Publications /

Policy Brief

This Policy Brief examines the current banking crisis in the United States and its implications for Africa. Many studies have pointed out the main factors responsible for this crisis, including poor risk-management practices in the failed banks, the sector’s weak regulatory structure, and the failure of bank supervisors. However, a key factor that has contributed to the extent and speed of the crisis is the U.S. Federal Reserve’s (Fed) policy actions, including the elimination of reserve requirements in 2020, which resulted in a surge in demand deposits, and led to banks taking excessive risks.

Although this crisis will prompt the Fed to exercise more caution in raising interest rates, it will not change its commitment to bring inflation down. In the next two years, developing countries, particularly those in Africa, should anticipate a challenging environment characterized by high interest rates and reduced demand for their exports, because of sluggish growth in major trading partners. In the meantime, these countries can learn valuable lessons from the 2023 banking crisis in order to mitigate the potential risks of bank runs.

INTRODUCTION

The ongoing U.S. banking crisis began with the Silicon Valley Bank (SVB) bank run of March 2023, which we analyzed in a previous PNCS Policy Brief (Dinh 2023a). This was a classic bank run. In a low interest rate environment, SVB had invested the rapidly growing deposits of its clients, mostly venture capital firms, in long-term securities hoping to get higher yields. In 2021, over 95% of total deposits in SVB were demand deposits, meaning they could be withdrawn at any time, and 90% of the deposits exceeded the $250,000 limit insured by the Federal Deposit Insurance Corporation (FDIC). When interest rates rose and SVB depositors withdrew money to seek higher returns elsewhere, SVB could not meet this demand and had to sell its securities at a big loss, the value of these assets having declined due to higher interest rates. This caused a loss of confidence, prompting more withdrawals, and, given the speed of social media and electronic banking, led to a bank run on SVB.

The SVB failure was followed by others. On May 1, 2023, the FDIC placed First Republic Bank (FRB) in receivership. On the same day, most of FRB’s assets were bought by JP Morgan Chase. With $212 billion in assets, FRB is the second largest U.S. bank to fail since Washington Mutual in 2008, and the third U.S. major bank1 failure in 2023, after Silicon Valley Bank and Signature Bank. All three banks had faced mark-to-market losses on treasuries, and had risky structures for their deposit base.

The FRB failure was analyzed in a recent PCNS Policy Paper (Dinh 2023b). Briefly, following the SVB failure, many depositors began to transfer their uninsured deposits2 from small and medium U.S. banks to larger banks. By the end of March 2023, depositors had withdrawn about $105 billion from the FRB, roughly half of its $212 billion assets. About 68% of the bank’s deposits were uninsured, compared to 90% of SVB’s. In mid-March, the bank’s credit rating was downgraded by Standard and Poor’s, leading to the establishment of a consortium of 11 large banks, including JPMorgan Chase and Bank of America, to rescue it. The consortium shored up FRB’s capital with a $30 billion deposit, but this did not prevent the bank’s stock price from dropping further. The bank was also unable to make use of the Fed’s newly established Bank-Term Funding Program, because almost 60% of its investment securities were in municipal bonds, and as such did not qualify as collateral.

So, like SVB, on April 28, 2023, FRB began to sell its long-term assets at a loss in order to raise equity. When it was announced that the FDIC was taking over the bank that day, FRB’s stock price dropped by 43%. When the stock price dropped further in after-hours trading, the FDIC approached various banks and gave them two days to place bids for FRB. On May 1, the FDIC announced that FRB had closed and its assets had been seized by the FDIC. JPMorgan Chase then won the auction, paying $10.6 billion for most of FRB’s assets.

FRB shared many features with SVB. First, both had large bases of uninsured depositors who could withdraw their money at short notice via electronic banking. Second, both held most of their assets in long-term bonds and/or loans, which created the duration-gap risk that the banks did not hedge (through derivatives, for example). Third, both banks had a rather specific groups of clients as depositors: venture capitalists with SVB and high-net- worth individuals with FRB. Fourth, both had faced collapses in their stock prices before the FDIC took over. The major difference between the two seems to be that SVB’s portfolio

was more liquid than FRB’s. A large proportion of FRB’s assets consisted of net loans (78% of total assets compared to 35% for SVB), particularly mortgage loans (64% for FRB compared to 6% for SVB). Most of SVB’s assets were in the form of securities, including 43% in mortgage securities.

