Publications /

Policy Brief

The global economic environment has changed as the U.S.—and to a less confrontational degree, the European Union—have clearly established a context of technological rivalry with China. Hindering China’s progress in the sophistication of semiconductor production has become a centerpiece of current U.S. foreign policy. While the U.S. is clearly winning the semiconductor war, the picture is different when it comes to clean-energy technology.

Both technology wars overlap with access to and refinement of critical raw materials (CRM), which are key upstream components of the corresponding value chains, encompassing mineral-rich emerging markets and developing economies. The way in which the U.S. and the European Union approach the goal of self-sufficiency, as well as access to and refinement of CRMs, will make a big difference to their stakes in the technology wars.

Introduction

Technological progress in the Chinese economy in recent decades has basically involved a process of using knowledge and technologies made available by globalization. In conjunction with local investment in capacity building, in addition to forced transfer in some segments, Chinese firms have acquired the capability to produce and adapt technologies, and, in some cases, even to make basic innovations (Canuto, 2021).

The environment has changed as the U.S., and to a less confrontational degree the European Union, have clearly put in place a technological rivalry with China. In a September 2022 speech, U.S. White House national security adviser Jake Sullivan (2022) mentioned advanced semiconductor and computing technologies, biotechnology, and clean-energy technology as areas in which the U.S. should maintain global leadership, as “a national security imperative”.

Hindering China’s progress in increasing the sophistication of semiconductor production has become a centerpiece of the current U.S. foreign policy. Following the success of Chinese production and exports in the less technologically advanced segments of the industry, the U.S. has raised barriers against Chinese access to North American equipment and technologies, preventing China from climbing the technological ladder, and even demanding that users in other countries do not facilitate circumvention of the restriction. Despite the fragmentation of the supply chain for the highest-end chips, all the basic components are in the hands of either the U.S. or its allies. The concrete consequence in the case of advanced semiconductors is that China will have to build the upper rungs of the technological ladder itself.

While the U.S. is clearly winning the semiconductor war, the picture is different when it comes to clean-energy technology. Unlike for semiconductors, where the U.S. and allies have the leadership and current control of bottlenecks in production chains, China has built a very strong position in clean-energy technologies. To catch up, the U.S. is counting on the Inflation Reduction Act (IRA), approved by Congress in 2022, and other bills. The European Union, in turn, is launching an investigation into Chinese state support for makers of electric vehicles, as soaring imports of their cars stoke fears about the future of European auto manufacturers.

Both technology wars include the issue of access to and refinement of critical raw materials (CRM), which are key upstream components of the corresponding value chains, encompassing mineral-rich emerging markets and developing economies. While China already has a firm footprint in CRMs domestically and abroad, the U.S. and Europe will need to take steps to safeguard their own needs. As a report authored by Garcia-Herrero et al (2023) points out, this can be best done through “green tech partnerships”.

Dual-use Goods, Semiconductors and Deglobalization

In 2017, when I was one of the executive directors of the World Bank, I visited the Gaza Strip, in Palestine, on a work mission. A sanitation project financed by the Bank in a residential area subject to flooding with sewage when it rained heavily had been halted because of a ban on the entry into Gaza of hydraulic pipes. When we spoke to the Israeli military authority responsible for blocking the tubes, he told us that the problem lay in their possible dual use, civil or military.

I remember this when I see references to national security in arguments against free trade in dual-use goods. Of all possible justifications for globalization-reversing national policies, national security is the most powerful argument against unfettered, market-driven globalization (Canuto et al, 2023). It is also the most difficult to evaluate, as it cannot be analyzed directly by researchers, market analysts, or journalists; it is necessary to take what government intelligence sources say.

The argument has found bipartisan support in the United States regarding China. A serious problem can always arise if a broad interpretation of ‘dual use’ results in the restriction of many goods and services—even clothing or medicines used by the military. As the concept has the potential to lead to broad and sweeping restrictions across multiple sectors, there is a risk that it could spur economic wars in the form of retaliation.

The main category targeted so far is the semiconductor sector. Semiconductors are an integral component of many consumer products, including cars and smartphones, but they can also be used in dual-use goods such as civil and military aircraft. Furthermore, they are used in supercomputing and artificial intelligence, areas with potential implications in terms of national security.

The dispute concerns the most advanced segments in the semiconductor industry. Yoon (2022) distinguished between more advanced semiconductors that are 3-14 nanometers in size, and the cheaper and simpler chips above 14 nanometers.

The economy is increasingly hanging on nanometers, or billionths of a meter. The width between individual transistors on a chip is measured in nanometers. The smaller the gap, the more transistors can be included in a single silicon chip, making the chip more powerful.

And everything depends more and more on such chips: smaller and faster semiconductors are needed for equipment including computers, smartphones, home appliances, electronic games, medical equipment, and telecommunications.

The first generation of electronics in the 1970s had one chip per device. Now, an electric car needs more than 2,000 semiconductors, more than twice the average number of chips in today’s fossil fuel-powered cars (Yoon, 2022). Chips also play a key role in next- generation technology, from 5G internet to cloud services and artificial intelligence.

