Publications /

Policy Brief

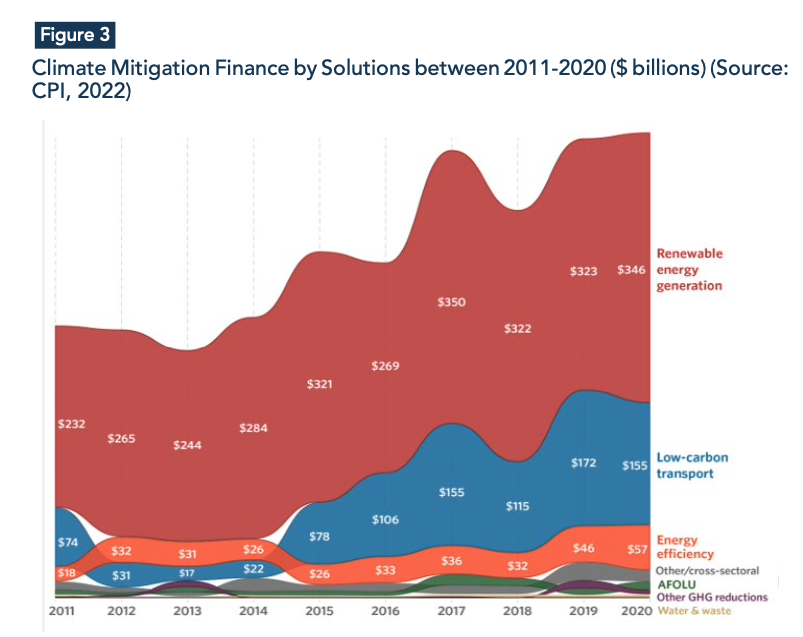

It is estimated that $1 trillion to $6 trillion per year (up to 2050) needs to be invested globally if the world is to stay below the 2°C global warming ceiling of the Paris Agreement and to meet its adaptation goals. Currently, investments stand at about $630 billion per year, way below the original target. And although great efforts have been made in the climate-finance area, more than 70% of the funds deployed have gone to one sector, renewable energy, followed by the transportation sector. The agriculture sector has been severely underfunded, even though it produces 20% of global greenhouse gas emissions. This leaves the most vulnerable communities at risk as the effects of climate change are already impacting this sector intensely. In this policy brief, four principles are proposed as a foundation when deploying funds into climate-change mitigation and adaptation projects: equity, creativity, impact, and transparency. Climate finance has an enormous potential to make bigger impacts when the right principles are applied.

INTRODUCTION

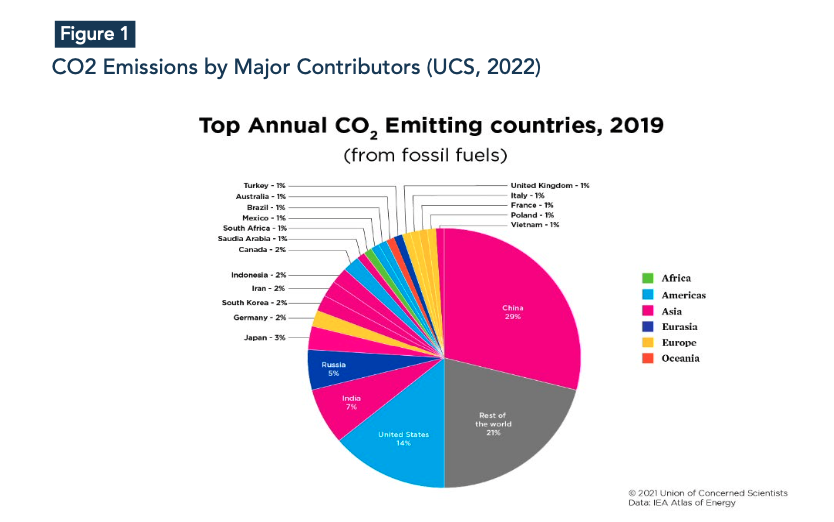

Volumes of greenhouse gas (GHG) emissions per capita in developing countries are much lower than those in industrialized countries; nonetheless, the impacts of climate change have already been significant in developing countries, compounded by existing vulnerabilities, and it is mostly these countries that have limited human, institutional, and financial capacity to anticipate and mitigate the direct and indirect effects of climate change. Figure 1 shows a clear picture of where most of the world’s greenhouse gases are being produced.