In a comprehensive post-mortem review3 of its role in the SVB crisis (2023), the Federal Reserve (Fed) pointed to four responsible factors: i) failure of SVB’s board and management in managing risks; ii) Fed supervisors not fully appreciating the seriousness of problems in SVB’s governance, liquidity, and interest rate risk management; iii) once the Fed’s supervisors identified the vulnerabilities, they did not take sufficient measures to make sure SVB fixed them; and iv) over the last few years, the Federal Reserve Board changed its regulatory and supervisory policies in response to a combination of external statutory changes and internal policy choices. The Fed report is both candid and thorough. The four factors it noted were also those we pointed out in March, except for the Fed’s decisions to raise interest rates.

Absent from the Fed report is any mention of the key trigger for SVB’s failure and the subsequent regional bank failures: the Fed decisions to hold interest rates at near-zero over a long period, from 2009 to 2022, and the repeated and large interest rate increases in the year beginning March 2022. Between March 17, 2022, and March 2, 2023, the Fed raised the federal funds rate (FFR) nine times, from a range of 0-0.25% to 4.75%-5.0%. On May 3, 2023, it raised the FFR by another 25 basis points (bps) to a range of 5.0%-5.25%, the highest in 16 years.

The Fed’s actions were understandably grounded in their valid concern about inflation. Some of the Fed’s policy actions were caused by the emergency nature of the COVID-19 pandemic, while others by misjudgments of the economic signals, which were made confusing in the highly uncertain circumstances facing the economy.

The Fed kept interest rates very low from 2009 to 2022, following the Global Financial Crisis of 2008. Its policy rate, the federal funds rate (FFR), which the Fed guided through setting the upper and lower limits, was near zero between 2009 and 2016, less than 2.5% between 2016 and 2020, and zero between 2020 and 2022. In the last 60 years, and at least since records have been kept, there has never been a longer period where interest rates were so low. Prior to 2009, the lowest the FFR ever reached was 0.63% in May 1958, and this was maintained for less than a month. When these low rates were deemed insufficient to meet the needed stimulus, rather than letting them fall to negative, the Fed began to lower longer term interest rates through quantitative easing, i.e. purchasing long-term securities issued by the government and/or guaranteed by government-affiliated agencies.

To be fair, the Fed was well aware of this abnormal period of low interest rates. In 2016, it began to raise the FFR, but had to abandon this policy in 2020 with the emergence of the COVID-19 pandemic. Following this long period of 2009 to 2022, the banks and the public were led to believe that any interest rate increases in 2022 and thereafter would be only temporary, just like in the 2016–2019 period. Between March 17, 2022 and May, 2023, the Fed had to raise the FFR ten times, from a range of 0-0.25% to 5.0-5.25%.

The crucial Fed decision that led to the intensity and frequency of these rate increases was the Fed’s inaction during 2021. This was the period when the Taylor rule4 indicated the need for a rapid rise in the federal funds rate5, while the Federal Open Market Committee (FOMC) declared the need to hold interest rates low. In particular, in the second half of 2021, when the Taylor rule again called for short-term interest rates to rise, the Fed remained committed to low interest rates. The Fed stated that both the rise in inflation and inflation expectations were “transitory” and would soon be brought back down to the 2% level6.

With four rounds of quantitative easing in 2009, 2010, 2012, and 2020, the Fed greatly increased its balance sheet and also the balance sheet of the banking sector. Thus, the Fed’s total assets multiplied from $0.9 trillion in 2008 to a staggering $8.9 trillion in March 2022, while total assets of the banking sector more than doubled from $10.9 trillion to $22.7 trillion over the same period.

