Publications /

Policy Brief

The global energy landscape in 2024 reflects a complex interplay of geopolitical tensions, economic pressures, and uneven progress in clean energy transitions. Despite record growth in renewable energy deployment and advancements in low-carbon technologies, the world continues to fall short of meeting its climate goals. Fragmented markets, entrenched fossil fuel dependencies, and supply chain vulnerabilities continue to challenge energy security and hinder global decarbonization efforts. Geopolitical conflicts, such as the war in Ukraine and rising tensions in the Middle East, have reshaped trade flows, deepened regional dependencies, and highlighted the fragility of global energy systems.

This paper analyzes key trends shaping the energy sector in 2024 and anticipates their implications for 2025. It examines the record-high demand for coal, the uneven deployment of clean energy technologies, the accelerating impact of artificial intelligence on electricity consumption, and the challenges of implementing effective carbon pricing mechanisms. The findings underscore the urgent need for coordinated international action to address vulnerabilities, align policy frameworks, and foster resilience in energy markets.

Introduction

The global energy landscape in 2024 was marked by complexity and inherent uncertainties. Despite significant progress in clean energy transitions, the world remains far from achieving its climate goals. Decisions by governments, industries, and consumers often perpetuate the shortcomings of the existing energy system instead of driving the transition to a cleaner and more secure future. As 2025 approaches, uncertainty in energy markets looms larger than at any time since the pandemic, fueled by a volatile mix of geopolitical, economic, and technological challenges (S&P Global, 2024).

Unresolved conflicts in Europe and the Middle East continue to threaten energy security, while geopolitical rivalries between China and the West deepen. China is leveraging its leadership in clean technology to expand its global influence, while the United States and Europe adopt protectionist measures, including enhanced tariffs to safeguard domestic industries (IEA, 2024a). The return of Donald Trump to the U.S. presidency introduces further unpredictability, raising questions about the country’s participation in the Paris Agreement and its approach to global climate governance (Emran, 2024). Meanwhile, inflationary pressures and fragmented trade policies complicate coordinated international efforts to address these pressing issues.

Amid this backdrop, clean energy transitions encounter formidable challenges, including entrenched reliance on fossil fuels and insufficient progress in key low-carbon technologies. Although record deployments of renewable energy and technological advancements highlight potential, systemic challenges persist. These include geopolitical tensions disrupting supply chains, uneven regional deployment of renewables, and a lack of coordinated policy efforts to integrate emerging clean technologies.

This Policy Brief analyzes the critical energy trends that shaped 2024 and anticipates those likely to define 2025, focusing on their implications for energy security, geopolitical shifts, and the trajectory of the global energy transition.

Trend 1: Energy Security is Under Pressure from Geopolitical Fragmentation and Market Disruption

In 2024, the global energy system continued to face increasing challenges from geopolitical tensions, economic pressures, and increasingly fragmented markets, extending across both traditional and emerging energy sectors. These interconnected issues threaten energy stability and complicate the progress of the clean energy transition.

Geopolitical conflict remains a major disruptor. The ongoing war in Ukraine continues to destabilize European energy supplies, while escalating tensions in the Middle East exacerbate global energy insecurity. Although the immediate threats from the Russia-Ukraine war began to recede by 2023, the risk of disruption remains high (IEA, 2024a). Countries heavily dependent on single suppliers remain vulnerable, underscoring the critical need for structural changes in energy trade and supply chains.

Trade policies and protectionist measures are intensifying these tensions, with nearly 200 restrictive measures targeting clean energy technologies introduced globally since 2020—five times more than in the previous five years (IEA, 2024a). These restrictions are slowing the growth of key supply chains, including solar PV and EV batteries. Adding to these challenges is the evolving relationship between the United States and China under the new U.S. administration. Based on past policy actions and recommendations outlined in the Project 2025 report, there is a growing concern that the Trump administration may withdraw the U.S. from the Paris Agreement, weaken methane and vehicle emissions regulations, and reduce incentives for EV adoption. Such shifts could undermine global climate efforts and exacerbate market uncertainty (S&P Global, 2024; Sabrine Emran, 2024).

The fragmentation of energy markets further exacerbates these vulnerabilities. Regional dependencies, particularly for critical minerals, have intensified, with China controlling over 80% of global solar PV manufacturing and 75-90% of critical mineral processing, including cobalt and rare earths. In 2024, China also produced two-thirds of the world's electric vehicles (IEA, 2024a). This concentration not only creates bottlenecks but also exposes other nations to geopolitical leverage. For instance, China's previous restrictions on rare earth exports during diplomatic tensions with Japan illustrate how dependence can translate into vulnerability.

Energy security, therefore, remains a key concern for policymakers, but its scope must extend beyond traditional fuels. Ensuring the secure transformation of electricity systems and clean energy supply chains is now critical. Europe's efforts to diversify gas imports from North Africa and the Eastern Mediterranean reflect a broader understanding of energy security. Similarly, the United States' domestic investments through the Inflation Reduction Act (IRA) aim to reduce reliance on foreign clean energy production. However, without international coordination, these initiatives risk remaining fragmented and less effective.

Trend 2: Persistent Fossil Fuel Demand and Supply Extends the Anticipated 2020 Peak into a Prolonged Plateau

The global oil market is expected to see modest demand growth in 2025, driven by a complex interplay of regional trends and geopolitical influences. Demand is expected to increase from 0.84 million barrels per day (mb/d) in 2024 to 1.1 mb/d in 2025, reaching a total consumption of 103.9 mb/d in 2025 (IEA, 2024b). While this growth is notable, it reflects a subdued pace influenced by sluggish economic momentum in key emerging markets such as China, Nigeria, and Argentina. Emerging Asia remains a significant driver of demand, but non-OECD regions, though still substantial contributors, have shown signs of slowing growth (IEA, 2024b).

OPEC's projections align closely, estimating global demand growth at 1.4 mb/d in 2025, with non-OECD countries contributing 1.3 mb/d and OECD demand increasing by a marginal 0.1 mb/d. These trends highlight the dependence on developing economies for demand growth and the uneven pace of recovery across regions (OPEC, 2024).

Global oil supply remains robust, reaching 103.4 mb/d in November 2024, supported by production recoveries in Libya and Kazakhstan (IEA, 2024b). Non-OPEC sources, particularly the United States, Canada, Brazil, and Norway, are expected to drive supply growth, contributing an additional 1.5 mb/d in 2024 and 2025. Meanwhile, OPEC+ has extended voluntary production cuts until September 2026 to stabilize the market. However, overproduction by some members and robust growth from non-OPEC countries suggest a well-supplied global market in 2025.