While major parts of South Asia, Africa, Latin America, and small island states are not major contributors, these regions face some of the most pressing vulnerabilities arising from climate change. As summarized in the IPCC report (2022), here are some of the major impacts of climate change, in the context of the vulnerability and adaptative capacity of the mentioned regions:

Africa: Crop yields are expected to be negatively impacted, therefore posing a risk in terms of food security, malnutrition, and loss of livelihood. Widespread poverty in Africa makes small agricultural communities more susceptible to losses in case of harvest failures. In addition, extreme weather is projected to increase mortality and diseases, as well as biodiversity losses.

Asia: Temperature extremes will also pose a risk to food and water security in this region. Rising sea levels added to weak infrastructure and institutions and will make coastal cities very vulnerable. Capacity is increasing in some parts of Asia but inequalities in income, limited technology, and decline in land and coastal resources, put communities at high risk from the effects of climate change.

Central and South America: As floods, landslides, and sea level rise are already causing severe damage to life and infrastructure, parts of Latin America are expected to face high risks of food and water insecurity (extreme droughts). Again, low-income communities do not have the social and economic safety nets that will enable them to withstand these impacts, which as a consequence could affect greatly economic growth in the region.

Small Island States: Island states are the most vulnerable to the changing water balance due to climate change, which will threaten coastal ecosystems, fisheries, food production, and tourism. Reduced habitability of coastal cities can also pose a risk of social and immigration crises.

CLIMATE FINANCE

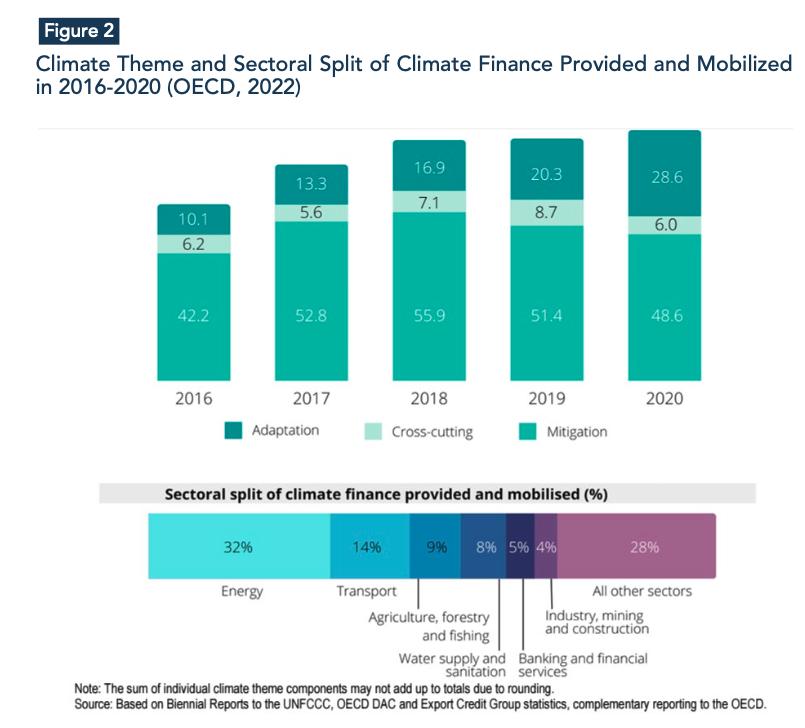

Even though climate finance volumes have almost doubled in the last decade, current investments for adaptation and mitigation of climate-change impacts still fall short of the set targets, and are mostly focused on two main sectors: energy and transportation (CPI, 2022). The goal of this policy brief is to highlight disparities in climate finance and propose principles for equitable financing for developing countries.

International and domestic climate finance has huge potential to enable the most vulnerable, if we consider the commitments made in the Paris Agreement and the latest Conference of the Parties (COP) resolutions. The United Nations Framework Convention on Climate Change (UNFCCC, 1992) has ‘equity’ as one of its core principles, including the “common but differentiated responsibilities and respective capabilities” principle. Still, there is growing concern that finance is not being deployed to the communities that need it most. Equity in terms of commitments to mobilize funds for adaptation and mitigation of climate change in developing countries needs to be the top priority. It is important to understand equity in climate financing: who are the major donors, who are the recipients, what conditions are attached to these funds? According to some experts and reviews, the climate finance structure as currently designed undermines equity (Pettinoti et al, 2022).

It is estimated, on a global scale, that about $630 billion per year (about 0.7% of world GDP) in climate finance is being deployed currently. This falls short of the estimated $1 trillion to $6 trillion (around 1% to 7% of global GDP) per year needed up to 2050 if the world is to keep global warming below the 2°C ceiling of the Paris Agreement and achieve its adaptation goals (IMF, 2022).