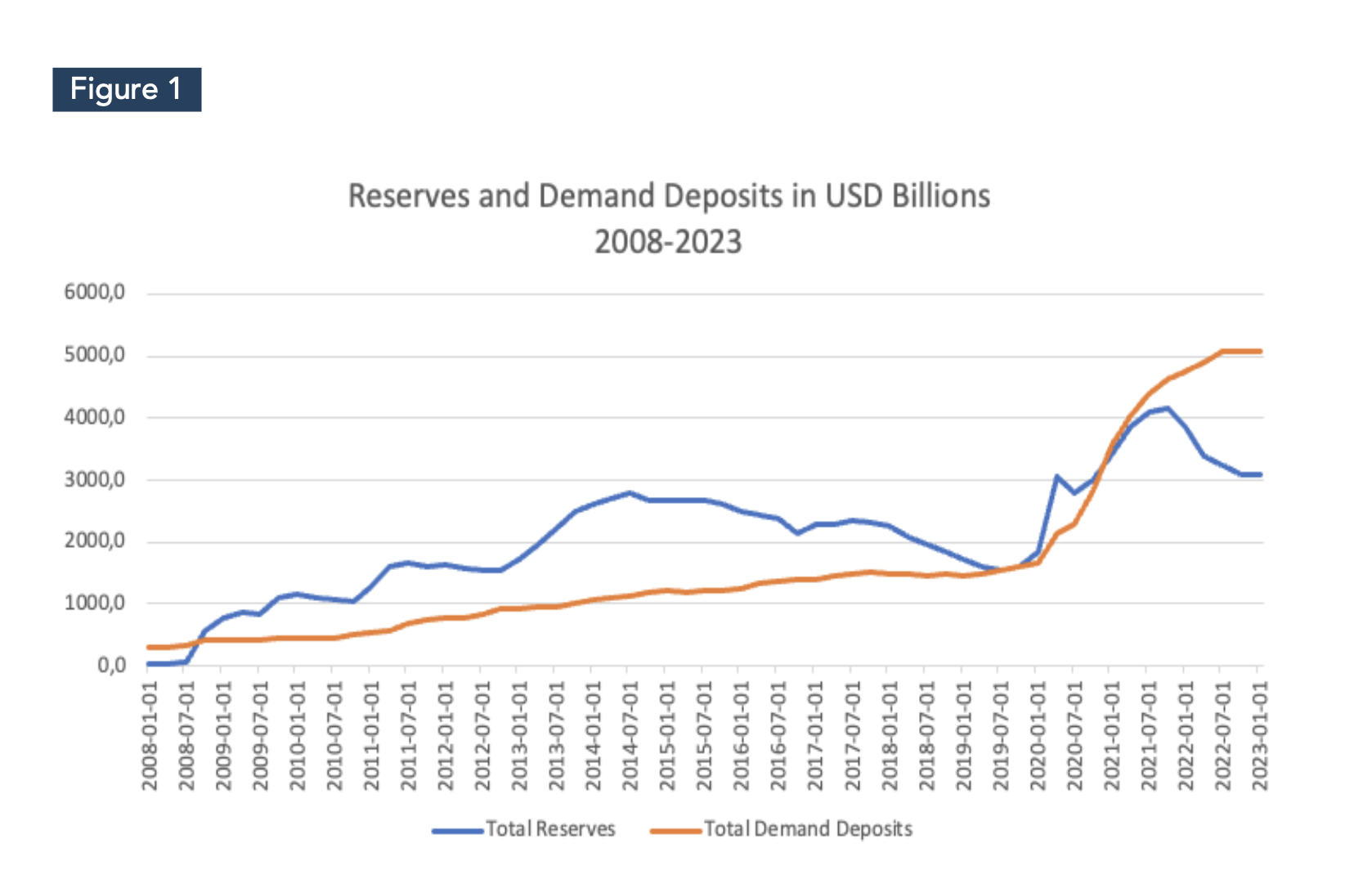

Furthermore, in March 2020, the Fed abolished the required reserve requirements for banks. As a result, and in a low-interest rate environment, demand deposits grew rapidly.

From January 2020 to January 2023, total demand deposits in the banking system rose from $1.7 trillion to $5.1 trillion7, while total reserves rose from virtually zero to 3.1 trillion8 (Figure 1). The FDIC also reported the same trend9. This growth can be easily seen in the balance sheets of banks such as SVB and FRB. The demand deposits of SVB grew from $59 billion in 2019 to $181 billion in 2021, and then to $133 in 2022. These were demand deposits, meaning they could be withdrawn any time. Demand deposits held in FRB grew from $66 billion in 2019 to $$132 billion in 2021, and then to $130 in 2022.