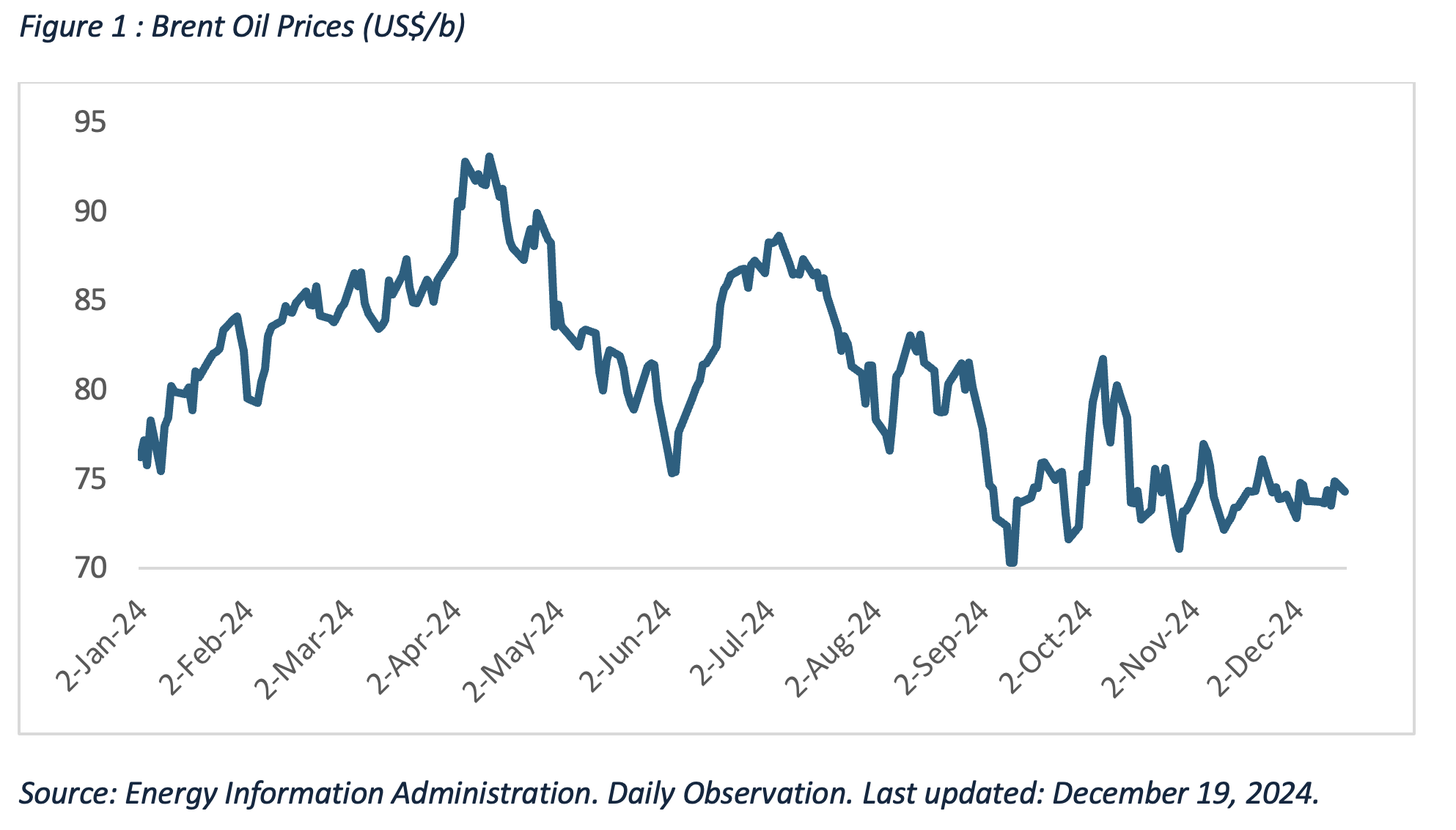

Oil prices are projected to remain relatively stable but volatile, shaped by geopolitical risks and economic conditions. Brent crude oil prices averaged $75/barrel (b) in September-October 2024, marking their lowest level since June 2023 (World Bank, 2024a). In November 2024, the OPEC Reference Basket (ORB) fell to $72.98/b, reflecting a marginal month-on-month decline. Strategic decisions by OPEC+ have helped mitigate potential supply overhangs, though risks persist from potential shifts in North American production and geopolitical escalations (OPEC, 2024). Brent crude prices are expected to decline by 2% in 2024 compared to 2023, averaging $80/b in 2024, down from $83/b in 2023, with a further decrease to $73/b in 2025 (World Bank, 2024a).

