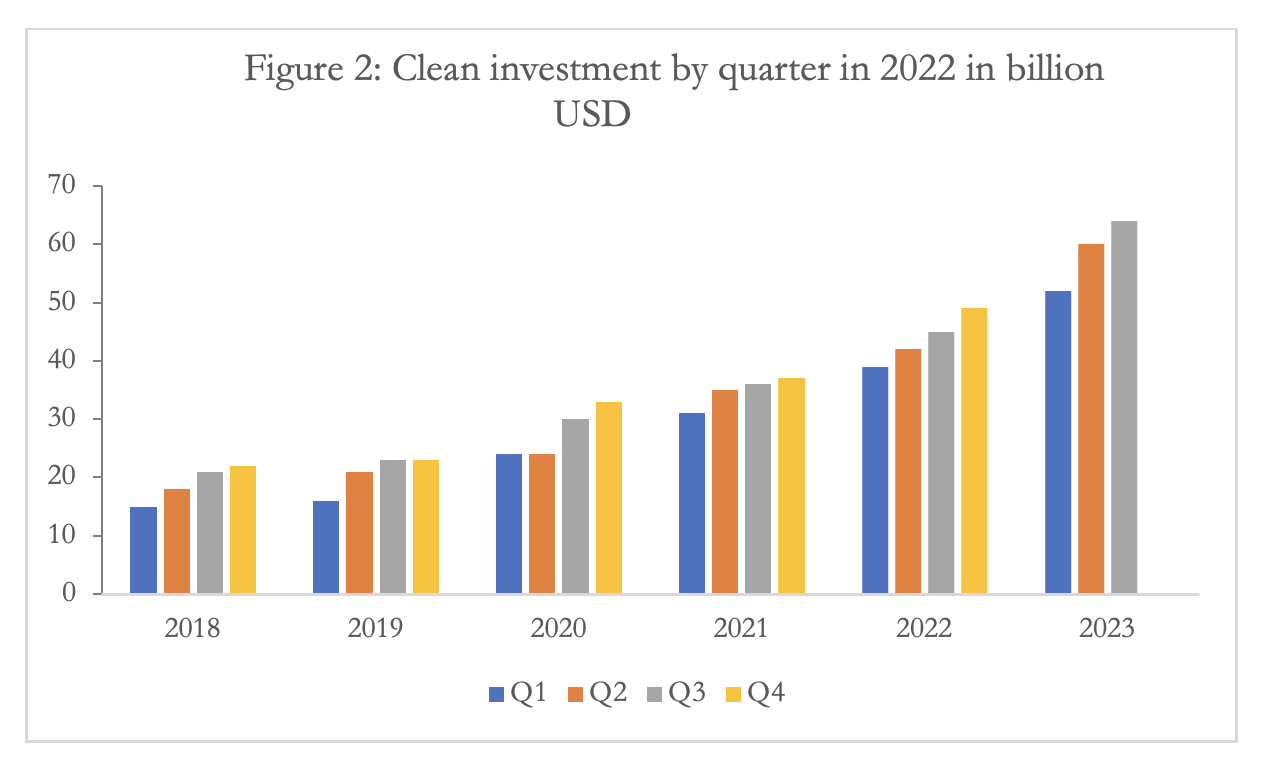

On the other hand, investment in clean energy technologies reached record levels under the Biden administration, totaling $64 billion in 2023, up from $49 billion in 2022 (Figure 2). There is little likelihood that this trend will continue under a President Trump mandate, given the history of his presidency. In 2018 for example, President Trump rolled back Obama-era rules on toxic air pollution from electricity generation and industrial sites, as well as the Environmental Protection Agency’s methane emissions rule for the oil and gas industry.

Source: Author’s calculations based on EPA GHG emissions and Rhodium Groupprevisions

Source: Rhodium Group / MIT-CEEPR Clean Investment Monitor

The Renewal of President Trump’s Mandate Viewed from the South: A Climate Perspective

Lower Energy Prices for Oil and Natural Gas Importing Countries

U.S. oil producers are anticipating reduced regulations under a renewed Trump presidency, which could lead to increased oil production and higher global supply, potentially resulting in lower oil prices.

However, if sanctions on oil production from Iran and Venezuela are intensified, global supply levels could decrease, leading to higher oil prices. Additionally, the effects of the U.S.-China trade war, which raised effective tariff rates on Chinese goods from 3.1% in 2018 to 19.3% in early 2020, may contribute to slower demand. Historically, these increased tariffs have strengthened the international value of the U.S. dollar, reducing demand for foreign currencies and impacting the competitiveness of U.S. exports.

Increased Climate Change Impacts: What is the Outlook for Developing Countries?

Climate change is not considered a major threat by President Donald Trump. However, it remains a critical concern, especially for developing regions like Africa, where it is viewed as a “race against time.” Between 2013 and 2022, natural disasters in Africa claimed over 100,000 lives and affected an additional 131 million people. President Trump’s stance on global warming is famously dismissive, as evidenced by his comment: “When people talk about global warming, I say the ocean is going to go down 100th of an inch within the next 400 years. That’s not our problem.”

Instead, his concerns lie with “nuclear warming”, suggesting a reduced focus on climate issues, which could exacerbate challenges for developing nations.

Critical Minerals: Competition and African Presence

As the U.S. continues decoupling from China, future competition over African critical minerals could intensify, but this may not lead to a significant increase in African involvement. Two potential scenarios exist:

- The U.S. may lose interest in African critical minerals due to President Trump’s strong support for fossil fuels and traditional car industries. This could create opportunities for new actors such as Saudi Arabia and the UAE to strengthen their presence in African countries rich in critical minerals.

- Alternatively, if President Trump were to appoint Elon Musk to a cabinet or advisory role, as suggested during his campaign, this could shift the outlook for critical minerals. While Trump has previously expressed skepticism about tax credits for electric vehicles (e.g., stating on August 19th in Pennsylvania that “tax credits and tax incentives are not generally a very good thing” and suggesting he would consider ending the $7,500 tax credit for EV purchases), Musk’s open support for Trump during his campaign could lead to policy adjustments favoring the critical minerals sector. In fact, Tesla, alongside several established players in the EV field, has signed agreements in African countries such as Mozambique and the Democratic Republic of Congo to reduce its dependency on critical minerals from China.

As the world’s second-largest polluter, significant attention is focused on the climate policies President Trump will implement. The future of emissions already signals concerns over an escalating climate change threat and potential setbacks in renewable energy investments.

While lower oil and gas prices might initially appear beneficial for energy-importing nations, the journey toward decarbonization and Net Zero targets—imperative to avert climate-related disasters—casts a different light. President Trump’s policies may introduce shifts in the energy sector that demand heightened efforts, continuous dialogue, and persistent caution.