Source: Board of Governors of the Federal Reserve System (US), Demand Deposits [WDDNS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WDDNS, May 7, 2023. Reserves of Depository Institutions: Total [TOTRESNS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TOTRESNS, May 7, 2023.

In a low-interest rate environment, facing large and growing demand deposits with no reserve requirements, banks naturally would maximize profits by purchasing long-term securities with higher yields. The dominant position of demand deposits in total assets of a bank, while most of its liabilities are long-term securities or loans, presents a classic duration-gap risk. When interest rates increase, the bank cannot meet the liquidity demands of depositors who seek higher returns elsewhere for their money, a process often facilitated by the speed of social media and the electronic banking system. But when a bank like SVB begins selling its long-term securities at a loss to meet its liquidity demand, customer confidence plummets and a bank run becomes the reality. At the end of 2022, total ‘available for sale’ securities of FDIC-insured commercial banks and savings institutions amounted to about $3.1 trillion, while demand deposits were about $5.1 trillion.

The decision to eliminate reserve requirements was understandable in the midst of the COVID-19 pandemic when there was a major need for banks to lend to households and businesses affected by the pandemic. But it may have increased the volatility of reserves and made it difficult for the Fed to control the money supply. In addition, it could have encouraged banks to take excessive risks because it has flooded banks with large demand deposits since 2020. Bank runs could therefore happen more frequently under these circumstances.

The mismatch in maturities between the demand deposits on the liability side, and investments and loans on the asset side of the banking sector, remains a source of financial instability. This is much more pronounced for certain regional banks than others, and there is a dire need for the authorities to help these banks bridge this gap, at least in the short- term, to ensure additional bank runs will be stopped.

IMPLICATIONS FOR AFRICA

So far, the banking crisis in the U.S. has been limited to regional banks. Large banks have benefited from measures taken after the Global Financial Crisis (2007-2009) to strengthen their capital bases, and have remained strong. Some may even benefit from interest-rate increases, which raise their interest margins. Given the Fed’s determination to fight inflation, it is reasonable to assume that U.S. interest rates will remain high for at least another year, if not longer. Meanwhile, the U.S. economy has shown signs of slowing down. Considering the deceleration in the growth prospects of the EU, China, and Japan, global demand for goods and services from developing countries does not appear promising for 2023 and the first half of 2024.

According to the World Bank (2023), global economic growth is expected to slow sharply from almost 3% in 2022 to 1.7% in 2023, marking the lowest growth rate since 1994, except during the Global Financial Crisis (2009) and COVID-19 (2020). This is a result of policy tightening aimed at controlling high inflation, worsening financial conditions, and ongoing disruptions from the Ukraine war. Economic growth in the U.S., the euro area, and China remains weak, and demand for the exports of African countries is likely to be weak as well. Urgent global efforts are needed to reduce debt distress in Africa. Given the limited policy space, the World Bank (2023) urges national policymakers to «ensure that any fiscal support is focused on vulnerable groups, that inflation expectations remain well anchored, and that financial systems continue to be resilient.»

U.S. interest rate increases could cause significant increases in the debt-servicing burden of African countries, raise long-term bond yields and sovereign spreads, reduce capital inflows, and necessitate exchange-rate adjustments. In addition, they could also cause a decline in investment and consumption (Arteta et al, 2022), resulting in a decrease in economic growth. However, developing countries have no control over these effects. What they can do is build a resilient financial system by taking measures to minimize the risks of bank runs.

Banking crises are not uncommon in developing countries. Laeven and Valencia (2020) identified 41 such crises in 91 developing countries from 1990 to 2021. Kose and Ohnsorge (2023) revealed that during the year of an average banking crisis, actual global output growth declined significantly from an average of 3.5% during 1990-2021 to a mere 0.7%. The study found that the impact of banking crises was stronger but shorter-lived in developing countries compared to advanced economies. Consequently, five years after a banking crisis, the effect was no longer statistically significant in developing countries, but remains significant in advanced economies because of the effects on employment and investment.