Such tiny semiconductors are at the heart of the current rivalry between the United States and China. At the end of 2019, we observed how the technological chapter of the U.S.-China confrontation, initiated by President Trump, would continue under President Biden (Canuto, 2019). Indeed, in addition to President Biden not reversing his predecessor’s trade measures, new Washington rules block China’s access to chips and prohibit the sale of equipment needed to produce them, in addition to making certain essential technologies to produce advanced chips unavailable. The rules in force in this regard are the most restrictive to date.

Given the critical character of semiconductors in so much of what is done today, their advanced versions and their manufactures have become a kind of substitute for the weapons and armies used in ‘proxy wars’ during the Cold War between the U.S. and the Soviet Union. Hindering China’s progress in terms of the sophistication of semiconductor production has become a centerpiece of U.S. policy toward the country.

It was also notable how easily Biden’s fiscal package dedicated to semiconductors received bipartisan support in the U.S.

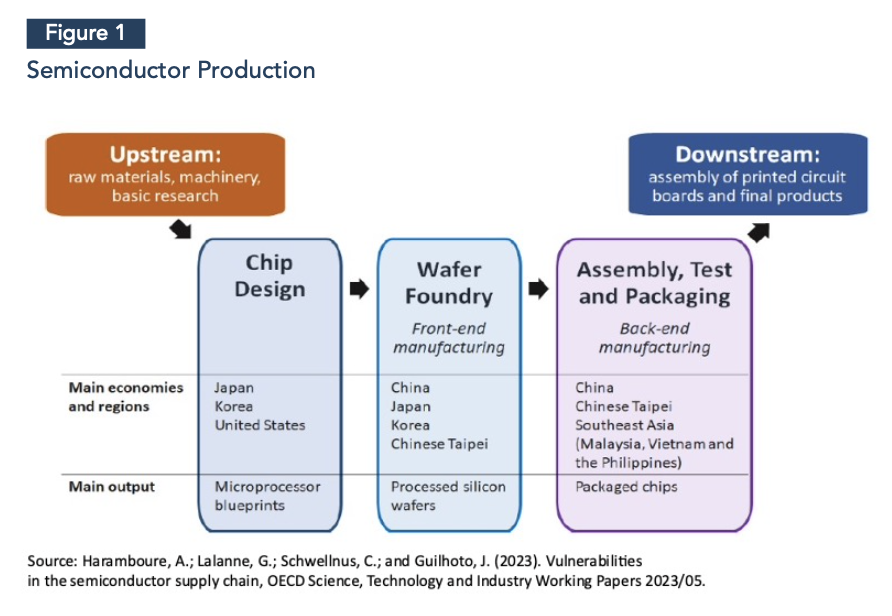

Taiwan and South Korea have mastered cutting-edge chip manufacturing technology and account for close to 50% of the world semiconductor market. The U.S. accounts for 12% of the global market, but its local companies do not produce advanced chips on a large scale. On the other hand, many stages of the semiconductor production process rely on U.S.-originated technologies, including the equipment needed to produce the most advanced chips. Figure 1 displays the value chain of semiconductor production.