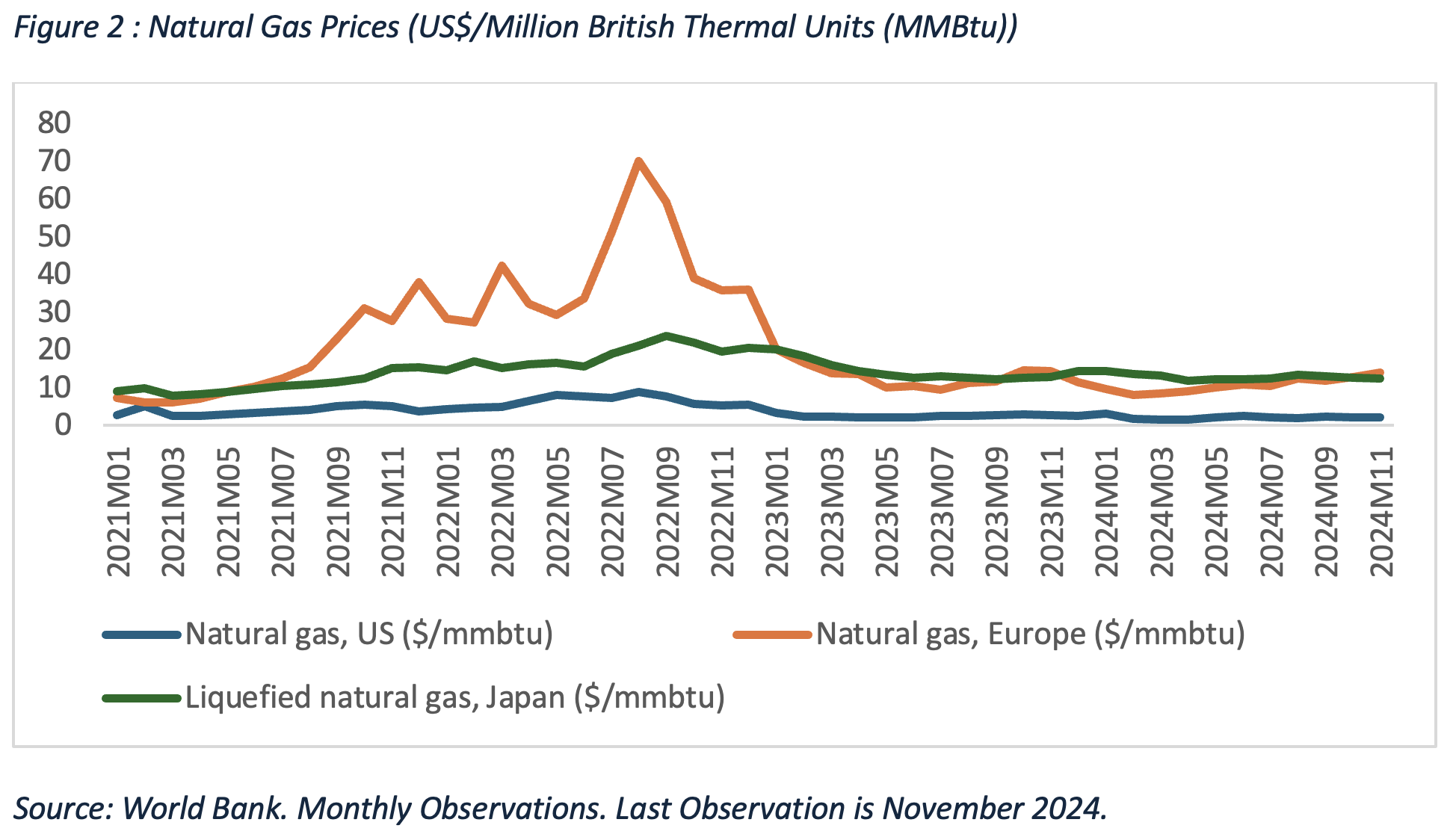

The natural gas market continues to exhibit significant regional differences. Following the reduction of Russian pipeline exports to Europe, global natural gas trade routes have undergone a major realignment. Additionally, a substantial increase in liquefied natural gas (LNG) export capacity is expected to come online (IEA, 2024a).

In the United States, prices are projected to rise by 55% in 2025, driven by increasing demand for LNG. In Europe, prices are anticipated to increase by 7% before stabilizing in 2026. Intense competition for LNG between Asia and Europe is narrowing price differentials, fostering greater integration of global gas markets. However, this competition, coupled with potential disruptions in Russian supply and regional temperature extremes, presents ongoing challenges (World Bank, 2024a).

Policy changes in the United States are expected to play a key role in shaping LNG dynamics. Donald Trump's push for energy deregulation could accelerate permitting and infrastructure development, significantly boosting U.S. LNG exports (Rystad et al., 2024). His administration has pledged to reverse the Biden-era moratorium on non-FTA LNG approvals, which has contributed to tighter global gas balances. Reversing this pause would benefit U.S. developers with pending projects, but it also raises concerns about a potential oversupply in global markets. A "too much, too soon" scenario could destabilize prices, especially if global demand fails to keep pace with increased supply (Rystad et al., 2024). Oversupply risks are compounded by trade tensions with China, a critical market for U.S. LNG. Renewed tensions could undermine demand from Chinese buyers, negatively impacting U.S. producers and LNG developers.

Trend 3: Global Coal Demand and Production Set to Break Records Despite Growth in Renewables

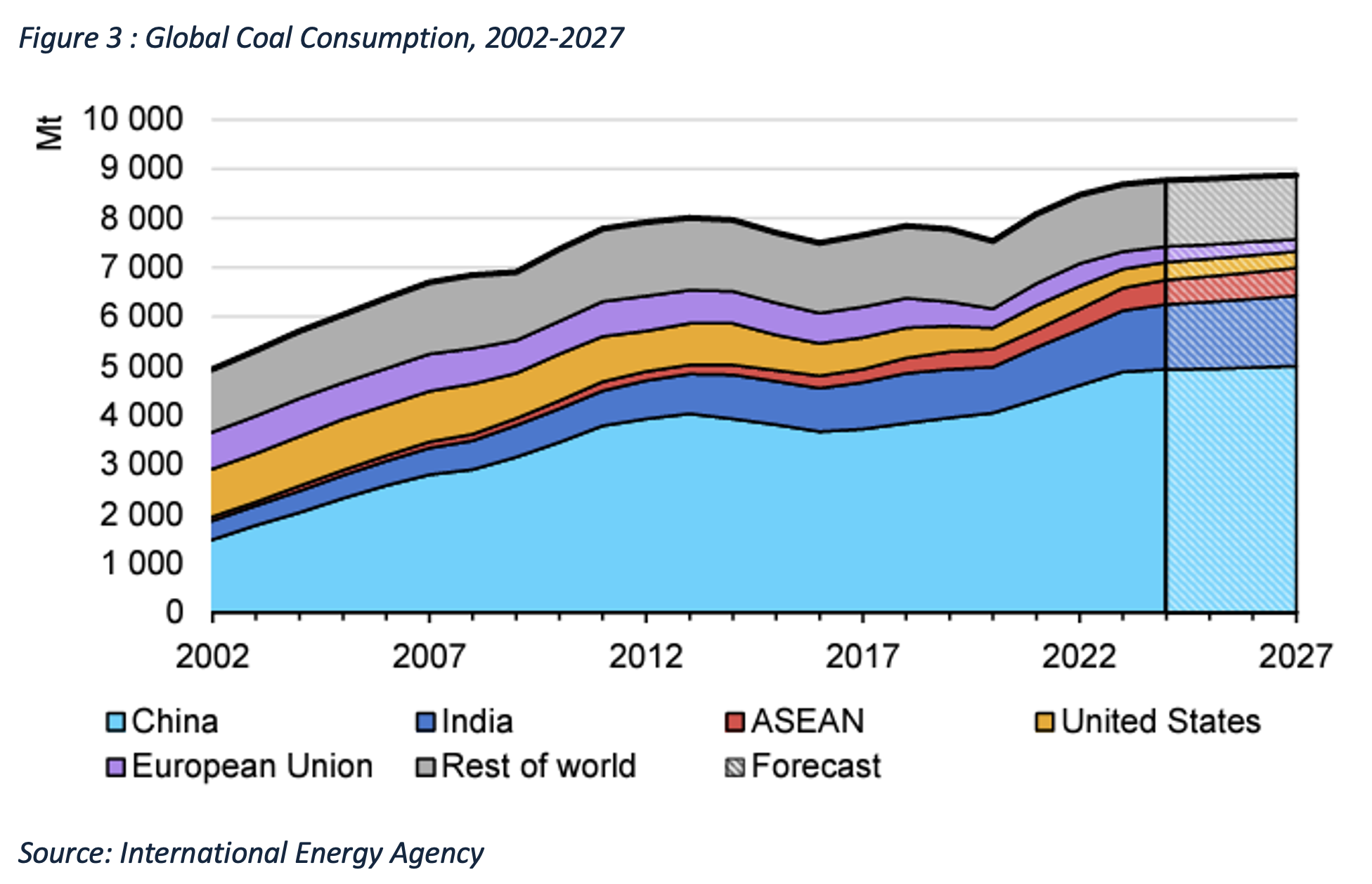

Global coal demand is projected to grow by 1% in 2024, reaching a record high of 8.77 billion tons (Bt). This represents a slowdown from the rapid growth of recent years, including increases of 7.7% in 2021, 4.7% in 2022, and 2.4% in 2023. The power sector remains the main driver of this growth, with global electricity generation from coal expected to reach 10,700 terawatt-hours (TWh), another all-time high (IEA, 2024c). Despite record growth in renewable energy capacity, coal continues to play a critical role in meeting rising energy demand, particularly in developing countries. China and India dominate global coal consumption, significantly shaping market dynamics. In 2024, China’s demand is expected to increase by 1% to 4.9 Bt, driven primarily by the power sector, which alone burns one-third of the world's coal. Although China is rapidly expanding its nuclear, solar, and wind capacity, electricity demand is growing faster than supply due to increased electrification in transportation, industrial heating, and emerging industries such as data centers and artificial intelligence (IEA, 2024c; S&P Global, 2024). Meanwhile, India's coal demand is projected to grow more than 5% to 1.3 Bt, driven by its power and industrial sectors.

