Publications /

Opinion

This Opinion was originally published in Project Syndicate

In today's global economy, developing countries must embrace a new policy framework that strengthens their macroeconomic resilience, harnesses technology for productivity growth, and fosters growth and structural transformation. None of this will be possible with an "every country for itself" mentality.

RABAT – The global economic landscape is changing rapidly, and developing countries are now facing three major constraints: the resurgence of protectionism, shrinking macroeconomic policy space, and profound technological disruption. With the neoliberal Washington Consensus – the dominant economic-policy framework for a half-century – no longer fit for purpose, a new paradigm is urgently needed to guide development in the years ahead.

In recent years, free trade, once a cornerstone of international cooperation, has given way to rising tariffs, large-scale industrial subsidies, and economic “decoupling.” The US-China trade war exemplifies this trend, with average tariff rates up sharply since 2018. Now that Donald Trump, the self-proclaimed “Tariff Man,” is back in the White House, a reversal is unlikely. And it is not just the United States: the European Union has also embraced tariffs, including on Chinese electric vehicles, citing unfair subsidies.

Moreover, countries have increasingly pursued industrial strategies as a means of bolstering strategic sectors. Of course, China, with its state-led economic model, has long relied on industrial policy, which is the basis of its Made in China 2025 plan, introduced in 2015. But even advanced economies – the leading proponents of the free-market orthodoxy of the past – are now embracing such interventions. The US CHIPS and Science Act, for example, includes $52.7 billion in funding for semiconductor development. And the EU has its own industrial strategy.

Such initiatives are designed to bolster economic security, but they also fuel geopolitical tensions and lead to value-chain fragmentation. For developing countries, this presents both challenges and opportunities. The growing alignment of trade with geopolitical dynamics – including the push for “friend-shoring” – might enable some countries to attract more foreign direct investment, but resource-dependent and least-developed countries face reduced demand for exports and heightened economic uncertainty.

Meanwhile, developing countries’ ability to mount fiscal- and monetary-policy responses is severely constrained. Successive crises – including the 2008 global economic crisis, the COVID-19 pandemic, and various commodity-price shocks – have eroded fiscal buffers. Demographic pressures, from young people in need of jobs to population aging, weigh on public budgets. Climate-change mitigation and adaptation also demand substantial investments. And some countries are redirecting funds to defense in response to rising geopolitical tensions. Large debt-service payments remain a major burden, compounded by high global interest rates.

Moreover, high global interest rates are forcing developing countries to raise their own interest rates to mitigate capital outflows and currency depreciation, with adverse effects on investment and economic growth. Making matters worse, central-bank independence in some countries has been eroded – a trend that undermines policymakers’ ability to control inflation and support economic stability.

All this is happening while rapid technological change is disrupting traditional growth models. Developing-economy growth has historically been driven by structural transformation – the reallocation of resources from low- to high-productivity sectors, such as from agriculture to manufacturing. In Africa, this dynamic accounted for 74% of productivity growth before 2008.

But as Dani Rodrik and Joseph E. Stiglitz have observed, structural transformation can no longer be achieved through export-oriented industrialization, not least because manufacturing has become more skill- and capital-intensive. Slower global growth, heavier debt burdens, deglobalization, and climate change (which is affecting traditional sectors such as agriculture) further undermine this approach.

The alternative strategy Rodrik and Stiglitz propose focuses on a comprehensive green transition and increased productivity in labor-intensive services. But while this approach holds promise, considerable public-sector capacity is required to support private-sector innovation and policy experimentation. A more comprehensive policy framework, capable of filling the vacuum left behind by the Washington Consensus, would start with three key priorities.

First, developing economies must bolster their macroeconomic resilience. To this end, they should strengthen fiscal frameworks, in order to build up more robust macroeconomic buffers; implement inflation-targeting regimes to promote price stability; and adopt more flexible exchange-rate regimes that can provide a “shock absorber” amid external volatility.

Second, countries should leverage technology to boost productivity, with a focus on the private sector. In addition to increasing the efficiency and transparency of government services, digital technologies can expand access to education, support innovation by facilitating research and development, and transform critical sectors, such as health care and agriculture.

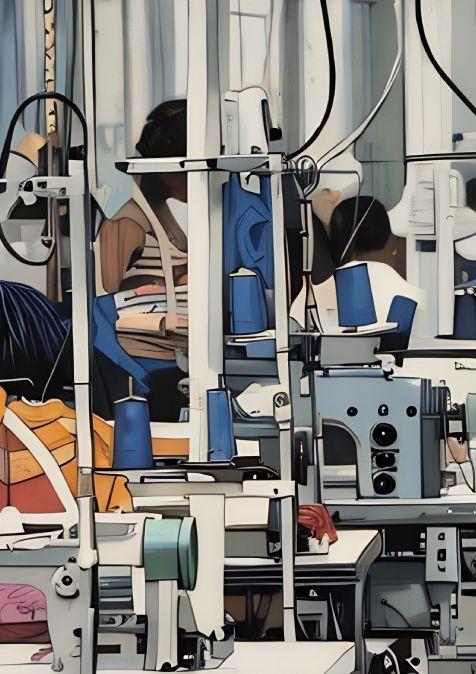

Lastly, governments should continue to promote growth through structural transformation. While the services sector holds promise for job creation, it alone cannot absorb the millions of young people, particularly the unskilled and semi-skilled, entering the workforce in developing countries each year. Fortunately, some labor-intensive sub-sectors, such as agribusiness and garment production, remain viable sources of jobs and growth in low- and middle-income countries.

Green manufacturing and the pharmaceutical sector also offer promising pathways for industrialization. Special economic zones, strategic land use, and more dynamic startup ecosystems can stimulate industrial growth and job creation. Developing economies might also need to take steps to safeguard domestic industry from an influx of Chinese goods redirected from the US and the EU. Such measures should be transparent and time-bound, and comply with World Trade Organization rules.

None of this will be possible with the “every country for itself” mentality that seems to be taking hold worldwide. While the Washington Consensus had a decidedly mixed track record, it emphasized international engagement and cooperation. Countries must not throw out the baby with the bathwater. If developing countries are to build more resilient and inclusive economies in today’s global environment, they must embrace partnerships, share knowledge, and pursue collaboration among the government, the private sector, and international institutions.