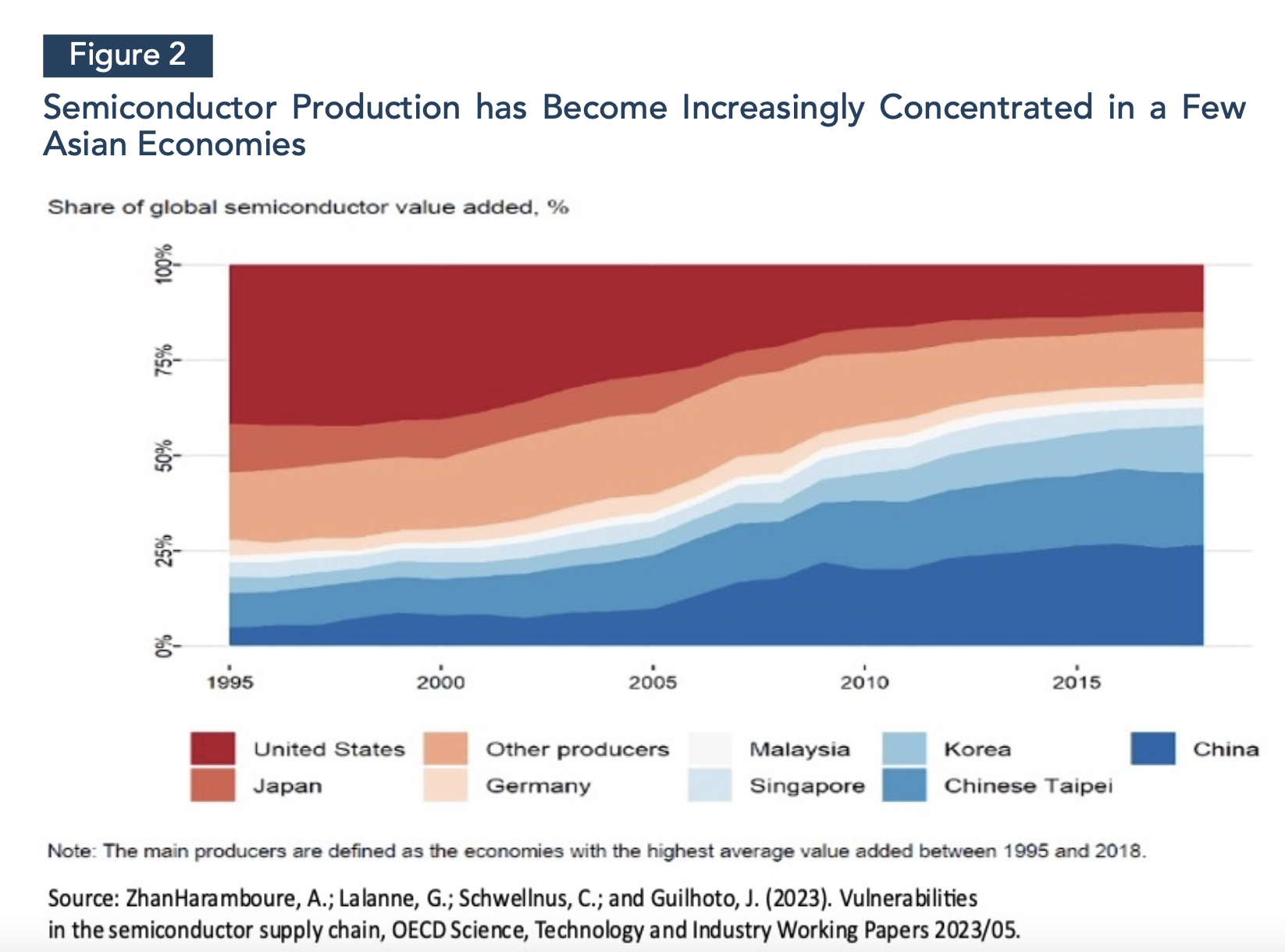

Figure 2 depicts the evolution of global market shares, without any breakdown of figures by levels of sophistication and technological requirements. In the recent past, China has occupied a large share of the markets for cheap semiconductors with higher nanometers. One can see in this case an attempt to repeat the trajectory in which the country made good use of globalization to increase added value, and consequently to climb the ladder of per-capita income.