While coal demand in developed economies continues to decline, the pace of decline is slowing. In 2024, demand is expected to decline by 12% in the European Union and 5% in the United States, compared to steeper declines of 23% and 17%, respectively, in 2023. In contrast, rising coal demand in developing countries such as Indonesia and Vietnam will offset these declines, reflecting coal's role as an energy source for economic growth in emerging markets.

Coal production is set to reach record highs, with global production exceeding 9 Bt in 2024. China, the world's largest producer, accounts for half of global production and will increase production by 1%. India, supported by government incentives for public and private producers, is expected to increase production by 7%, reducing its reliance on imports. Indonesia, benefiting from both robust domestic demand and stable international markets, is forecast to produce more than 800 million tons (Mt). However, future trends may diverge: production in China is expected to slow due to high inventories and slowing demand, while India is poised for continued growth. Indonesia may face challenges from weaker international demand for thermal coal (IEA, 2024c).

International coal trade is on track to reach a record high of 1.55 Bt in 2024, driven by strong demand in Asian markets, particularly China, India and Indonesia. This shift underscores Asia's growing dominance in the global coal trade, even as demand declines in Europe. Indonesian exports are expected to exceed 550 Mt, and Mongolia has become the second largest exporter of metallurgical coal, supplying exclusively to China (IEA, 2024c).

Coal prices, which fell sharply during the pandemic, surged to record highs following Russia's invasion of Ukraine in 2022. Although prices have since moderated, they remain significantly elevated, 50% above pre-pandemic levels. As of November 2024, European thermal coal prices averaged $120 per metric ton, compared with $80 per metric ton in 2017-19. Similarly, Australian thermal coal prices have risen to $140 per tonne, up from $90 per tonne at the end of the last decade (IEA, 2024c; World Bank, 2024a).

Looking ahead to 2025, global coal demand is unlikely to decline significantly. Continued growth in electricity demand, particularly for data centers, electric vehicles, and industrial applications, is expected to support coal-fired power generation. In India, where renewable energy growth lags behind rising electricity demand, coal consumption is likely to continue to rise. Meanwhile, rising natural gas prices in the United States, driven by LNG exports, could lead to a temporary resurgence in coal-fired power generation. If these trends persist, global coal demand will reach new highs in 2025, despite continued declines in Europe and other advanced economies (S&P Global, 2024).

Trend 4: Low-Carbon Energy Growth Continues, but Falls Short of Net-Zero Targets Amid Economic and Policy Hurdles

Despite significant progress in the deployment of low-carbon energy sources, growth remains uneven and insufficient to meet net-zero targets. Renewable energy capacity expanded by more than 560 GW in 2023, with China accounting for 60% of the increase. However, regions such as Europe and North America face persistent barriers, including high financial costs, unresolved supply chain issues, and policy misalignments. For example, several offshore wind auctions in Europe in 2024 were unsuccessful due to unrealistic price expectations (IEA, 2024a, EIU, 2024).

Although renewable energy deployment is expected to accelerate in 2025 in response to decarbonization goals and the need for energy security, challenges such as rising capital costs and extended project timelines pose risks to scaling up (McKinsey, 2024a). In particular, technologies with lower levelized costs of energy (LCOE), such as solar and wind, are expected to continue to grow rapidly, but high-cost solutions, such as clean hydrogen and carbon capture, utilization, and storage (CCUS), lack sufficient policy support and market incentives to achieve similar progress (McKinsey, 2024a).

The race to dominate clean technology is increasingly polarized, with China leading in both deployment and manufacturing. As the world's largest producer and consumer of solar panels, EVs, batteries, wind turbines, and hydrogen electrolyzers, China continues to leverage its leadership to reduce its domestic fossil fuel demand and increase its global influence. For example, China's EV penetration exceeded 50% of all light vehicle sales in 2024, and its oil demand for passenger vehicles is expected to decline in 2025 (S&P Global, 2024).

In contrast, the West faces significant headwinds. Reduced clean energy incentives in Europe and promises by the Trump administration in the U.S. to roll back provisions of the IRA have slowed the deployment of clean technologies. The bankruptcy of Northvolt, a European battery manufacturer, highlights the challenges Western companies face in competing with China's low-cost equipment (S&P Global, 2024). The U.S. and the European Union have also imposed tariffs on Chinese-made clean technologies, including electric vehicles, to protect domestic industries. While these measures are intended to protect local manufacturing, they risk raising costs and slowing the energy transition (IEA, 2024a, S&P Global, 2024).

Nuclear power is gaining renewed attention as a reliable and carbon-free source of electricity. In 2024, North America commissioned its first large-scale nuclear power plant in decades—the Vogtle plant in Georgia—although its $36 billion cost underscores ongoing economic challenges. Companies such as Microsoft, Google, and Amazon have signed power purchase agreements (PPAs) tied to nuclear capacity to meet growing data center power demands (S&P Global, 2024). Meanwhile, small modular reactors (SMRs) are emerging as a potential game-changer, with China's Linglong-1 and the U.S. X-energy project in Texas as key developments to watch in 2025.

Hydrogen, especially clean hydrogen, faces significant barriers despite its potential as a decarbonization tool. Most current production is still based on fossil fuels (gray hydrogen), and the transition to renewable hydrogen requires massive investment in electrolysis capacity. Rising costs and limited policy support have already led to an increasing number of project cancellations. However, key auctions in Europe and Japan in 2025 could advance selected projects, while China and India continue to lead in scaling up clean hydrogen production (Rystad et al., 2024). The sector's progress will depend on more pragmatic approaches to policy and market alignment, especially as cost premiums for renewable hydrogen remain high.

Trend 5: Artificial Intelligence and Data Centers Driving Uncertainty in Electricity Demand

The rapid growth of artificial intelligence (AI) and the proliferation of data centers will reshape global electricity consumption. By early 2024, more than 11,000 data centers had been registered globally. While the number of servers grew by about 4% per year between 2010 and 2020, data center electricity demand plateaued during this period due to significant efficiency improvements in cooling and the consolidation of workloads into larger, more efficient cloud data centers (IEA, 2024a). Since 2020, however, electricity demand has surged, outpacing efficiency improvements, driven by the growing demand for digital services and AI-related computing workloads (IEA, 2024a; Spencer & Singh, 2024). Global data center electricity consumption was estimated at 240-340 terawatt-hours (TWh) in 2022, accounting for 1-1.3% of total electricity consumption (IEA, 2024a). The share of electricity demand varies by region, with data centers consuming 2-4% of electricity in major economies such as the United States, China, and the European Union. In some areas, the local impact is much more pronounced; for example, data centers account for more than 20% of electricity use in Ireland and more than 10% in at least five U.S. states (Spencer & Singh, 2024).