Contrary to popular belief, bank runs have occurred quite frequently in African countries, primarily due to shallow financial markets and structural economic weaknesses. For instance, Zimbabwe experienced a severe banking crisis from 2004 to 2009, triggered by hyperinflation and economic instability that eroded confidence in the banking sector and led to bank runs. In 2008, Nigeria witnessed a bank run prompted by rumors of insolvency of some banks, causing worried depositors to rush and withdraw their funds, creating panic and straining the banking system. Similarly, Kenya faced a banking crisis in 2016 following the failures of Imperial Bank, Dubai Bank, and Chase Bank, resulting in a banking panic and massive deposit withdrawals. In 2019, Ghana experienced a banking crisis arising from the closure of several banks, leading to a loss of confidence among depositors and subsequent bank withdrawals. South Africa also faced a bank run in March 2020 after the collapse of VBS Mutual Bank, when concerns about deposit safety and the stability of other small banks prompted depositors to withdraw funds, before intervention by the South African Reserve Bank restored confidence in the banking sector.

The ongoing banking crisis in the United States serves as a powerful reminder for policymakers and bank officials in Africa to strengthen risk-management policies and practices, reinforce the effectiveness of supervision, and enhance the regulatory structure of their banking sectors.

The ultimate responsibility for risk management in an individual bank lies with its board and management. However, many countries lack a coherent risk-management framework that should include: i) a system for identifying, measuring, and monitoring liquidity risk; ii) setting risk limits and controls for compliance; iii) diversification of funding sources; and iv) a contingency funding plan outlining strategies and actions to be taken during a liquidity crisis.

African banks commonly face liquidity risks such as asset liquidity risk, which arises when a bank’s assets cannot be easily converted into cash without significant loss of value (similar to SVB’s mark- to-market losses on U.S. Treasury Bills). This risk can occur when banks hold a high proportion of illiquid or long-term loans that cannot be quickly converted into immediate cash inflows. Another risk is deposit withdrawal risk, which can arise because of factors including economic volatility, political instability, or lack of depositor confidence. Currency liquidity risk is also a significant and common risk, occurring when banks face the risk of currency liquidity mismatches. In countries where foreign exchange is scarce, if a bank has significant foreign currency liabilities but lacks sufficient foreign currency assets or access to foreign currency funding, it may struggle to meet its obligations during currency depreciations or shortages of foreign exchange.

Strengthening central bank supervision: By actively monitoring banks, ensuring adequate liquidity, maintaining deposit insurance system (in case this falls under its jurisdiction10), and regulating banks during crises, central bank supervision plays a crucial role in preventing bank runs. These measures are essential for maintaining stability and confidence in the banking system and reducing the likelihood of bank runs. To be effective, central bank supervision must operate within a robust regulatory framework for the sector (below), but the framework itself is only valuable if it is enforced vigorously by a well-functioning supervisor.

To identify weaknesses in individual banks promptly, central bank supervision must monitor their operations closely through regular inspections and audits. These assessments should focus on areas including capital inadequacy, risky lending practices, and liquidity shortages. Conducting regular inspections and stress tests on commercial banks allows the central bank to assess their financial health and identify potential vulnerabilities. Stress tests involve analyzing how banks would perform under adverse scenarios, such as significant economic downturns or sharp interest rate increases, and should be conducted to gauge their resilience.

By employing both on-site inspections and off-site monitoring systems, the central bank can identify any signs of distress or misconduct that may lead to a bank run. It is crucial for the central bank to encourage commercial banks to enhance their transparency and disclosure practices. Requiring banks to provide accurate and timely information about their financial condition, risk exposures, and corporate governance facilitates informed decision-making by depositors and investors.

To reinforce the regulatory structure for commercial banks, the authorities could consider a number of measures:

-

Securing the independence of the regulatory authority responsible for overseeing and regulating commercial banks. This authority should operate separately from the government and be free from political interference, to ensure independent and timely decision-making.

-

Ensuring that the regulatory framework includes clear and comprehensive regulations that govern the operations of commercial banks. As mentioned above, these regulations should cover areas including capital adequacy, risk management, liquidity requirements, governance standards, and disclosure obligations.

-

Adopting a risk-based approach to supervision, which involves assessing the risk profiles of individual banks and allocating supervisory resources accordingly.