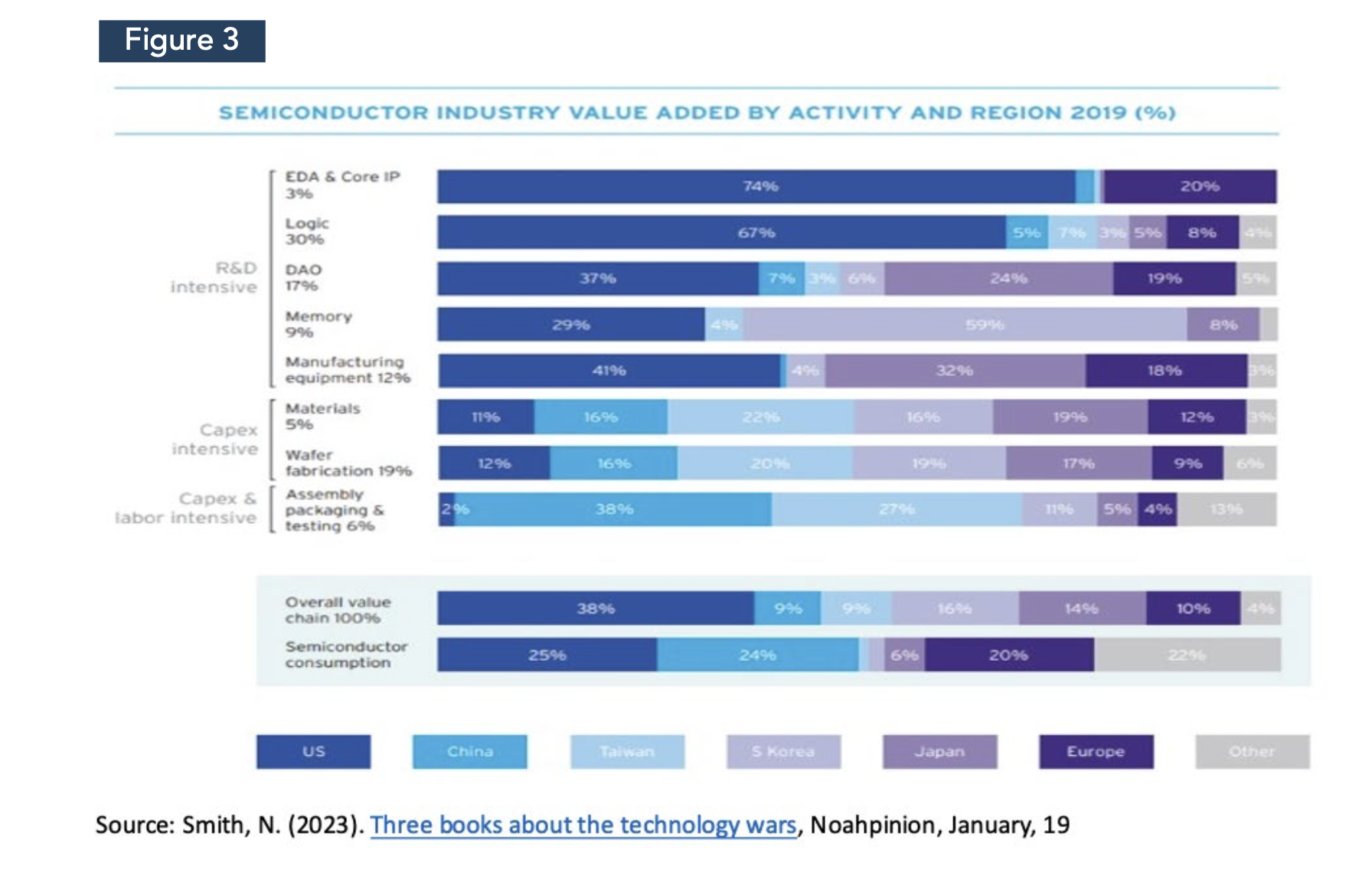

The U.S. semiconductor ‘proxy war’ consists precisely of cutting off access to the higher rungs of the ladder for some economies. China will have to build them itself. Figure 3 shows at which stages of semiconductor production different countries predominate.

In October 2022, the United States announced broad export controls on the semiconductor industry, targeting China. Under the restrictions, any semiconductor made with American technology for use in supercomputing or artificial intelligence can only be sold to China with an export license issued by the United States, a license that is difficult to obtain. Given that nearly all semiconductors are produced using U.S. technology, this rule effectively covers the entire global industry.

The United States doesn’t export many semiconductors directly to China. However, the export controls targeted chip-making countries that use U.S. software and/or machines in their manufacturing facilities. Users/partners outside the U.S. have been pressured to abide by those restrictions.

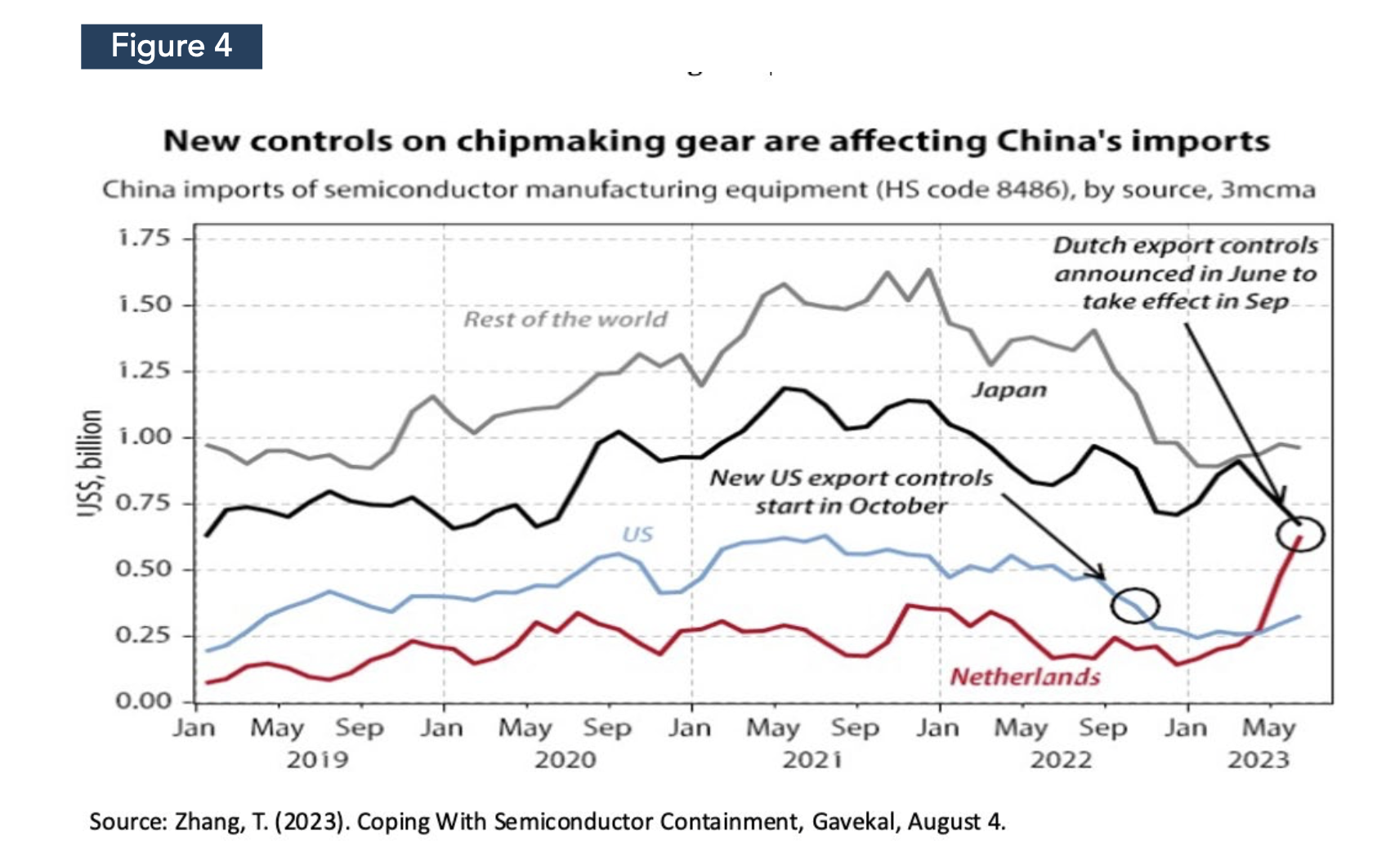

Third countries face the following choice: seek the export licenses required by the United States or stop using their technology and equipment. Hence there is increasing use of the phrase ‘armed interdependence’ to characterize how the United States has used the interdependence inherent in global trade and supply chains to force its trading partners to align with its technology war against China. Additionally, its citizens are prohibited from working with Chinese chip producers unless they have specific approval. With these measures, the U.S. seeks to prevent China from advancing technologically using what already exists on the frontier on the American side in sectors crucial to national security. Figure 4 suggests that the effect of such restrictions has been significant.