Data center electricity demand is projected to grow 10-15% annually through 2030, potentially accounting for 5% of global electricity demand by the end of the decade (S&P Global, 2024). In developed economies such as North America, Europe, and Asia, where electricity demand has been flat or declining, data centers represent a new source of growth, contributing to a projected 2-3% annual increase in electricity consumption. In developing economies, this additional demand will exacerbate already robust electricity growth, further straining power grids (S&P Global, 2024).

The rapid growth of data centers poses several challenges for power grids, particularly due to the mismatch between the 2-3 year construction timeline for data centers and the 4-5 year or longer timeline required for new power generation and grid expansion (S&P Global, 2024). This lag can exacerbate local power shortages and increase reliance on aging coal or gas-fired generation to meet demand, potentially delaying decarbonization efforts. While large technology companies such as Google, Microsoft, and Amazon are leading the way in procuring clean energy for their data centers, this practice can divert renewable energy from the broader grid, requiring additional fossil fuel capacity to fill the gap (Spencer & Singh, 2024). The supply chain for AI-related chips is also a bottleneck. Companies such as Taiwan Semiconductor, which holds more than 90% of the market for AI-related chips, face production capacity constraints. Lead times for new chip fabrication plants average 3-5 years, limiting the speed at which the industry can scale to meet AI-driven demand (IEA, 2024a).

AI is rapidly becoming a major driver of data center electricity consumption, with investment in AI and computing resources accelerating rapidly. The United States is expected to lead this growth, with data center demand rising from 25 GW in 2024 to more than 80 GW by 2030. Meeting this demand would require between 50 and 60 GW of additional infrastructure in the U.S. alone, driven by increasing data, computing, and connectivity needs as well as the scaling of generative AI technologies (McKinsey, 2024b). While generative AI has the potential to create $2.6 to $4.4 trillion in global economic value, achieving even a fraction of this would require significant investments in infrastructure and energy (McKinsey, 2024b).

Despite the promising economic outlook, the International Energy Agency (IEA) highlights the uncertainty surrounding the growth trajectory of AI-related electricity demand. While significant investments are being made in AI startups and computing resources, the nature, speed, and scale of end-use adoption remain unclear (IEA, 2024a).

Trend 6: Stalled Progress in Reducing Greenhouse Gas Emissions as 2025 Becomes a Defining Year for Global Climate Action

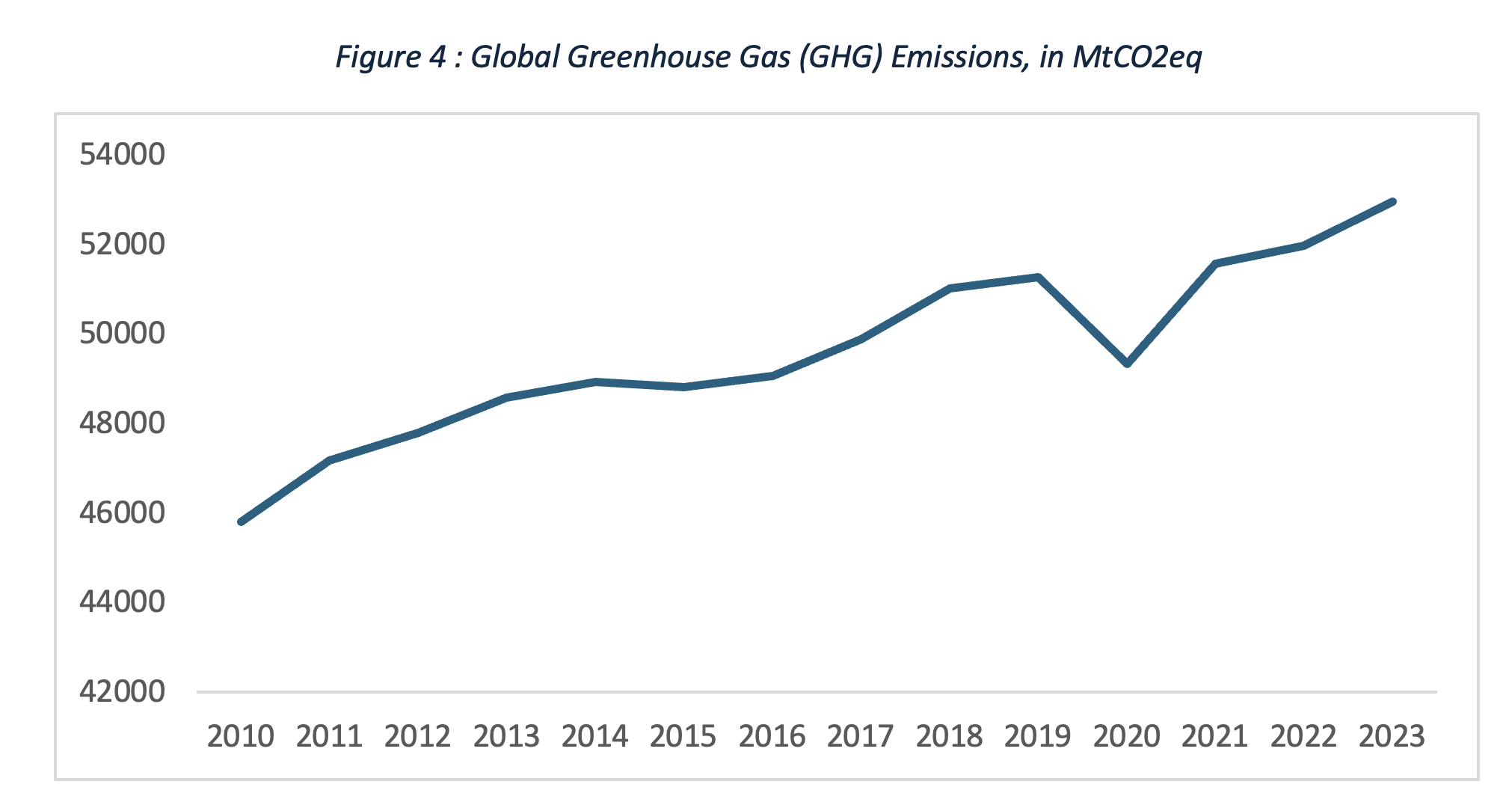

Despite growing policy innovation, global consensus, and private sector commitments, greenhouse gas (GHG) emissions are not declining at the rate needed to meet climate goals. Between November 2023 and October 2024, global temperatures surged by an alarming 1.62°C, a stark warning of accelerating climate change (Climate Change News, 2024). This current trajectory suggests that, without immediate action, this milestone could become unattainable within the next six years.