-

Implementing a system of regular inspections and reporting requirements for commercial banks. On-site inspections enable regulators to assess the financial health, risk-management practices, and compliance of banks. Reporting requirements, including periodic financial statements and risk disclosures, provide regulators with essential information to monitor banks’ activities and identify early warning signs of potential bank runs

-

Finally, an important lesson from the current U.S. banking crisis is the macroeconomic role of the central bank in conducting monetary policy. In the age of social media and electronic banking, monetary policy cannot be carried out independently from other policies, such as financial stability. The U.S. Federal Reserve’s actions during the current banking crisis highlight the impact of monetary policy decisions on the extent and speed of the crisis. As discussed in a recent PCNS Policy Paper11, the prolonged period of near-zero interest rates from 2009 to 2022, the continuation of zero-reserve requirements for banks after the pandemic, and the delay in raising the Federal Funds rate in 2021, despite emerging inflationary signs, contributed to banks’ risk- taking behavior and the current banking crisis. These decisions diverged from the previously followed Taylor-rule prescriptions since 1995.

Ignoring the consequences of monetary policy on financial stability can jeopardize the effectiveness of monetary policy itself. For instance, if the banking crisis deepens to the point where the central bank resorts to money printing to rescue banks, the objective of raising interest rates to fight inflation becomes compromised. The central bank faces a dilemma in such a scenario. If it repeatedly raises interest rates in an environment in which banks assume low rates will persist, bank runs are likely to occur, unless the regulatory and supervision framework is adequate. On the other hand, if the central bank does not raise interest rates, it risks losing credibility as inflation continues to rise, making it challenging to combat inflation in the future.

REFERENCES

Arteta, C., Kamin, S. and Ruch, F.U., 2022. How Do Rising U.S. Interest Rates Affect Emerging and Developing Economies? It Depends. World Bank Policy Research Working Paper 10258. Prospects.

Board of Governors of the Federal Reserve System.2023. Review of the Federal Reserve’s Supervision and Regulation of Silicon Valley, April 28, 2023. https://www.federalreserve.gov/ publications/files/svb-review-20230428.pdf

Dinh, H.T. 2023a. Lessons From the Silicon Valley Bank Crisis. Policy Brief PB-15/23. March 2023. Policy Center for the New South. https://www.policycenter.ma/publications/lessons-silicon-valley- bank-crisis

Dinh, H.T. 2023b. The Current Banking Crisis and U.S. Monetary Policy. Policy Paper PP-10/23. May 2023. Policy Center for the New South. https://www.policycenter.ma/publications/current-banking- crisis-and-us-monetary-policy

Kose, M. Ayhan, and Ohnsorge, Franziska, eds. 2023. Falling Long-Term Growth Prospects: Trends, Expectations, and Policies. Washington, DC: World Bank. License: Creative Commons Attribution CC BY 3.0 IGO

Laeven, L., and F. Valencia. 2020. “Systemic Banking Crises Database II.”IMF Economic Review 68 (2): 307-61.

World Bank. 2023. Global Economic Prospects, January 2023. Washington, DC: World Bank. doi:10.1586/978-1-4648-1906-3. License: Creative Commons Attribution CC BY 3.0 IGO

1. The first bank failure was actually California-based Silvergate, a relatively small bank with assets of about $11 billion, and 90% of deposits tied to cryptocurrency businesses.

2. Defined as individual accounts with a balance above the maximum $250,000 insured by the FDIC.

3. Board of Governors of the Federal Reserve System. Review of the Federal Reserve’s Supervision and Regulation of Silicon Valley Bank, April 28, 2023. https://www.federalreserve.gov/publications/files/svb-review-20230428.pdf.

4. John Taylor rule refers to the monetary policy rule under which the short-term nominal interest rate is adjusted according to the gap between real and trend GDP and the gap between the actual inflation rate and the targeted inflation rate. See Dinh (2023b).

5. See https://www.atlantafed.org/cqer/research/taylor-rule?panel=1.

6.See https://www.federalreserve.gov/newsevents/pressreleases/monetary20211103a.htm#:~:text=Inflation%20is%20elevated%2C%20largely%20reflecting,price%20increases%20in%20some%20sectors.

7. Defined as total demand deposits at commercial banks and foreign related institutions, other than those due to the U.S. government, U.S. and foreign depository institutions, and foreign official institutions.

8. Defined as the sum of total reserve balances maintained plus vault cash used to satisfy required reserves.

9. See https://www.fdic.gov/analysis/options-deposit-insurance-reforms/report/options-deposit-insurance-reform-full.pdf, p. 13.