An alternative interpretation of recent semiconductor export restrictions is that they have little to do with national security but are aimed at curbing China’s path of economic development through the creative absorption of technology available abroad. If so, the new restrictions mark the end of an era of globalism and economic cooperation, and the beginning of another cold war.

The case of semiconductors fits well with what we observe to be a partial reversal of

globalization in high-technology segments that considered sensitive from the point of view of national security, with costs still considered justifiable by government authorities (Canuto, 2022). As in the case of the hydraulic pipes in the sanitation project in the Gaza Strip, everything will depend on which of the dual uses is considered a priority.

The results of U.S. government activism on domestic production are still to be seen. Meanwhile, semiconductor producers in Taiwan and South Korea are grateful because the U.S. has made it harder for mainland Chinese producers to enter the segments they dominate.

The U.S. is winning the semiconductor war. Despite the fragmentation of the supply chain for the highest-end chips, all the basic components are in the hands of either the U.S. or its allies. The concrete consequence in the case of advanced semiconductors is that China will have to build the upper rungs of the technological ladder itself.

Proxy War on Clean-energy Technologies

The situation with clean-energy technologies appears contrary to that with semiconductors. In clean-energy technologies, China has built a very strong position.

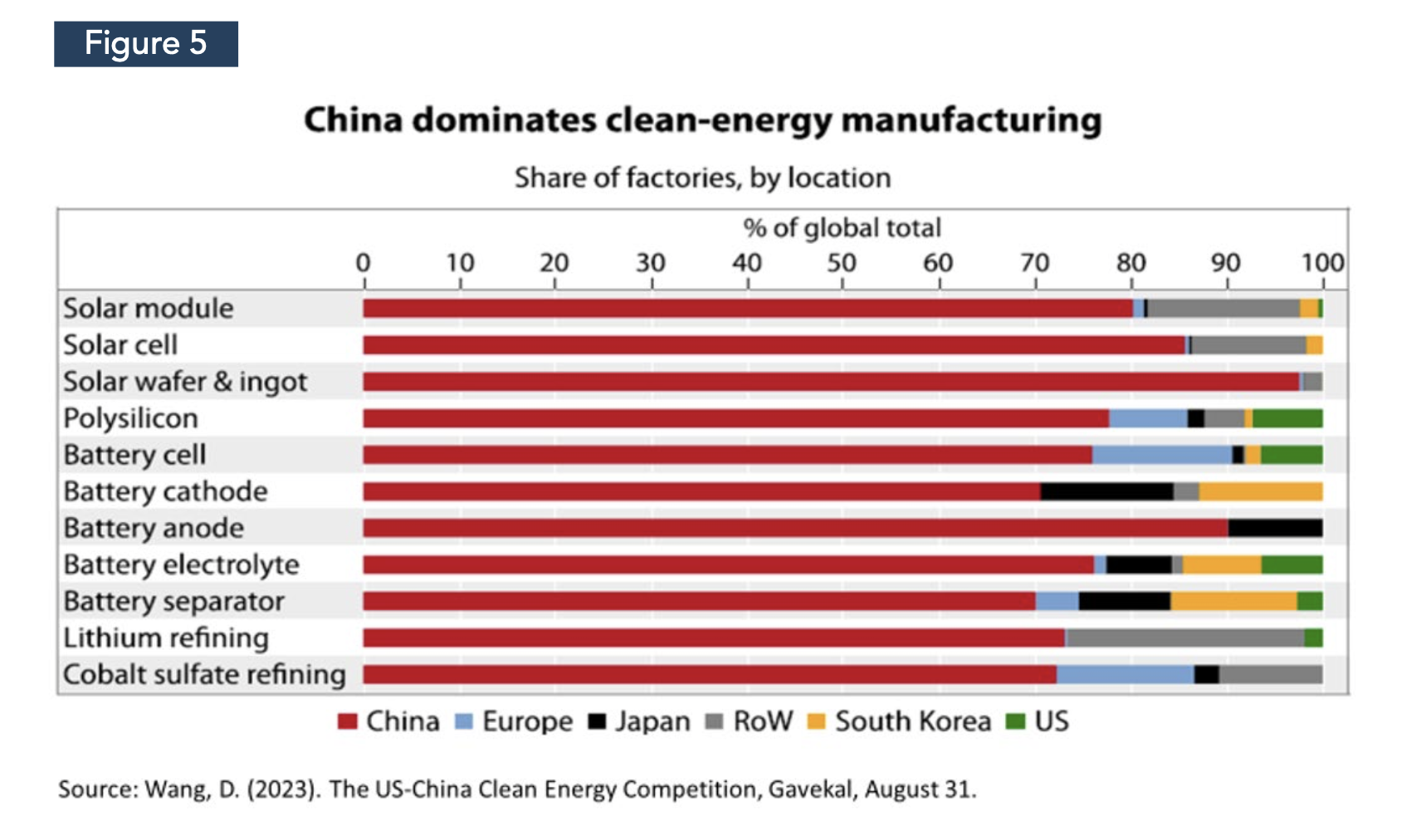

The transition to clean energy is requiring both scientific innovation and large-scale expansion of established technologies. The U.S. remains excellent at the former, including scientific work on carbon capture, storage, and removal. The U.S. is also exploring frontiers in geothermal energy, benefiting from hydraulic fracturing expertise in the shale oil and gas industry (Wang, 2023). On the other hand, in commercial industries that are in the expansion phase, the U.S. lags China in the most critical decarbonization technologies: solar, wind, batteries, and hydrogen (Figure 5). The higher pace of investment in clean energy by China in the last decade has given it an advantage in learning and technology domains.

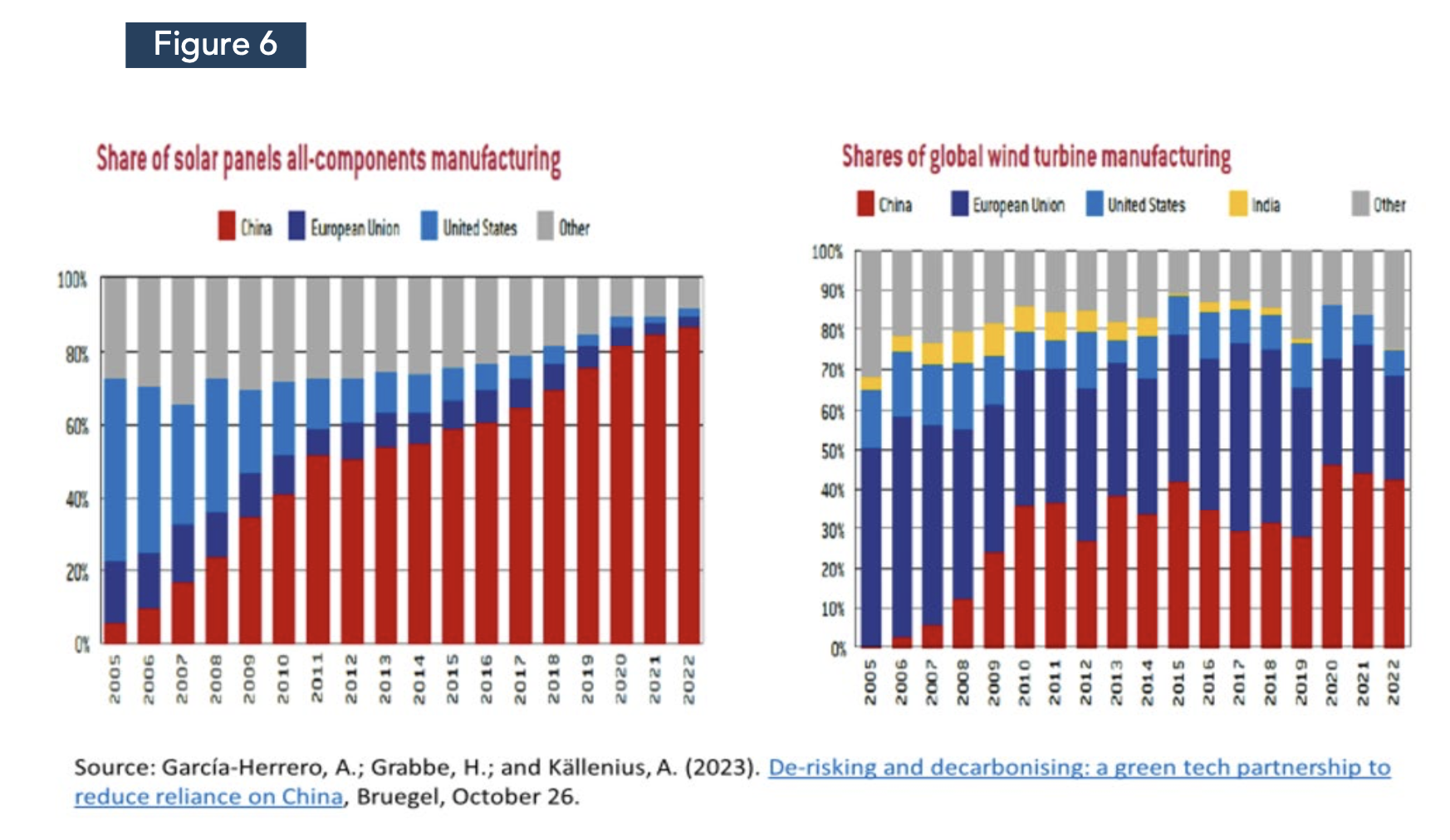

Chinese dominance is evident in solar energy (Figure 6). The 90% decline in the cost of solar energy generation over the last decade came mainly from there, with Chinese companies being responsible for 75% to 95% of each component of the value chain. Tariffs and import bans have not prevented the situation that, today, U.S. imports of photovoltaic cells come mostly from Chinese manufacturers located in Southeast Asia.