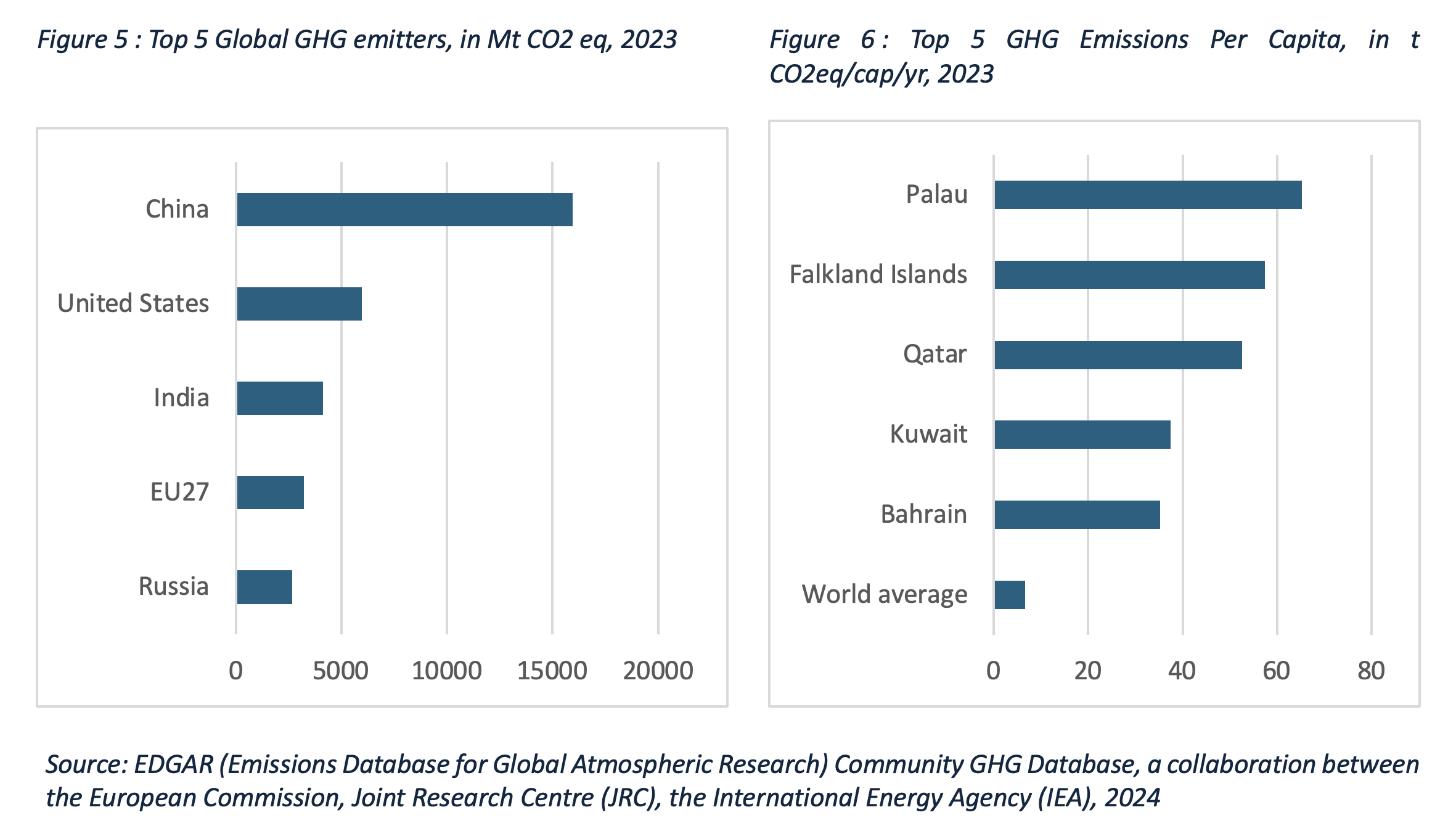

Global greenhouse gas emissions are estimated to be between 53 gigatons of CO2 equivalent (GtCO2e) and 57.1 GtCO2e in 2023, an annual increase of 1.9%, driven by rising energy demand and dependence on fossil fuels (European Commission, 2024; UN Environment Program, 2024). In particular, despite the progress of clean energy deployment, two-thirds of the increase in global energy demand in 2023 was met by fossil fuels, pushing energy-related CO2 emissions to another record high (IEA, 2024a). Major emitters—China, the United States, India, the EU27, Russia and Brazil—together account for over 62% of global GHG emissions. However, per capita emissions vary widely, with countries such as Qatar and Kuwait among the highest emitters, while larger economies have comparatively lower emissions (EDGAR, 2024).

This continued growth in emissions is occurring despite robust decarbonization efforts. Since the Paris Agreement, net-zero commitments have been incorporated into legislation in major economies, supported by significant private sector commitments. However, challenges remain in translating macro-level targets into effective regional and local policies. For example, local internal combustion engine (ICE) bans and renewable energy standards (RES) often face resistance due to affordability concerns, grid constraints, and limited manufacturing capacity (McKinsey, 2024a).

Emerging economies, particularly in Southeast Asia, India, and the Middle East, are key drivers of global energy demand. Their net-zero commitments often extend further into the future than those of developed countries, reflecting differences in economic priorities and access to financing for low-carbon technologies. The financing gap is particularly stark, with many developing countries lacking the resources to expand clean energy infrastructure, underscoring the need for international financial support (McKinsey, 2024a; Jaïdi et al., 2024).

The outcomes of COP29 in Baku highlight both progress and persistent gaps. While progress in operationalizing Article 6 carbon markets and tripling climate finance commitments to $300 billion annually by 2035 represent significant steps forward, they fall short of addressing the $1.3 trillion climate crisis faced by developing countries. Issues such as lack of transparency in carbon markets and insufficient equity in financing mechanisms raise concerns about their effectiveness and accessibility for vulnerable countries. In addition, the failure to maintain momentum on fossil fuel divestment reflects the ongoing geopolitical tensions that hinder global consensus (Jaïdi et al., 2024).

Looking ahead, February 2025 marks a key deadline for countries to submit their Nationally Determined Contributions (NDCs), which outline climate strategies through 2035 to limit global warming. These plans will face their first major test at COP30, scheduled for November 2025 in Belém, Brazil. This conference carries symbolic weight, as it is the first to be held in Brazil since the 1992 Rio Earth Summit, which established the United Nations Framework Convention on Climate Change (UNFCCC).

The stakes are high. Political shifts, economic challenges such as inflation, and competing priorities threaten to undermine the ambition and effectiveness of NDCs (Rystad et al., 2024). Failure to make significant progress in setting or achieving new targets at COP30 could undermine confidence in the COP process, echoing the fallout from the 2009 Copenhagen negotiations. Failure to deliver on climate promises risks pushing climate action further down the list of global strategic priorities (S&P Global, 2024).

