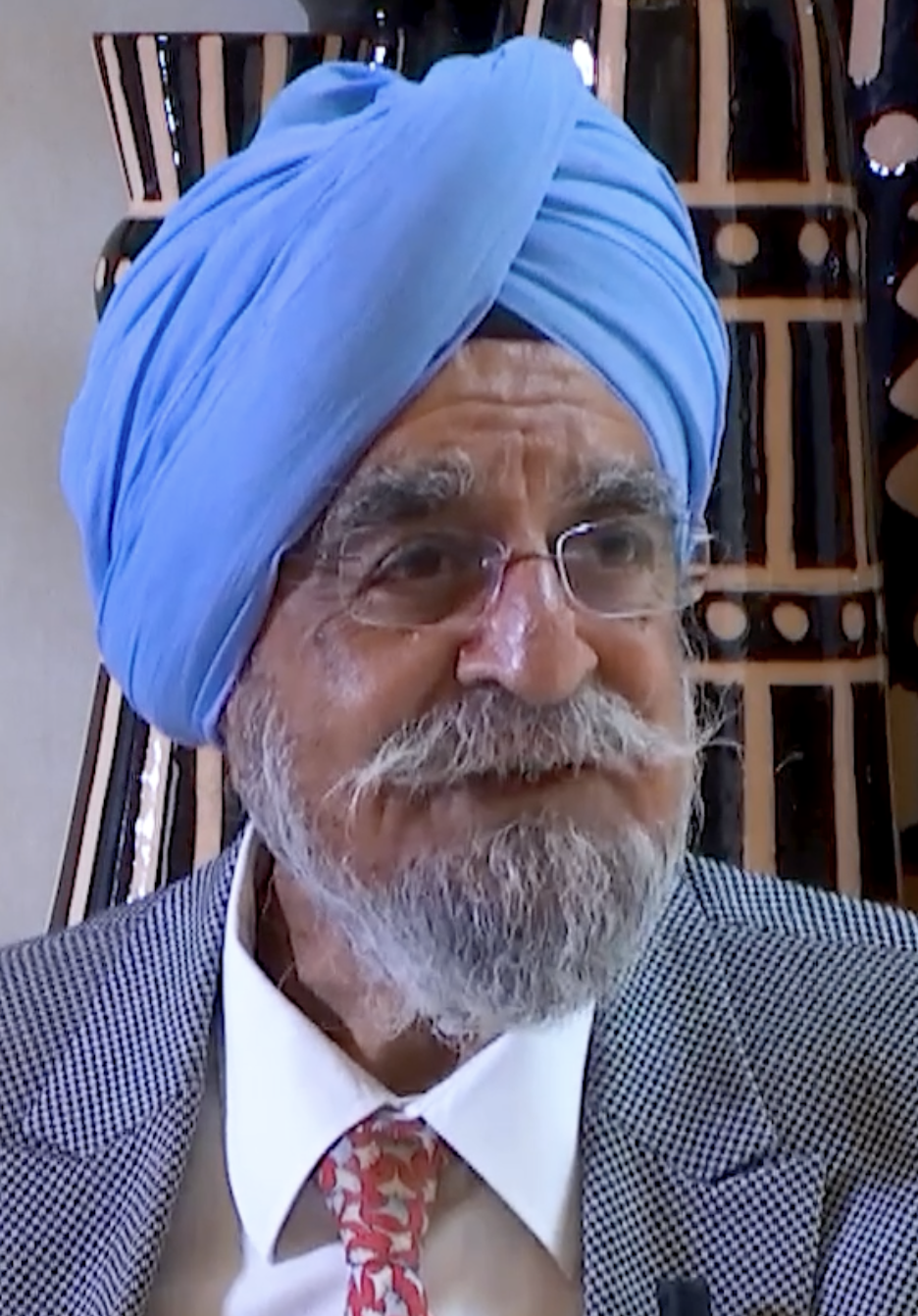

The Covid-19 pandemic has plunged the world into a health, social and economic crisis of exceptional magnitude. In economic terms, the restrictions established to contain the spread of the virus have resulted in a sudden stop to entire sectors of activity and major disruptions to supply chains. Consequently, the global economy experienced its worst recession since World War II in 2020, with a 3.3% contraction in real GDP, a sharp decline in trade and direct investment flows, in addition to massive job losses. As a result, the downward trend in poverty that began in the 1980s has been reversed and more than 100 million additional people have fallen back into extreme poverty. In this context, a number of questions seem relevant: What are the levers to act on for a quick and strong recovery for the world economy? What place for human development in the post-Covid development strategies? How to conciliate between ambitious development objectives and budget sustainability? Moderator: Otaviano Canuto, Senior Fellow, Policy Center for the New South Speakers: - Maria Eugenia Brizuela de Avila, Former Minister of Foreign Affairs, El Salvador - Harinder Kohli, President and CEO, Centennial Group, USA - Frannie Leautier, Chairperson, Co-Founding Partner, Mkoba Private Equity Fund, Tanzania