The Chinese are also at the forefront when it comes to electric vehicle batteries, gaining ground even from rival firms in Japan and South Korea that were at the technological forefront. In this case, physical proximity to car manufacturers matters. Chinese producers benefited from the explosion in the production of electric cars in China, whose local consumption was subsidized by the government. The results in terms of productivity and competitiveness meant that China surpassed Germany in car exports in 2022.

The challenge is more complex in the case of wind energy. China today has the majority of the world’s 10 largest producers of wind turbines, but they mainly serve the domestic market. Turbines, with large towers and blades, require assistance and services at installation sites, and Chinese firms face difficulties in this case.

Finally, Chinese companies are taking the lead in producing clean hydrogen products, an energy source that could grow over the next decade. One problem with hydrogen is that its production uses significant energy, to break down water molecules through electrolysis. The sharp drop in the cost of solar and wind energy could eventually change the cost-benefit ratio of large-scale clean hydrogen production.

It is worth noting that Chinese clean-energy technology has advanced in part because of massive investments in its application. In 2022, as in other years of the decade, spending on renewable energy capacity in China was greater than in the U.S. and Europe combined.

And the U.S.? The Inflation Reduction Act, passed by Congress in 2022, will provide

$400 billion to $1 trillion in support for solar energy, high-capacity batteries, hydrogen production equipment, and other forms of renewable energy. Jake Sullivan (2023) referred to this and other bills from the Biden Administration as pillars of the country’s modern industrial and innovation strategy.

If the U.S. seeks to be entirely self-sufficient in clean tech, partly by including ‘friendly’ countries and excluding China entirely, it will be harder to climb the ladder of productivity and competitiveness. If they try to follow the path symmetrically to what they seek to do to the Chinese in advanced semiconductors, at the very least their energy transition will be more expensive.

The Critical Role Played by Critical Raw Materials (CRM)