Trend 7: Global Carbon Pricing Falls Short of Supporting Accelerated Transition Pathways

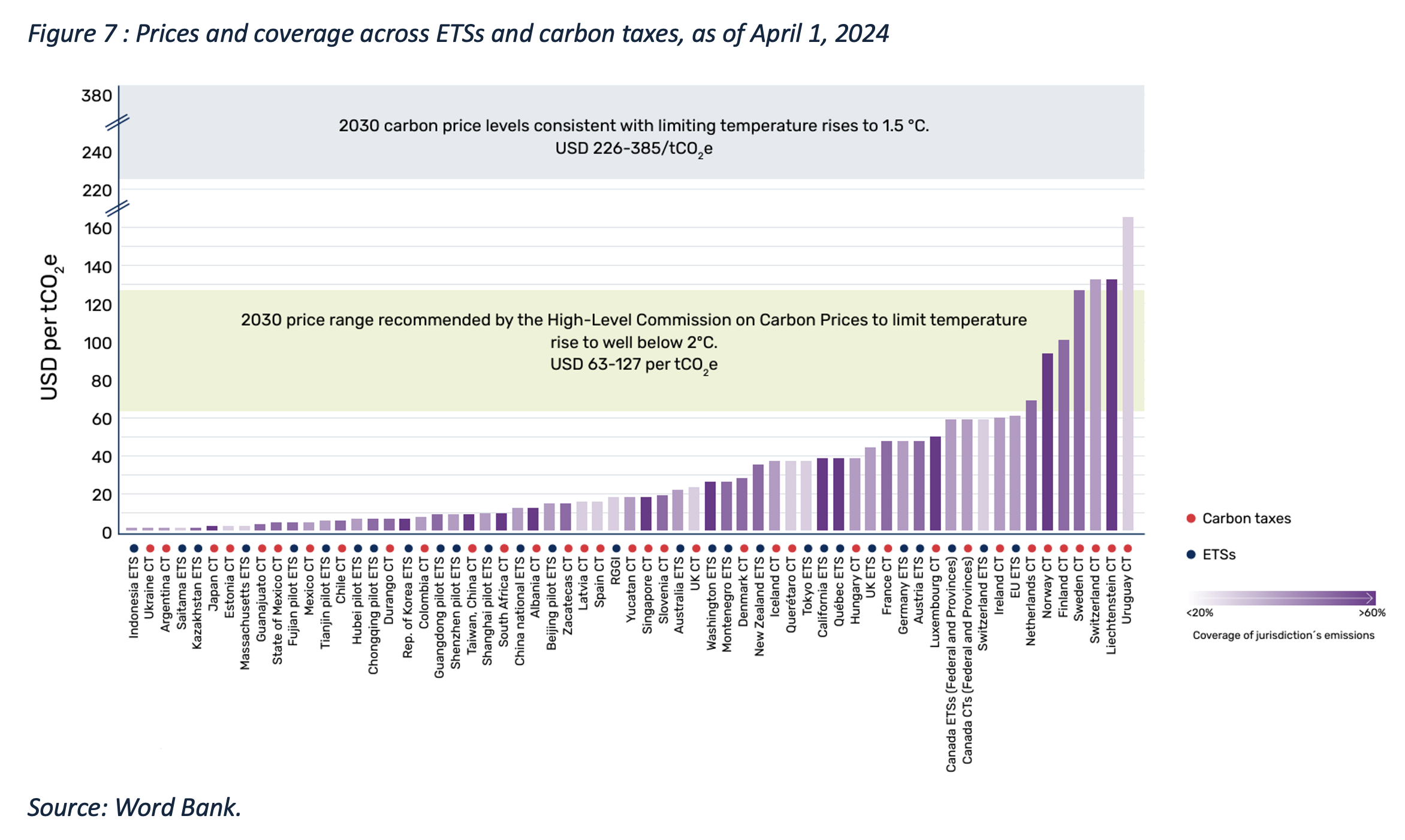

By 2023, global carbon pricing revenues exceeded $104 billion, with emissions trading systems (ETSs) contributing the majority of these revenues (World Bank, 2024b). Although carbon pricing revenues have reached record highs, their contribution to countries' national budgets remains low (World Bank, 2024c).

Carbon pricing mechanisms now encompass 24% of global emissions, a notable rise from just 7% a decade ago. Proposals currently under consideration could increase this to nearly 30%, but achieving such an expansion will require stronger political commitment and policy alignment (World Bank, 2024b; World Bank, 2024c). There are now 75 carbon pricing instruments in use around the world. These mechanisms, including carbon taxes and ETSs, have primarily targeted traditional sectors such as energy and industry, but are now expanding into areas such as aviation, shipping and waste management.

Moreover, the EU's Carbon Border Adjustment Mechanism (CBAM), currently in its transitional phase, is encouraging governments to introduce carbon pricing for emissions-intensive sectors such as cement, steel and fertilizers. Middle-income countries such as Brazil, India, Chile, Colombia, and Turkey are also advancing carbon pricing initiatives, reflecting the growing global momentum for market-based climate policies.

Despite this progress, less than 1% of global emissions are currently covered by a carbon price high enough to meet the High-Level Commission on Carbon Prices’ goal of limiting global warming to well below 2ºC (World Bank, 2024b). Price levels vary considerably by region, with the EU ETS averaging €85 per tonne in 2023, falling to €71 in 2024 and potentially rising to €149 by 2030. In California, prices are expected to rise from $34 per ton in 2023 to $46 in 2025, potentially reaching $93 per ton by the end of the decade (Bloomberg, 2024). These price disparities undermine the predictability and effectiveness of carbon markets, limiting their global impact and creating uncertainty for businesses and investors.

Indeed, the current global carbon price is too low to incentivize transformative actions, such as the large-scale deployment of carbon capture, utilization, and storage (CCUS). The market is also constrained by a lack of liquidity, particularly on the demand side. Estimates suggest that carbon prices need to rise to between $150 and $225 per ton of CO2 to align with a 1.5°C pathway, with regional variations depending on the cost of clean energy and the availability of low-carbon technologies (McKinsey, 2024a). Moreover, an implementation gap persists between countries' climate commitments and their enacted policies, underscoring the need for greater political will to align carbon pricing with the ambition needed to meet global climate goals (World Bank, 2024b).

The integrity of voluntary carbon markets is also a challenge. While these markets are gaining traction, concerns remain about greenwashing and insufficient credit quality. The Integrity Council for the Voluntary Carbon Market (IC-VCM) is working to establish benchmarks for high-quality credits, with the first tranche expected in 2024. Without rigorous standards, carbon credit prices could stagnate at $13 per ton by 2030, discouraging investment. Conversely, if markets adopt robust standards and prioritize high-quality carbon removal technologies, such as direct air capture, prices could rise to $146 per ton by 2030 (Bloomberg, 2024). Efforts to align carbon markets with strong quality benchmarks and address transparency issues are critical to unlocking their potential as a tool for reducing emissions.

Conclusion

The energy dynamics of 2024 reveal a fundamental reality: fragmented markets, intensifying geopolitical tensions, and growing economic pressures are interlinked challenges that demand a coordinated response. Achieving global energy security and advancing clean energy transitions require collaborative efforts that go beyond individual national agendas, address vulnerabilities, and build a robust and interconnected energy framework.

The world stands at a crossroads. Despite record growth in renewable energy deployment and advances in technologies like artificial intelligence and energy storage, the pace of change is not fast enough to align with climate goals or ensure equitable access to energy. Fossil fuels remain deeply embedded in the global energy mix, with coal, oil, and gas still dominating in many regions, particularly emerging economies where demand continues to grow. This reliance, coupled with geopolitical tensions and protectionist policies, has deepened market fragmentation, threatening the stability needed for a coordinated energy transition.