Of the projects funded globally, a vast majority has been directed towards mitigation initiatives. Adaptation financing is slowly increasing but remains largely underfunded. As shown in Figure 3, finance for mitigation projects has been strongly dominated by renewable energy in the last 10 years, accounting for almost 70% of the total. Other sectors including energy efficiency, agriculture, and industry have made limited progress because of technical, commercial, and governance barriers. Agriculture (including forestry, fisheries, and other land use) has not attracted investment from climate initiatives, although this sector is estimated to contribute nearly 20% of total global GHG emissions (CPI, 2022).

Even though Africa has contributed very little to climate change in terms of emissions, it has already felt to an excessive degree the impacts. With the projected population increase in Africa by the end of this century, it is imperative that investment in climate adaptation and mitigation rises in quantity and quality to avoid further disaster. A study by Brookings (2022) identified three critical areas in which investments have to scale up: energy transitions, climate change adaptation and resilience, and restoration of natural capital (through agriculture, food, and land use practices) and biodiversity. Evidently priorities are different and will vary by country, but altogether, Africa will need to invest around $200 billion per year by 2025, and close to $400 billion per year by 2030, on these priorities.

The agriculture sector has faced several barriers to securing financing for climate adaptation and mitigation projects. In most developing countries and poor economies, small-scale agriculture is the most predominant model, which makes it hard for farmers to secure formal property rights and provide collateral to access finance. Also, there is limited access to insurance and guarantees to cover risks (CPI, 2022). Population growth, geopolitical crises, and land degradation are already huge challenges for food security in many regions of the world. This, compounded with the increase in extreme climatic events, will add to the stress on agricultural resources in many developing country regions. The effect of climate change on the productivity of land and precipitation has to be one of the major challenges that threaten to worsen rural poverty.

A MORE EQUITABLE FINANCIAL LANDSCAPE

Providing support to the most vulnerable communities via current financial frameworks has not been very effective. Factors including poor governance, corruption, lack of specific goals, and no decision making at local levels have made the deployment of funds very inefficient. The international and domestic financial channels discriminate against the poor communities that are impacted the most and do not have the means to secure credit.

The Global Environment Facility (GEF) has been the main financial mechanism since the UNFCCC’s entry into force in 1994. The Green Climate Fund (GCF) was established in 2010. The Conference of the Parties (COP) is responsible for determining financial policies, priorities, and criteria for funding. There are also the Special Climate Change Fund (SCCF), and the Least Developed Countries Fund (LDCF) (managed by GEF), and the Adaptation Fund (AF) (UNCC, 2023).

According to the International Monetary Fund, while these are practical mechanismsthey have not delivered sufficient financial support for climate action in some regions. Other private and official flows will be needed to close the gap (IMF, 2022). In many cases, the financial aid available is not aligned with middle-income countries’ priorities, or they have very rigid rules and coniditionalities. There is a need for alternative domestic and international resources that can be made available and targeted to vulnerable communities and projects.

Consequently, criteria for the deployment of funds should not only consider efficiency (how much funds have been mobilized), but should consider the impact of funded projects in terms of creating resilience as a top standard.

Four principles are proposed to create a better, more impactful, climate-finance landscape:

1. Principle of equity

This principle includes:

- Equity across nations,

- Equity across communities, - Equity across genders

Evidently climate impacts vary widely among different populations. As poor communities see their livelihoods threatened by climatic variation (mostly in rural settings), providing access to microcredits has proved to make a huge impact on their economic growth and resilience (where large international funds do not reach).

2. Principle of creativity

Finding ventures that include cross-sectoral activities and solutions that cross disciplines. Institutional and governance models that cross boundaries and create opportunities to create greater resilience. Efforts are needed to recognize the environmental, economic, and social benefits of adaptation beyond the current financial architecture.

For example, promoting behavioral changes in populations is an area in which investment could be beneficial. A move towards a more sustainable, climate-resilient, healthy diet can help reduce health and climate change costs by up to $1.3 trillion, while supporting food security, according to the Initiative for Climate Change and Nutrition (I-CAN, 2022).

3. Principle of impact

Integrating the impact on local communities and ecosystems as a major factor for deploying funds can alleviate the effects of severe climate variation and can help the most vulnerable adapt; the impact of providing financial services to those who need it the most, but usually do not qualify forinternational and domestic aid, as well as building capacity to create more resilient communities, must be considered in climate finance.