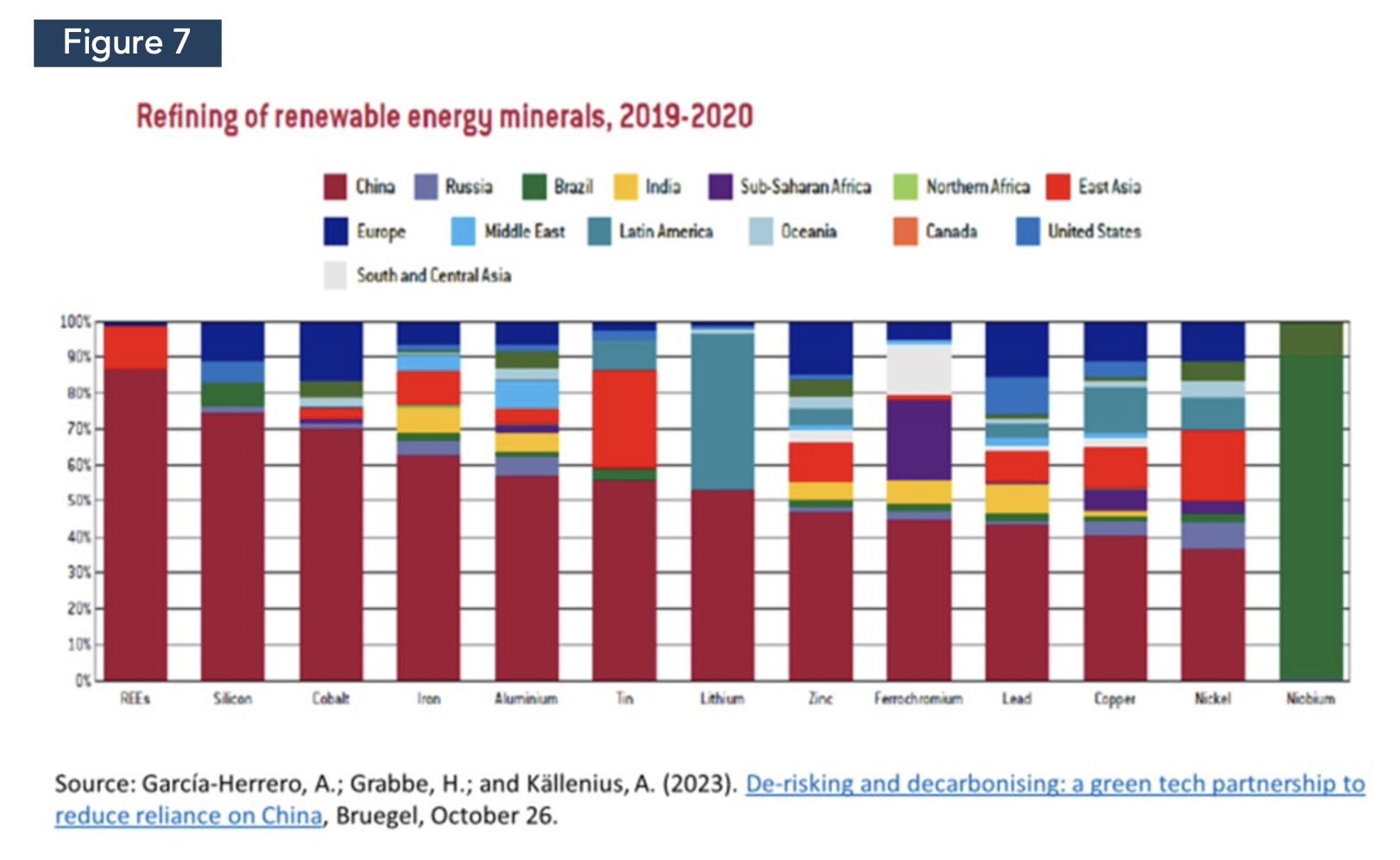

Finally, it is worth mentioning another point: mining and refining of critical minerals upstream of the renewable energy supply chain. China’s territory is abundant in mineral resources, many of which are central to the production of clean-tech goods, including 72% of the world’s natural graphite and 66% of rare earth elements (Garcia-Herrero et al, 2023).

However, overall, the extraction of clean-tech minerals is spread across the globe, following the locational dispersion of deposits. Chinese companies have been making acquisitions abroad, purchasing a large part of the cobalt and lithium supply. Minerals are distributed across the globe, but most of the refining is in China. Recent threats by China to restrict exports of gallium and germanium represent an escalation in global competition for critical minerals and metals, i.e. yet another field for ‘proxy wars’.

In addition to the domestic extraction of key minerals, China has built up abroad a network of mineral supply agreements to supply its domestic refining industry, including cross-border acquisitions and trade agreements. These are primarily in southern and western Africa, Oceania, Latin America, and regional neighbors. Globally, China has a special position in terms of processing of rare earth elements, with a market share above 85%, and of silicon and cobalt, all of which are integral to the production of high-energy-density batteries, wind turbines, and solar panels (Figure 7).

China’s share of metals processing is much higher than its share of extraction of those metals. That reflects how strategic the Chinese government has been in its long- standing aim to achieve dominance of the clean-tech industry.

There is no equivalent initiative on the side of the U.S., European Union, and other advanced economies. Domestically, environmental challenges and risks—including depletion of groundwater resources—have been a stumbling block. It would not be easy to re-shore processing on a large scale.

This illustrates how costly and ineffective in terms of clean-energy competition a search for self-sufficiency would be for the U.S. and other advanced economies. An obvious response would be partnerships with emerging markets and developing countries (EMDEs) that would include local refining and some insertion up in the value chain by these countries, provided that environmental risks and others are properly dealt with. By the same token, instead of reacting to China’s current dominance in clean-energy technology by taking an inward-oriented, self-contained industrial approach, advanced economies should enhance the search for complementarities and synergies with those EMDEs that have significant potential to be clean-energy providers. This could include Latin America and the Caribbean (Zhang and Canuto, 2023) and its capacity to offer opportunities of ‘powershoring’ (Arbache, 2023), as well as Africa and other regions.

Concluding remarks

The global economy currently faces risks of fragmentation, with national security among the reasons for national policies of ‘de-risking’ of supply chains, or ‘decoupling’ with China (Canuto, 2023). Such an environment encompasses technological wars as ‘proxy wars’, with sectoral landscapes differing, e.g. with respect to semiconductors and clean energy. The ways the U.S. and the European Union approach the goal of self-sufficiency, as well as access to and refinement of critical raw materials, will make a big difference for their stake in the technology wars.

References

Arbache, J. (2023). What green and fair transition? CAF – Development Bank of Latin America, September 13.

Canuto, O. (2019). The US-China Trade War Is Accelerating China’s Rebalancing, Policy Center for the New South, November 8.

Canuto, O. (2021). Climbing a High Ladder - Development in the Global Economy, Policy Center for the New South.

Canuto, O. (2022). Slowbalization, Newbalization, Not Deglobalization, Policy Center for the New South, June 1.

Canuto, O. (2023). Growth Implications of a Fractured Trading System, Policy Center for the New South.

Canuto, O.; Arbouch, M.; Zhang, P.; and Ait Ali, A. (2023). GVCs, Resilience, and Efficiency Considerations: Improving Trade and Industrial Policy Design and Coordination, G20/T20, June.

García-Herrero, A.; Grabbe, H.; and Källenius, A. (2023). De-risking and decarbonising: a green tech partnership to reduce reliance on China, Bruegel, October 26.

Sullivan, J. (2022). Remarks by National Security Advisor Jake Sullivan at the Special Competitive Studies Project Global Emerging Technologies Summit, Washington, D.C., September 16.

Sullivan, J. (2023). Remarks by National Security Advisor Jake Sullivan on Renewing American Economic Leadership at the Brookings Institution, Washington, D.C., April 27.

Wang, D. (2023). The US-China Clean Energy Competition, Gavekal, August 31.

Yoon, J. (2022). Lex in-depth: the cost of America’s ban on Chinese chips, Financial Times, November 24.

Zhang, T. (2023). Coping With Semiconductor Containment, Gavekal, August 4.

Zhang, P. and Canuto, O. (2023). Global Leadership for Latin America and the Caribbean, Project Syndicate, September 12.