Geopolitical conflicts, such as the war in Ukraine and escalating tensions in the Middle East, have amplified energy security risks, reshaping trade flows and reinforcing regional dependencies. The energy market has become increasingly polarized, with China leveraging its dominance in clean technologies to expand its global influence, while the United States and Europe contend with protectionist measures and shifting policy priorities. At the same time, high inflation, fragmented supply chains, and insufficient climate finance hinder the progress needed to meet global decarbonization targets. The energy transition faces significant structural challenges. Supply chain vulnerabilities, such as bottlenecks in critical minerals and renewable energy components, undermine deployment efforts. Low carbon pricing levels and an uneven application of policy tools weaken incentives for investment in essential technologies like carbon capture and clean hydrogen. Moreover, the accelerating demand for electricity, driven by AI and digitalization, highlights the urgent need for robust grid infrastructure and clean energy capacity.

Addressing these challenges requires a paradigm shift in how nations collaborate on energy policy, infrastructure, and innovation. Fragmentation must give way to alignment, and short-term measures must be balanced with long-term strategies. Global forums, such as COP30, offer a crucial opportunity to establish a unified vision, but their success hinges on translating commitments into actionable policies that prioritize equity, transparency, and accountability.

To ensure progress, countries must prioritize resilience by investing in diverse and sustainable energy systems, securing critical supply chains, and fostering global partnerships that align energy transitions with economic development. Coordinated efforts to scale clean technologies, implement effective carbon pricing mechanisms, and integrate renewable energy with existing grids are essential to overcoming the barriers that have hindered progress.

The stakes are clear: a fragmented and uncoordinated approach risks locking the world into a trajectory of energy insecurity and environmental degradation. Conversely, a collective and unified effort can unlock the full potential of the clean energy transition, fostering a more sustainable, equitable, and resilient global energy future.

References

Bloomberg., 2024. Global Carbon Market Outlook 2024, https://about.bnef.com/blog/global-carbon-market-outlook-2024/#:~:text=Price%3A%20California's%20carbon%20price%20is,the%20end%20of%20the%20decade., Accessed 26 December 2024.

Climate Change News., 2024. In Numbers: The State of the Climate in 2024, https://www.climatechangenews.com/2024/11/11/in-numbers-the-state-of-the-climate-in-2024/#:~:text=2024%20is%20on%20track%20to%20be%20the%20first%20year%20above%201.5C&text=The%20global%20average%20temperature%20for,above%20the%201991%2D2020%20average, Accessed 24 December 2024.

EDGAR (Emissions Database for Global Atmospheric Research)., 2024. Community GHG Database, a collaboration between the European Commission, Joint Research Centre (JRC), the International Energy Agency (IEA), https://edgar.jrc.ec.europa.eu/report_2024#intro, Accessed 24 December 2024.

Emran, S., 2024. Outlook on Climate Policy under President Trump’s Renewed Mandate, Opinion, Policy Center for the New South, https://www.policycenter.ma/publications/outlook-climate-policy-under-president-trumps-renewed-mandate, Accessed 24 December 2024.

European Commission, 2024. GHG Emissions for all World Countries, JRC Science for Policy Report, https://edgar.jrc.ec.europa.eu/booklet/GHG_emissions_of_all_world_countries_booklet_2024report.pdf, Accessed 24 December 2024.

EIU (Economist Intelligence Unit)., 2024. Energy Outlook 2024. https://www.eiu.com/n/campaigns/energy-in-2024/, Accessed 23 December 2024.

IEA (International Energy Agency)., 2024a. World Energy Outlook 2024, October 2024. https://www.iea.org/reports/world-energy-outlook-2024, Accessed 23 December 2024.

_2024b. Oil Market Report- December 2024,https://www.iea.org/reports/oil-market-report-december-2024, Accessed 24 December 2024.

_2024c. Coal 2024: Analysis and Forecast to 2027, Executive Summary, December 2024, https://www.iea.org/reports/coal-2024/executive-summary, Accessed 26 December 2024.

Larabi, J., Berahab, R & Emran, S., 2024. FROM ONE COP TO THE NEXT: How Has the Climate Finance Commitment Evolved During the Past Decades? Policy Paper, Policy Center for the New South, https://www.policycenter.ma/index.php/publications/one-cop-next-how-has-climate-finance-commitment-evolved-during-past-decades, Accessed 23 December 2024.

McKinsey, 2024a. Global Energy Perspective 2024, September 2024, https://www.mckinsey.com/industries/energy-and-materials/our-insights/global-energy-perspective#/, Accessed 24 December 2024.

_2024b. How Data Centers and the Energy Sector Can Sate AI’s Hunger for Power, September 17, 2024, Insights, https://www.mckinsey.com/industries/private-capital/our-insights/how-data-centers-and-the-energy-sector-can-sate-ais-hunger-for-power, Accessed 24 December 2024.

OPEC (Organization of the Petroleum Exporting Countries)., 2024. OPEC Monthly Oil Market Report, 11 December 2024, https://momr.opec.org/pdf-download/, Accessed 26 December 2024.

Rystad, J., Busby, E., & Selvaraju, K., 2024. Shaping Energy Markets in 2025: 12 Trends to Watch in the Year Ahead, Rystad Energy, https://www.rystadenergy.com/news/energy-2025-trends-forecast, Accessed 26 December 2024.

S&P Global., 2024. S&P Global Commodity Insights Releases its 2025 Energy Outlook, https://press.spglobal.com/2024-12-11-S-P-Global-Commodity-Insights-Releases-its-2025-Energy-Outlook, Accessed 24 December 2024.

Spencer, T. & Singh, S., 2024. What the Data Centre and AI Boom Could Mean for the Energy Sector, Commentary, 18 October 2024, International Energy Agency, https://www.iea.org/commentaries/what-the-data-centre-and-ai-boom-could-mean-for-the-energy-sector, Accessed 25 December 2024.

UN Environment Program., 2024. Emissions Gap Report 2024: No More Hot Air…Please! With a Massive Gap Between Rhetoric and Reality, Countries Draft New Climate Commitments, https://www.unep.org/resources/emissions-gap-report-2024, Accessed 23 December 2024.

World Bank., 2024a. The Commodity Markets Outlook in Eight Charts, John Baffes & Kaltrina Temaj, November 2024, https://blogs.worldbank.org/en/developmenttalk/the-commodity-markets-outlook-in-eight-charts0, Accessed 23 December 2024.

_2024b. Global Carbon Pricing Revenues Top a Record $100 Billion, Press Release, https://www.worldbank.org/en/news/press-release/2024/05/21/global-carbon-pricing-revenues-top-a-record-100-billion, Accessed 26 December 2024.

_2023c. State and Trends of Carbon Pricing- 2024, Executive Summary, https://openknowledge.worldbank.org/server/api/core/bitstreams/d14ff4b1-823f-4d70-927c-456449772089/content, Accessed 26 December 2024.