4. Principle of transparency

Governments and financing agencies should maintain rigorous transparency standards to work against corruption and double standards. Funding agencies and global organizations have not been able to recognize how power works in many developing countries, especially informal power (clientelism and corruption) (Browne, 2022). Civil society has an important role in ensuring transparency and bringing to light the needs of communities for resource allocation.

FINAL REMARKS

Making climate finance work for low-income, vulnerable communities can be challenging, especially with the requirements and scope of the financial mechanisms in place. Creative and innovative ways to provide access to finance for small projects are essential in order to create resilience and reduce emissions. While investment in the agriculture and industrial sectors may be high-risk, it is necessary to find additional sources of public and private sector capital, and make it accessible to those who need it the most.

Nobel Laureate Muhammad Yunus and his Grameen bank were awarded the Nobel Peace Prize for his concept of micro-credits to grant poor people small loans on easy terms, while teaching them the basics of financial principles (Nobel Prize, 2006). The application of this micro-credit concept has big implications for social and political empowerment of the poor (Bayulgen, 2008). Redesigning the economy and creating business models with social and environment principles at the forefront is possible with the right tools, incentives, and access.

REFERENCES

Bayulgen, O (2008). Muhammad Yunus, Grameen Bank and the Nobel Peace Prize: What Political Science Can Contribute to and Learn from the Study of Microcredit. International Studies Review. Vol. 10, No. 3 (Sep., 2008), pp. 525-547

Brookings, 2022. FORESIGHT AFRICA: top priorities for the continent in 2022. Chapter 4: Climate Change. Accessed online at https://www.brookings.edu/wp-content/uploads/2022/01/foresightafrica2022_fullreport.pdf

Browne, KE (2022). Rethinking governance in international climate finance: Structural change and alternative approaches. WIRES Climate Change. Volume 13, Issue 5, e795. Accessed online at https://wires.onlinelibrary.wiley.com/doi/full/10.1002/wcc.795

CPI (2022). Climate Policy Initiative: Global Landscape of Climate Finance - A Decade of Data: 2011-2020. By authors Baysa Naran, Jake Connolly, Paul Rosane, Dharshan Wignarajah, Githungo Wakaba. guidance of Dr. Barbara Buchner. Accessed online at https://www.climatepolicyinitiative.org/publication/global-landscape-of-climate-finance-a-decade-of-data/

I-CAN (2022). Initiative on Climate Change and Nutrition – Launched as an initiative of COP27. Accessed online on March 2023 at https://www.gainhealth.org/resources/reports-and-publications/initiative-climate-action-and-nutrition-i-can

IMF (2022). IMF Staff Climate Note 2022/009 Belianska, A., Bohme, N., Cai, K., Diallo, Y., Jain, S., Melina, G., Mitra, P., Poplawski-Ribeiro, M., and Solo Zerbo. Climate Change and Select Financial Instruments: An Overview of Opportunities and Challenges for Sub-Saharan Africa.

IPCC (2022). Climate Change 2022: Impacts, Adaptation and Vulnerability. Technical Summary. Accessed online on March 2023 at https://www.ipcc.ch/report/ar6/wg2/

Nobel Prize (2006). The Nobel Peace Prize 2006: Muhammad Yunus Facts. Accessed online at https://www.nobelprize.org/prizes/peace/2006/yunus/facts/

OECD (2022), Aggregate trends of Climate Finance Provided and Mobilised by Developed Countries in 2013-2020, https://www.oecd.org/climate-change/finance-usd-100-billion-goal.

Pettinotti L., Cao Y., Colenbrander S., Pandit Chhetri R., Khan M. P., Watson C., (2022) ‘Surfacing perceptions of equity in the finance themes of the Global Stocktake’. ODI. Part of the Financing Climate Action: iGST Discussion Series https://www.climateworks.org/independent-global-stocktake/finance-working-group/

UNCC (2023). United Nations Climate Change. Introduction to Climate Finance. Accessed online on March 2023 at https://unfccc.int/topics/introduction-to-climate-finance

UNFCCC (1992). UNITED NATIONS FRAMEWORK CONVENTION ON CLIMATE CHANGE UNITED NATIONS 1992

UCS (2022). Union of Concerned Scientists (USA). Countries Share of CO2 Emissions. Published Jul 16, 2008 Updated Jan 14, 2022. Source of date from IEA Atlas of Energy. Accessed online on March 2023 at https://www.ucsusa.org/resources/each-countrys-share-co2-emissions